Terraform Labs rebooted the Terra blockchain following a software update to help prevent attacks against the network in the wake of the collapse of its algorithmic stablecoin and related Luna token that had rocked cryptocurrency markets.

The solution is designed to help prevent so-called governance attacks against its protocol, a way to manipulate the fundamentals of a given blockchain by acquiring enough tokens to force a majority vote.

Following the release of the patch, Terra previously said that the network would be back up and running once two-thirds of the voting power belonging to validators came online to finalize the update. In previous outages of blockchain networks like Solana, this process has taken several hours to complete, as validators can reside in multiple time zones.

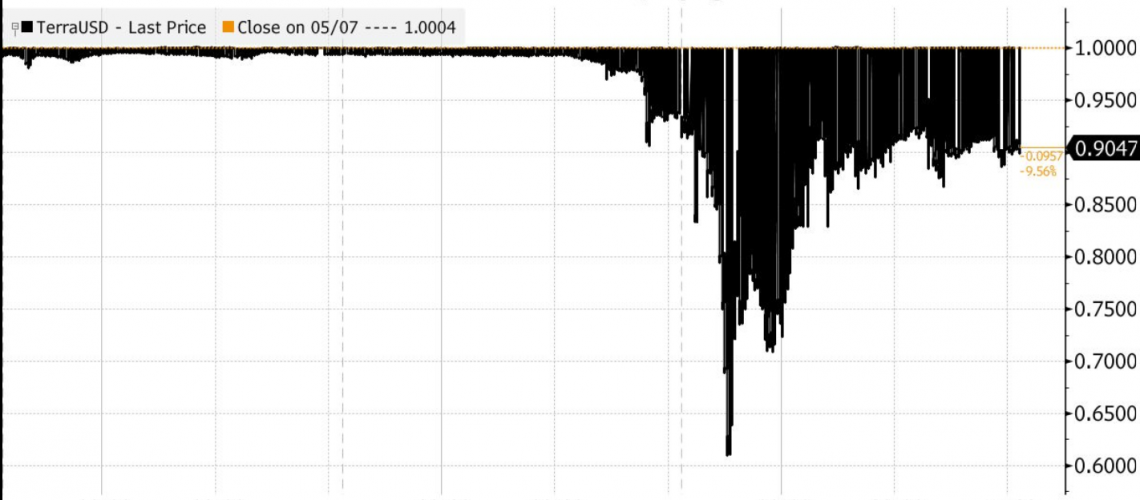

Terra’s UST is one of the largest stablecoins in the world, while its corresponding Luna hit an all-time high of $119 just last month. Its fall has been quick and fast, leaving the broader crypto community in the dark about how this could affect the broader ecosystem.

The outage meant that no transactions occurred on the Terra blockchain while the system was shut down, forcing the price of its two tokens to stop moving. The value of UST, which uses a complex combination of code and trading incentives to maintain its peg to the dollar, was hovering around 36 cents before the blackout, while Luna, a sister token to UST that helps maintain the former’s price, had fallen. near zero on Thursday, according to data compiled by Bloomberg and CoinGecko

The developers of Terra’s Discord server speculated that stopping their blockchain might be the only solution left to them, after a plan to recapitalize UST by seeking external funding appeared to fall apart. Terra’s support organization, Luna Foundation Guard, had tried to raise more than $1.5 billion to prop up its token, but backers did not materialize immediately.

Sid Powell, chief executive of Maple Finance, said the Terra community was concerned that an attempt to attack his protocol using a majority vote could compromise the security of the network, and as the price of Luna declined , that risk became more likely. Several platforms that rely on the Terra blockchain to operate are now also facing disconnection, including its own decentralized lender Anchor Protocol.

Around the time of the suspension, there were still more than $1.05 billion worth of tokens locked up on Anchor, according to data from Defi Llama. Anchor has been the main driver of Terra’s rising value in the cryptocurrency sector, thanks to a promised interest rate of up to 20% for merchants willing to deposit UST on its platform.

“They’ve made the decision that they can’t enforce network security,” Powell said. “It’s bad for crypto because of the damage to reputation and sentiment, obviously demoralizing for crypto.”