The hype around the Metaverse is constantly increasing, making it the next big thing in the digital world. The latest push came when Facebook rebranded its corporate name to Meta, focusing on the Metaverse in October. The Metaverse has been referred to as the vision of how the Internet will work in the future. It means an enhanced digital environment where it is possible to perform social functions (work, play, shopping and creativity) in a digital environment. We’ll explore the Roundhill Ball Metaverse ETF, the first exchange-traded fund designed to expose investors to the metaverse.

RoundHill Ball Metaverse Profile

The Roundhill Ball Metaverse (“METV ETF”) was designed to expose investors to the Metaverse by tracking, before fees and costs, the performance of the Ball Metaverse Index (“METV Index”). The Ball Metaverase Index is the first index formulated to track the worldwide performance of organizations building the Metaverse. In addition, the index seeks to monitor the achievement of globally traded equity securities of companies that engage in activities or provide products, services and technologies to leverage the Metaverse and benefit from the earnings generated. The Metaverse Index tracks companies based on the following classifications:

- Compute: These companies empower and supply computing power to grow and support the metaverse.

- Networks: companies that provide real-time connections, high-bandwidth, and data services to customers.

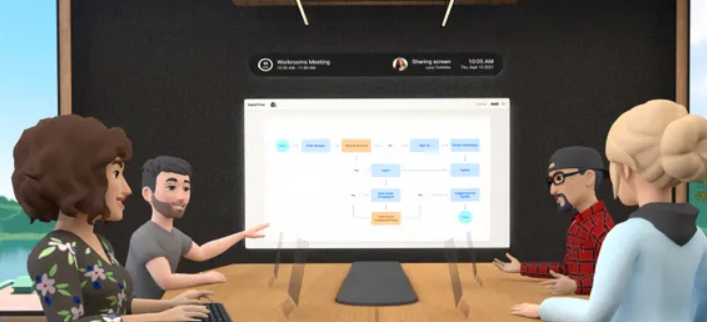

- Virtual Platforms: Companies that produce and operate interactive and often three-dimensional virtual worlds, environments, and simulations where individuals and businesses can engage in exploring, creating, and socializing with one another.

- Exchange Standards: Companies that develop tools, contracts, formats, resources, and engines that serve as interoperability standards and enable the establishment, operation, and continuous improvement of the Metaverse.

- Payments: Businesses that support digital payment procedures and operations including fiat on-ramps to pure payment digital currencies and financial services.

- Content, asset and identity services: related to the design, sale, storage, secure protection and financial management of digital assets such as virtual goods and currencies. Likewise, companies that deal with the protection of user data and identity.

- Hardware: refers to the companies that design, develop, and sell the physical devices that users can use to access, interact with, design, and develop the Metaverse.

A solid reason to invest in the Roundhill Ball Metaverse ETF

The Roundhill Ball Metaverse has been positioned as a way for investors to get exposure to the metaverse. The fund has collected more than 40 stocks in its portfolio, including some of the top companies involved in the Metaverse. Here is a summary of how the top 5 companies in this fund participate in the Metaverse:

- Nvidia – This gaming and technology company provides tools for people to create their metaverses. The most recognized of these tools is the omniverse. It has been said that the omniverse brings together its expertise in artificial intelligence, graphics, computing infrastructure, and simulations.

- Roblox – This is a popular gaming metaverse as its founders have been dreaming of perfecting their interpretation of the Metaverse for 16 years. Roblox has already built a successful metaverse platform that combines unique identities, immersive experiences, and a functional economy running on its own Robux virtual currency. Furthermore, the game engine can be used to create virtual worlds, as it allows users to generate content.

- Unity Software: Unity is another game engine that can be used to create metaverses. the company’s software works with nearly half of all PC and console games. The software runs on more than 20 different platforms and approximately 4.5 billion devices. The company offers the savvy gamer a galaxy of virtual locations, games, and experiences, providing plenty of opportunities to explore the Metaverse.

- Microsoft: Microsoft has been creating a tool to power Microsoft tools and other mesh applications. Mesh is accessible on the enterprise-focused augmented reality Hololens 2 headset and on any VR headset or any device using any mesh-enabled app.

- Metaplatforms: You recently entered the Metaverse with the release of Horizons worlds for adults in the US and Canada. With the Oculus Quest 2 VR headset, users can interact for free in Horizon Worlds, a virtual reality social platform.

What does Roundhill Ball Metaverse EFT hope to achieve?

As discussed above, the main goal of Roundhill Ball Metaverse EFT is to expose the Metaverse to the general population. They provide exposure to various companies such as

- Infrastructure development companies that are essential to the metaverse like Cloudflare and Nvidia

- Virtual world creation game engines like Unity and Roblox

- Content creation, commerce, and social enterprises for the Metaverse, such as Tencent, Sea, and Snap.

Roundhill Ball Metaverse EFT Price Prediction

Based on any virtual currency market, it is difficult to predict how the market will go as there are so many variables involved. However, the price seems to fluctuate with an increase of 0.24% on May 25, 2022. There is no immediate prediction of how the price or the market will behave; however, there are bullish reports for the future. It is because the company is entering Europe with its investment. The firm stated that it would monitor companies in the rankings listed above that seek to promote the Metaverse. The company claims that the move to enter Europe is so that everyone has the opportunity to invest in the company and not just US investors. However, if major investors or holders pull out of the project, the price may plummet, although this is unlikely. Ark research has predicted that revenue from virtual worlds may be as high as $400 billion by 2025, and Bloomberg claims that the market opportunity in the multiverse may be as high as $800 billion by 2024. These predictions should not be taken as financial advice. .