Cointelegraph Research Terminal, the leading provider of premium databases and institutional-grade research on blockchain and digital assets, has added a new report to its expanding library. The latest paper looks at a particular group of players in the

Bitcoin mining industry. Published by crypto consultancy Crypto Oxygen, the report highlights the current landscape of publicly traded crypto mining companies that control approximately 17% of the total hash rate of the entire Bitcoin network.

The crypto mining industry is a rapidly growing and evolving sector. In January of this year, a United States-based company, Core Scientific, went public through a Special Purpose Acquisition Company (SPAC) merger, making it the world’s most publicly traded crypto mining company. largest exchange in revenue and hash rate. Core Scientific’s hash rate leads all public companies with 8.3 exhashes per second (Eh/s), and it mined 5,769 BTC in 2021, generating around $545 million in revenue. Coming in second and third in terms of revenue are Riot Blockchain and Hive Blockchain Technologies, which earned $215 million and $195 million, respectively.

Strategic, Operational, and Financial Breakdown

Hash rate and revenue are just a few ways to distinguish between companies, but they don’t paint the full picture as some companies have separate revenue models from their core mining activity. The report dissects these key statistics and offers a more detailed comparison, covering the strategic, operational and financial performance of each company.

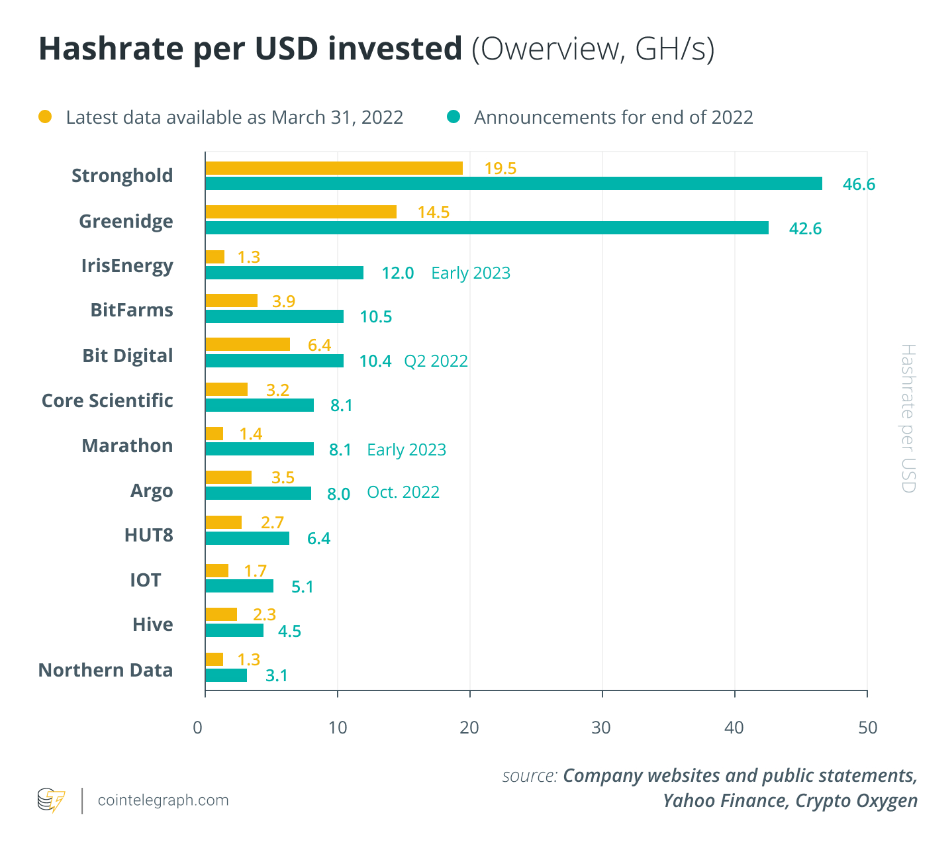

For example, the report compares each company’s operations via the current hash rate per US dollar invested. This way, it is easier to see which company offers the most investment value to investors, which, in the case of this metric, is Stronghold Digital Mining with 46.56 gigahashes per second (GH/s) to lead the pack.

Aside from this, the report also provides a quick snapshot of each company’s operations, including each company’s operational Key Performance Indicators (KPIs), business model, data center locations, BTC holdings, and other relevant information.

Specifically, major players like Marathon have lean setups and are completely dependent on being hosted by third-party providers, while others, like Stronghold, own assets along with the entire value chain, including electrical infrastructure.

Instead of relying solely on financial reports and public statements, Crypto Oxygen also conducted a survey to include direct feedback from the companies analyzed in its research.

Sustainability

One of the main concerns of Bitcoin mining, in general, relates to Environment, Social and Governance, or ESG. Sustainability has always been a central topic of conversation in relation to the crypto mining industry, with publicly traded companies particularly subject to increased scrutiny. However, there appears to be a focus among the companies in the report on limiting the carbon footprint of their operations, despite differences in approaches.

Of the 12 companies, eight are already carbon neutral or environmentally friendly operations. Bitfarms, Hive, Iris Energy and Argo are four companies that rely exclusively on renewable energy sources. Northern Data, Core Scientific, and Greenidge Generation use offset credits to reduce their carbon footprint. Marathon Digital Holdings and Hut 8 Mining are also already using carbon offset credits and aim to become carbon neutral by the end of 2022, while 67% of Bit Digital’s power source comes from renewables.

Indirect Exposure

Investing in public crypto mining companies gives investors exposure in the crypto space, although not as direct as owning Bitcoin. The correlation between the share prices of mining companies and the BTC price is highlighted in the report, and the recent drop in the BTC price proves it. It also shows that larger BTC holdings tend to be a key factor in the downturn.

However, the share prices of mining companies have fallen disproportionately. What the 46-page report offers is an analysis of the performance of each public mining company and presents a detailed comparison of each to help bring more clarity to the players involved in the development space and the industry at large.