With the rise of GameFi, Initial Game Offering (IGO) is gaining popularity among crypto investors. IGO allows you to pre-purchase a blockchain game’s NFTs or tokens at its early development stage.

Introduction

IGOs are usually organized through launchpad platforms. Typically, investing through launchpads requires participants to lock the platform’s native token for a certain period of time. Depending on the project, participants can gain early access to the game’s tokens or NFTs. In some cases, the tokens and NFTs acquired from IGOs can be traded outside of the gaming ecosystem on decentralized exchanges and NFT marketplaces.

How does an IGO work?

Initial Game Offering (IGO) is a method for blockchain gaming projects to raise capital. It’s similar to an Initial Coin Offering (ICO), but apart from cryptocurrency tokens, IGO participants can get early access to the in-game assets while supporting the game’s early development. IGO offered assets often include mystery boxes, characters, skins, accessories, weapons, and other items. In most cases, these are NFTs required to access or play the game.

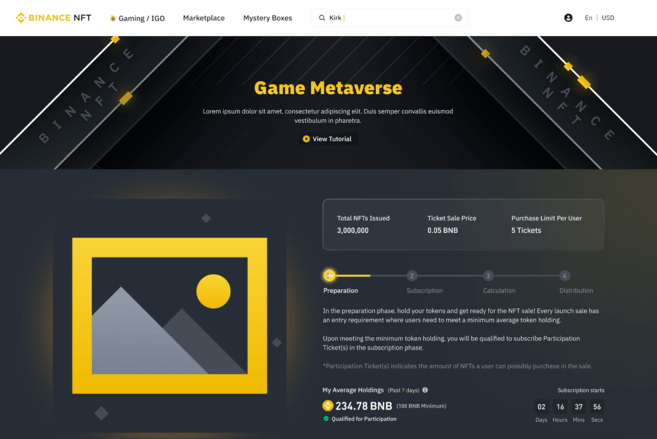

Currently, there are a number of IGO launchpads on the market, including Binance NFT, BSCPad, TrustSwap, and EnjinStarter. Different launchpads have different setups for an IGO, but it usually requires investors to purchase the launchpad platform’s native token to participate. Take IGOs on Binance NFT as an example, investors need to hold a certain amount of BNB in their Binance Wallet to be eligible to participate.

After acquiring the required tokens, participants need to lock them in a pool for a certain period. Depending on the allocation algorithm, they will then receive the project’s token or NFTs based on the amount of tokens locked.

Binance NFT uses a subscription mechanism to select reward winners, so that all participants can get an equal opportunity to get the NFT assets from the IGO. Sometimes, participants are required to hold or stake the purchased gaming token or NFTs for some time before they can trade it on the market.

Differences between IGO, ICO, IEO, and IDO

There are several fundraising methods in the crypto world. Some of the more popular ones are Initial Coin Offering (ICO), Initial Exchange Offering (IEO), and Initial DEX Offering (IDO). They are all similar methods of crowdfunding, but there are certain differences in the way they operate.

Initial Coin Offering (ICO)

Initial Coin Offering (ICO) was the first fundraising approach in crypto. It allows blockchain-based project teams to raise funds through the use of cryptocurrencies. The ICO method was used by Ethereum back in 2014 and was a very popular means for crowdfunding until early 2018. ICO events can offer an effective way for projects to get financial support during the early development stages. You can learn more about ICO in our What Is an ICO (Initial Coin Offering)? article.

Initial Exchange Offering (IEO)

The key difference between an Initial Exchange Offering (IEO) and the other offerings is that an IEO is not hosted by the project’s team directly but within a cryptocurrency exchange. Partnering with reputable crypto exchanges can benefit both the project and IEO participants. In most cases, the projects have to go through rigorous review before being hosted on an exchange. The project team behind the IEO can also increase its reach across the exchange user base. The Binance Launchpad is a popular example of an IEO platform.

Initial Dex Offering (IDO)

Initial Dex Offering (IDO) is an ICO that is hosted on a decentralized exchange (DEX). IDOs were created to tackle the shortcomings of the ICO and IEO models. For example, as the project’s token is launched on a DEX, it generally costs less for projects to get listed compared to IEOs. IDOs also provide immediate token liquidity, meaning that tokens can be listed almost immediately upon the completion of IDO.

However, as IDOs operate on DEXes, they don’t always go through a rigorous due diligence process. This might increase the overall risks as some IDO projects will potentially have lower quality or a questionable reputation. You should also be careful with rug pulls as many IDOs turned out to be scam projects running away with investors’ funds.

Tips for participating in IGOs

As with every investment, there is no guarantee that IGOs will give a profitable return. Before committing to any IGO, you should always DYOR and consider the potential risks.

For example, you can check the gaming project’s website or social media to see if it provides a clear plan or development roadmap. You can also see if any reputable investors or partners are backing the project.

How to participate in an IGO on Binance NFT?

You can participate in IGOs on Binance NFT to get exclusive in-game assets and NFT collections from an array of gaming projects.

Binance NFT adopts a unique subscription mechanism to ensure all users get an equal opportunity to participate in IGOs. The final NFT allocation will be based on a fully public and verifiable selection algorithm.

Log in to your Binance account and go to the Binance NFT homepage. Click on the IGO project banner you wish to participate in.

You will be redirected to the subscription page, where you can see all the project details. To be qualified for participation, you need to maintain a minimum BNB holding.

There are four phases in a Binance IGO: Preparation, Subscription, Calculation, and Distribution. Check out this FAQ article for more details on what you need to do in each phase.

Closing thoughts

IGOs offer an innovative way for game developers to fund their projects through the use of blockchain technology. While IGOs can be a good way for investors to support gaming projects at an early stage, they also carry significant financial risk. You should always perform due diligence before risking your funds.