What Is Bitcoin Mining? Bitcoin mining explained

Bitcoin is the process of creating valid blocks that add transaction records to the public ledger of Bitcoin (BTC), which is called a blockchain. It is a crucial component of the Bitcoin network as it solves the so-called “double spending problem”. (See more What is Bitcoin, and how does it work?)

The double spending problem refers to the need to find a consensus on transaction history. Ownership of Bitcoin can be proven mathematically through public key cryptography. However, crypto alone cannot guarantee that a particular coin has not previously been sent to someone else.

To form a shared history of transactions, it is necessary to have an agreed order that is based, for example, on the time of the creation of each transaction. But any external input can be manipulated by whoever provides it, requiring participants to trust that third party.

In this article, we will discuss what crypto mining is, how to mine Bitcoin, how Bitcoin mining works, the cost of Bitcoin mining, whether is Bitcoin mining illegal, and the various Bitcoin mining issues miners face.

How does Bitcoin mining work?

Mining (blockchain mining, in general) takes advantage of economic incentives to provide a reliable and trustless way of sorting data. The third parties that order transactions are decentralized and receive monetary rewards for their correct behavior. On the contrary, any misconduct results in a loss of financial resources, at least as long as the majority remains honest.

In the case of Bitcoin mining, this result is achieved by creating a succession of blocks that can be mathematically proven to have been stacked in the correct order with a certain commitment of resources. The process depends on the mathematical properties of a cryptographic hash, a way of encoding data in a standardized way.

Hashes are a one-way encryption tool, which means that it is almost impossible to crack them on their input data unless all possible combinations are tried until the result matches the given hash. So how is Bitcoin mined?

This is what Bitcoin miners do: They loop through trillions of hashes every second until they find one that satisfies a condition called “difficulty.” Both the difficulty and the hash are very large numbers expressed in bits, so the condition simply requires the hash to be less than the difficulty.

The difficulty is resetting every 2016 Bitcoin block, or approximately two weeks, to maintain a constant block time, which refers to the time it takes to find each new block during mining.

The hash generated by the miners is used as an identifier for any particular block and is made up of the data found in the block header. The most important components of the hash are the Merkle root, another aggregate hash that encapsulates the signatures of all the transactions in that block, and the unique hash of the previous block.

This means that altering even the smallest component of a block would dramatically change its expected hash, and that of each subsequent block as well. The nodes would instantly reject this incorrect version of the blockchain, protecting the network from tampering.

Through the difficulty requirement, the system ensures that Bitcoin miners do real work: the time and electricity spent analyzing the possible combinations. This is why the Bitcoin consensus protocol is called “proof of work”, to distinguish it from other types of block creation mechanisms. To attack the network, malicious entities have no other method than to recreate their entire mining power. For Bitcoin, that would cost billions of dollars.

But how long does it take to mine 1 Bitcoin? A BTC generally takes around 10 minutes to create, although this is only true for strong processors. The Bitcoin mining hardware you use will determine how fast you can mine.

Why mine Bitcoin?

In many ways, Bitcoin mining is comparable to gold mining. Crypto mining (in the case of Bitcoin) is a computer operation that creates new Bitcoin and tracks the transactions and ownership of the cryptocurrency. Bitcoin and gold mining consume a lot of energy and can yield significant financial rewards.

Therefore, you can mine BTC for profit/rewards. Some BTC miners build Bitcoin mining pools by pooling their efforts with other miners. Pools of miners working together have a more significant chance of earning rewards and splitting the profits. Additionally, members of a mining pool pay a fee to be part of the pool.

If your focus is not on money, you may want to mine Bitcoin if you enjoy playing with computers and learning about this new technology. For example, while setting up Bitcoin mining, you can learn how your computer and blockchain-based networks work. (See more The history of Bitcoin: When did Bitcoin start?)

Is it worth mining Bitcoin?

To find an answer to the above question, perform a cost-benefit analysis (using web-based calculators) to see if Bitcoin mining is worth it. A cost-benefit analysis is a systematic method used by organizations to determine which actions should be taken and which should be avoided.

First, determine if you are willing to invest the required startup capital in hardware and determine the future value of Bitcoin and the level of difficulty before committing your resources. It is also crucial to examine the specific difficulty amount of the cryptocurrency you want to mine to see if the mining operation would even be lucrative.

When both Bitcoin prices and mining difficulty drop, it usually means fewer miners are mining BTC and acquiring BTC is easier. Nonetheless, expect more miners to compete for less BTC as Bitcoin prices and mining difficulty increase.

Is Bitcoin mining legal?

If you are wondering if Bitcoin mining is legal, the answer is yes, considering the acceptance by various jurisdictions. For example, Enigma (based in Iceland) opened one of the largest Bitcoin mining operations in the world.

Crypto mining is considered a business in Israel and is subject to corporate income tax. On the other hand, crypto miners are considered money transmitters by the Financial Crimes Enforcement Network (FinCEN) in the United States, meaning they may be subject to rules governing such conduct.

Also, near the base of the Colchagua volcano, a new coin-shaped “Bitcoin city” will be built, as El Salvador President Nayib Bukele announced in November 2021. Bitcoin mining will be powered by geothermal energy. throughout the city. . El Salvador will raise a $1 billion “Bitcoin bond” with the help of crypto infrastructure provider Blockstream to begin construction of the city.

However, in Algeria, Nepal, Russia, Bolivia, Egypt, Morocco, Ecuador, and Pakistan, Bitcoin mining is prohibited. You should always check the local rules where you live to find out if Bitcoin mining is legal in your jurisdiction.

How are Bitcoin miners paid?

The network recognizes the work done by Bitcoin miners in the form of rewards for generating new blocks. There are two types of rewards: new Bitcoin created with each block and fees paid by users to transact on the network.

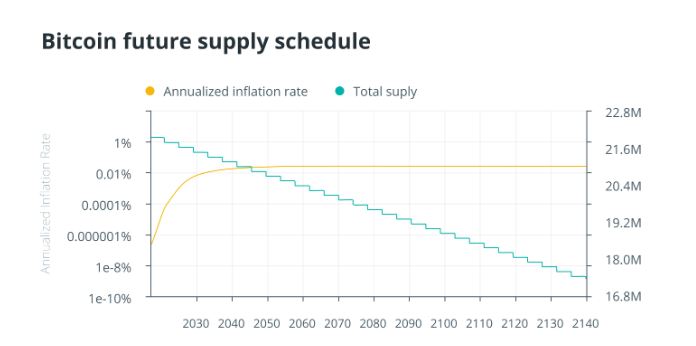

The newly minted Bitcoin block reward, amounting to 6.25 BTC as of May 2020, is the majority of miners’ income. This value is scheduled to be halved at fixed intervals of about four years so that eventually no more Bitcoin is mined and only transaction fees ensure the security of the network.

By 2040, the block reward will have dropped to less than 0.2 BTC, and only 80,000 Bitcoin out of 21 million will remain available. Only after 2140 will mining effectively end as the final BTC is slowly mined.

Although the block reward decreases over time, previous halvings have been largely offset by increases in the price of Bitcoin. While this is no guarantee of future results, Bitcoin miners enjoy a relative degree of certainty about their prospects. The community is very supportive of the current mining arrangement and has no plans to phase it out like Ethereum, another major minable currency. With the right conditions, individual Bitcoin miners can be sure that the company will make a profit.

While mining is a competitive business, getting started is still relatively easy. In the early years of Bitcoin, hobbyists could simply launch some software on their computers and get started right away. Those days are behind us, but setting up a dedicated Bitcoin miner is not as difficult as it seems at first.

How to choose hardware for Bitcoin mining?

If you are curious about how to mine Bitcoin, the first thing to note is that in order to mine BTC, your only option is to purchase a Bitcoin miner, that is, an application-specific integrated circuit device, commonly known as an ASIC. . .

These devices can only mine Bitcoin, but they are very efficient at doing so. They are so efficient that their introduction around 2013 made all other types of mining computing devices obsolete almost overnight.

If you are looking to mine with common CPUs, GPUs or more advanced FPGAs, you will need to look at other coins. Although these devices can mine Bitcoin, they do so at such a slow rate that it is just a waste of time and electricity.

For reference, the best graphics card available just before the ASIC boom, the AMD 7970, produced 800 million hashes per second. Now, an average ASIC produces 100 trillion hashes per second, a difference of 125,000 times.

The number of hashes produced in one second is commonly known as the “hash rate” and is an important performance measure for mining devices.

Two other factors should be considered when purchasing a Bitcoin mining device. One is electricity consumption, measured in watts. Between two devices that produce the same amount of hashes, the one that consumes less electricity will be more profitable.

The third measure is the unit cost of each device. There is no point in having the most energy-efficient ASIC in the world if it takes 10 years to recover through mining.

Bitcoin has a pretty vibrant ecosystem of ASIC manufacturers, often differing on these three parameters. Some may produce more efficient but also more expensive ASICs, while others make lower-performance hardware that is cheaper. Before discussing which device best suits your needs, it is important to understand the other factors that influence Bitcoin mining earnings.

The Economics of Bitcoin Mining

Like the real estate business, Bitcoin mining is all about location, location, location. Different places in the world will have different average prices of electricity. Residential electricity in many developed countries is often too expensive for mining to be financially viable.

Since the price of electricity is usually between $0.15 and $0.25 per kilowatt-hour, Bitcoin mining in residential areas has too high a bill to remain profitable.

Professional Bitcoin miners will often locate their operations in regions where electricity is very cheap. Some of these include the Sichuan region of China, Iceland, the Irkutsk region of Russia, as well as some areas in the United States and Canada. These regions will generally have some form of cheap local electricity generation, such as hydroelectric dams.

The prices enjoyed by these Bitcoin miners will often be below $0.06 per KWh, which is usually low enough to make a profit even during market downturns. In general, prices below $0.10 are recommended to maintain a resilient trade. Finding the right location for mining largely depends on one’s circumstances. People living in developing countries may not need to go beyond their own homes, while people living in developed countries are likely to have higher barriers to entry.

In addition to the choice of hardware, the earnings and income of an individual miner are highly dependent on market conditions and the presence of other miners. During bull markets, the price of Bitcoin can skyrocket higher, resulting in the BTC they mine being worth more in dollars.

However, positive inflows from bull markets are offset by other Bitcoin miners seeing higher profits and buying more devices to take advantage of the revenue stream. The result is that each miner now generates less BTC than before.

Eventually, the revenue generated tends toward a breakeven point where less efficient miners start earning less than they spend on electricity, thus turning off devices and allowing others to earn more Bitcoin.

Usually, this doesn’t happen instantly. There is some lag as sometimes ASICs cannot be produced fast enough to offset the rising price of Bitcoin.

In a bear market, the opposite principle applies: revenues are reduced until miners start shutting down their devices en masse. To avoid being outbid, existing Bitcoin miners must find a winning combination of location and hardware that allows them to maintain their advantage. They must also constantly maintain and reinvest their capital, as more efficient hardware can completely throttle the earnings of older miners.

Mining Hardware Profitability Comparison

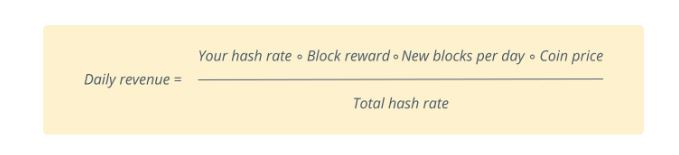

There are several online calculators on websites like AsicMinerValue, CryptoCompare, and Nicehash, where you can quickly check the profitability of a mining device. It is also possible to estimate earnings manually with the following formula:

This is the formula many of these calculators use, and it simply represents your share of the overall hash rate divided by the total network issuance in dollars. The required input values are either fixed parameters (the block time for Bitcoin is 10 minutes, so six blocks are mined in an hour and 144 in a day), or can be found on data websites such as Blockchain.com or Coinmetrics.

To find the profit, you also have to subtract the cost of electricity. Thanks to the equivalence between kilowatts and kilowatt hours, this can be as simple as multiplying the energy consumption of the device by 24 hours in a day and the price of electricity per kilowatt hour.

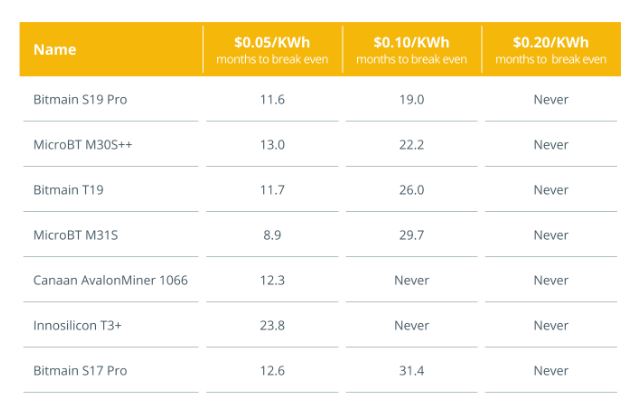

Below is a table illustrating the top ASICs currently on the market and their payback period, i.e. how long it would take for the investment to break even on current income. It’s worth noting that a Bitcoin miner’s earnings fluctuate wildly over time, and extrapolating a single day into the future can lead to inaccurate results. Nonetheless, it is a useful metric for understanding the relative effectiveness of each device.

As can be seen from the table, none of the ASICs are profitable at prices of $0.20 per KWh. The relative performance is about the same for each of the new generation ASICs, while older models can be an attractive proposition if electricity is cheap.

For example, the Canaan AvalonMiner 1066 has low energy efficiency but also a very low price, which makes it quite competitive in the low electricity price range despite being a fairly old model. The Bitmain S17 Pro, a previous generation ASIC, still holds its own due to its lower cost, but quickly becomes unattractive when the electricity price benchmark rises. MicroBT devices seem to have the most balanced performance overall for mining.

One last thing to consider is that this chart was compiled in a bull market. Earnings may be higher than average, although the 2020 halving is still fresh and may offset the effect with lower Bitcoin issuance.

Hardware purchase and configuration

Several stores sell ASICs to retail customers, while some manufacturers also allow direct purchases. Although they are more difficult to obtain than regular graphics cards, anyone can buy an ASIC at a reasonable price. It is worth noting that buying mining equipment from stores or manufacturers that ship from foreign countries can result in hefty import fees.

Depending on the manufacturer or the store, ASICs may be offered without a power supply, which will then have to be purchased separately. Some ASIC manufacturers sell their own units, but it’s also possible to use power supplies built for servers or gaming computers, though they’ll likely require special modifications.

ASICs must be connected to the Internet via an Ethernet cable and can only be configured through a web browser by connecting to the local IP address, similar to a home router.

Before proceeding, you need to set up an account with a mining pool of your choice, who will then provide detailed information on how to connect to their servers. From the ASIC web panel, you need to insert the pool connection endpoints and account information. The miner will start working and generating Bitcoin.

Mining through an established pool is highly recommended as you will be able to generate consistent returns by pooling your hardware with others. While your device may not always find the correct hash to create a block, your mining contribution will still be rewarded.

Bitcoin Mining Considerations and Risks

In addition to the financial risk of not making a profit, there are technical risks involved with managing high-powered devices like ASICs. Proper ventilation is required to prevent mining equipment components from burning due to overheating. All of the miner’s electricity consumption is dissipated to its surroundings as heat, and an ASIC is probably the most powerful device in your home or office.

That also means you have to carefully consider the limits of your power grid when mining Bitcoin. Your home electrical network is rated up to a maximum wattage level, and each outlet also has its own rating. Exceeding those limits could easily result in frequent power outages or electrical fires. Consult an expert to determine if your Bitcoin mining setup is safe.

Regular maintenance against dust and other environmental factors is also required to keep mining devices in good condition. While failures are relatively rare, ASICs can go out of service sooner than expected without proper maintenance.

While individual ASICs can fail, the biggest threat to their profitability is the potential for them to become obsolete. The most efficient miners will eventually crowd out the older devices.

Historic generations of miners like Bitmain S9, released around 2016, lasted roughly four years before becoming unprofitable under any electricity price setting (except zero). However, the speed of advances in computer technology is largely unpredictable.

Bitcoin mining is no exception to any other business. There is potential for rewards as well as risks. Hopefully, this guide provided a decent starting point for evaluating both.