Second Life, the long-running online metaverse that still attracts nearly a million monthly active users, has announced that it will begin charging US users local sales tax on many in-game purchases for the first time. since its launch in 2003. a significant drag on the robust in-game economy of the online universe and serves as a warning to other fledgling metaverse efforts hoping to sell virtual goods to US residents.

In announcing the move Monday, Second Life developer Linden Labs cited the 2018 Supreme Court decision South Dakota v. Wayfair, Inc., Et Al. That decision established that states and localities could collect sales tax even for products sold by online businesses that do not have a physical presence in that state. Following that decision, Linden Labs says it “has done everything we can to shield our residents from these taxes for as long as possible, but we can no longer absorb them.”

As such, starting March 31, Second Life users will be billed local taxes on recurring billings such as subscriptions and terrain fees. Linden Labs will continue to absorb taxes charged on one-time purchases such as name changes and L$ purchases of in-game currency. But those costs will be passed on to users “at some point in the future,” Linden Labs writes.

“This is news we don’t like to share, but for the health of the business and Second Life, we can no longer absorb these tax burdens,” writes Linden Labs. “Thank you for your understanding and your continued support of Second Life.”

Declare the pennies in your eyes

Specific sales tax rates can vary widely from state to state, and many localities charge additional sales tax on top of that. Residents of four states (Delaware, Montana, New Hampshire, and Oregon) pay no sales tax at all, while seven cities, including Seattle, Chicago, Los Angeles, and Oakland, California, charge residents more than 10% on sales. combined state and local sales. taxes on each purchase.

Those taxes could have a significant impact on Second Life’s US customers, who make up nearly half of the user base, according to SimilarWeb estimates for visits to SecondLife.com. In all, Second Life still generates roughly $600 million in economic activity each year and pays users more than $80.4 million annually in real-world cash, according to a September report by VentureBeat.

While US users have long had to pay income taxes on any real-world money drawn from the Second Life economy, the additional sales tax fees could be a significant drag for many users. month to month. “I have to think this will have a huge impact on the economy of Second Life and the culture of the community in general,” writes Second Life observer and journalist Wagner James Au.

A user of the Second Life Community Forums, Teresa Firelight, detailed how California local taxes will add about $20 a month to her current $202 of monthly investments in Second Life regions and parcels. That increase could force them to cut spending on alternative avatars (or “alts”), each of which comes with its own taxable $8.25 monthly premium subscription. “Plus, there’s the hassle factor… being upset about a tax can make me want to lower my alt premiums even more when they’re due,” Firelight writes.

While the new cost might surprise US Second Life users, those in Europe have been paying value-added tax rates of up to 17 to 27 percent on Second Life purchases since 2007.

Complaining about taxes isn’t new to Second Life either. Early in the game’s history, Linden Labs attempted to create a complicated tax system that automatically deducted more L$ in the world from users who built more items in the world (thus consuming more Linden Labs server resources). That led to an organized in-universe tax revolt, which in turn led Linden Labs to switch to its current system of charging users directly for the land via a monthly fee.

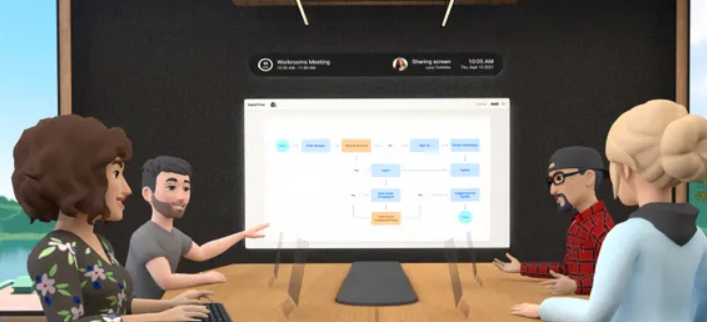

Linden Labs’ experience could serve as a warning, as other major companies rush to launch their own metaverse offerings. That includes companies using so-called “Web3” technologies, such as cryptocurrencies and NFTs, to power their virtual economies.

In addition to potential local sales tax exposure, cryptocurrencies can be taxed as income or capital gains when earned, sold, or converted to another form. In the meantime, NFTs could likely be taxed as collectibles, which would attract a top capital gains tax rate of 28 percent in the US. And the IRS is beginning to crack down on the application of gains based on cryptocurrencies thanks to a provision in last year’s bipartisan infrastructure bill.