Banks have long known that if they can capture customers’ attention when they’re young, they’re likely to take them for life. For this reason, they have always been quick to embrace new and emerging trends, and today’s hot tech potato, the metaverse, is certainly no exception.

Gen Z consumers are fully digital natives: online is the default option for them when searching for the products and services they need. The metaverse, immersive and persistent digital environments that potentially offer everything we need to live our lives digitally, under one roof, provides new ways for businesses to connect with customers. Banks, as always, have been willing to capitalize on it.

If you need a little more information about what the metaverse is and what it promises for the future, you can check out my article Easy for Anyone Explained. If not, let’s dig in and take a look at how banks and other financial services organizations are making their mark there:

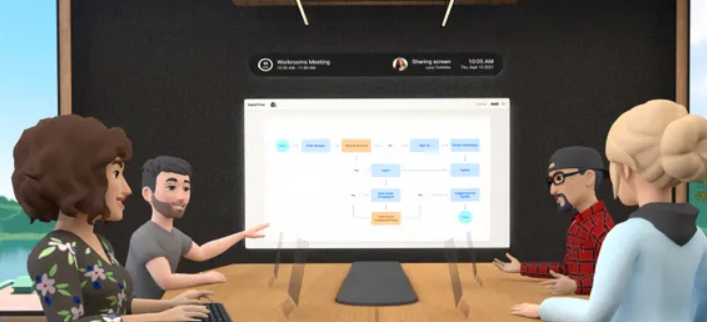

Virtual Lobbies

One of the most obvious uses of the metaverse, as far as retail banks are concerned, is to create “virtual branches” where they can sell banking products to a new generation of digital native Gen Z consumers, or provide customer service to their customers. existing.

Emerging metaverse platforms like The Sandbox and Decentraland attract hundreds of thousands of visitors each month, while established gaming platforms with metaverse-like functionality, like Roblox or Fortnite, can attract millions. Their audiences are digital natives and willing to do business with companies that share their understanding and enthusiasm for virtual worlds and game-style environments.

Among the first to set up virtual storefronts is HSBC, which bought land in The Sandbox earlier this year, which it will use to engage with online sports fans and esports enthusiasts. Its CMO for the Asia Pacific region, Suresh Balaji said: “At HSBC, we see great potential to create new experiences across emerging platforms, opening up a world of opportunity for our current and future customers and the communities we serve.” . Siam Commercial Bank of Thailand also has a virtual branch on The Sandbox platform.

JP Morgan Chase is another global banking giant that has already established a presence by setting up shop on the Decentraland platform. It created a lounge area called Onyx within the platform’s virtual Metajuku mall, which provides visitors with information about blockchain and other technology-driven initiatives the bank is involved in. It also features a tiger and a portrait of the company’s CEO, Jamie Dimon.

However, this trend is not as new as it seems. Linden Labs’ Second Life is often cited as one of the first metaverse environments, having been around since 2003. A few years later, in 2007, Danish investment bank Saxo opened an office on the platform, with many of the features than today’s metaverse. bankers are building, such as the ability to interact and communicate through avatars.

Closing the gap between virtual economies and real economies

With spending in the metaverse expected to hit $5 trillion by 2030, it’s a big deal, and banks are already thinking about the profits to be made by moving money and perhaps other assets between the digital and physical worlds.

The Metaverse platforms allow users to purchase virtual goods, including Nike sneakers and Gucci clothing, to decorate their avatars and virtual homes. You can earn money in online play-to-win games like Axie Infinity and Meta Cricket League. This usually involves trading cryptocurrencies and unique digital assets like NFTs. Transferring this money to the real world involves exchanging it for real coins, which are deposited into a bank account.

Calling itself the “bank of the metaverse,” startup Zelf offers regulated services for transferring money between virtual worlds and the real world, as well as exchanging valuable in-game items between players.

It’s all about image

Banks and financial services companies have a vested interest in developing their image as pioneering high-tech and tech-savvy organizations.

With new technologies like artificial intelligence (AI), automation, virtual reality (VR) and the Internet of Things (IoT) revolutionizing so many aspects of our lives, banks need to make sure they are seen to be ahead of the curve. One of the reasons for doing this is that they will continue to attract top talent, who might otherwise look to tech giants like Google, Facebook, or Apple for the most exciting and lucrative career opportunities.

Much has been written and said about the skills crisis facing organizations that want to take advantage of the most powerful and potentially game-changing technologies. By ensuring they have a prominent place in the metaverse, banks and financial institutions help ensure they are seen as top destinations for the brightest and most skilled graduates and job seekers—those who hold the keys to harnessing technologies. more transformative. .

The Future of Banking?

So is metaverse banking just another fad that will fade as consumers lose interest? Well, with real physical bank branches closing at unprecedented rates, it makes sense that financial institutions are looking to the metaverse and virtual worlds as a way to stay connected with customers and provide basic banking services.

It is also clear that virtual economies and trade in virtual goods and services are going to grow. As today’s younger generation of consumers grow up and want to bank and engage in financial services in settings in which they feel comfortable, it seems likely that virtual environments will provide a familiar platform for them to do just that.

It’s true that no one yet knows exactly what the metaverse is, let alone what it will be like five or ten years from now. However, it is clear that banking and finance feel that it will be an important part of our lives and they want to make sure that they are part of it too.

To stay on top of the latest in new and emerging business and technology trends, be sure to sign up for my newsletter, follow me on Twitter, LinkedIn and YouTube, and check out my books ‘Tech Trends in Practice’ and ‘Business Trends in Practice’. , which just won the 2022 Business Book of the Year award.