This article explains the basics of understanding Cryptocurrency trading pairs and how it works, which represents a key element in Cryptocurrency trading.

Delving into the world of cryptocurrencies is extremely intimidating, especially when it comes to a topic that is naturally complex. Not only do you have to deal with the complexities of understanding the technology behind cryptocurrencies, but you will also have to deal with the difficulty of knowing the intricacies of cryptocurrency trading. Like it or not, anyone who wants to enter the Crypto world MUST have a basic understanding of how to trade. Why? Because if you want to own cryptocurrencies, you need to know how to buy or sell them on an exchange, what factors to consider, and how to manage your coins, among other things.

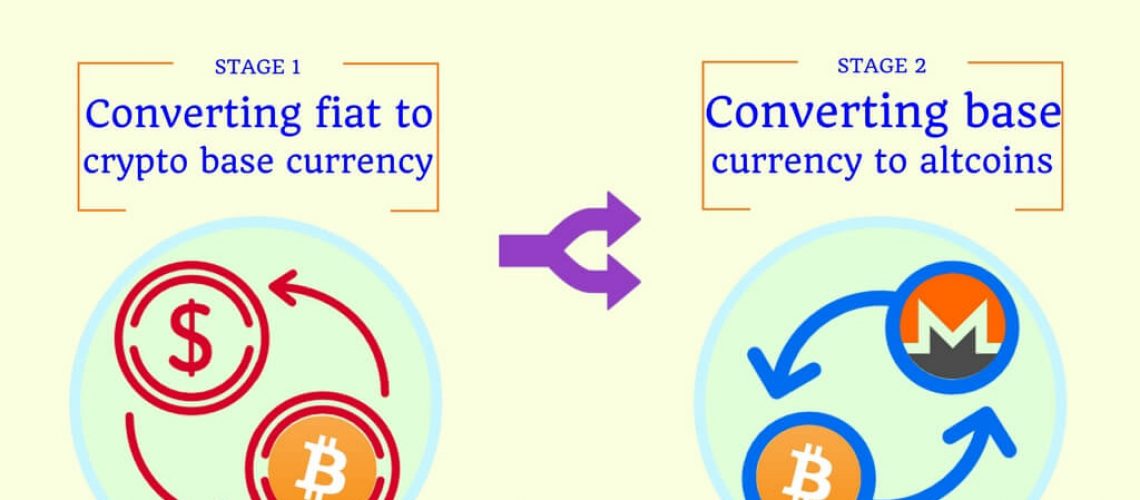

Before going into details, it is important to understand the general description of the Cryptocurrency trading process:

STAGE 1

The first stage involves buying the base currency of the Cryptocurrency world, in the form of Bitcoin, using your national currency.

There are more than 1200 cryptocurrencies, in which all of these currencies can only be bought with Bitcoin and cannot be bought with your national currency. This is why Bitcoin is considered the gateway to the world of cryptocurrencies and therefore a base currency for cryptocurrencies. This stage converts your fiat currency (paper currency) into the crypto base currency.

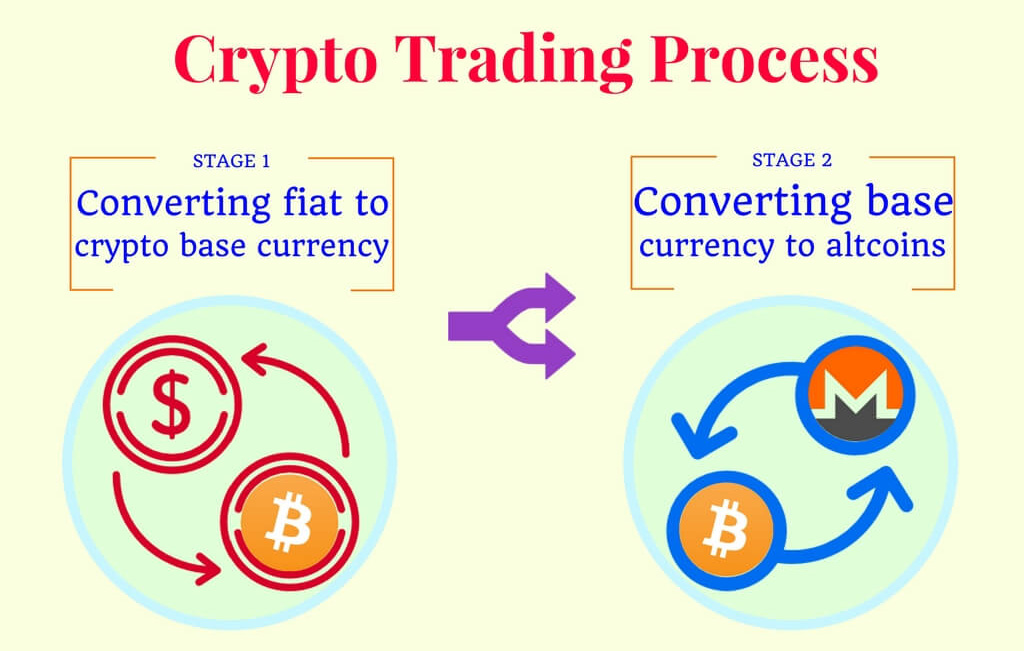

Some national exchanges allow you to buy Ethereum and Litecoin using their national currency. Therefore, ETH and LTC would also be considered base currencies along with Bitcoin. In fact, ETH and LTC are even more preferred as confirmation times are much faster and their transfer is much cheaper.

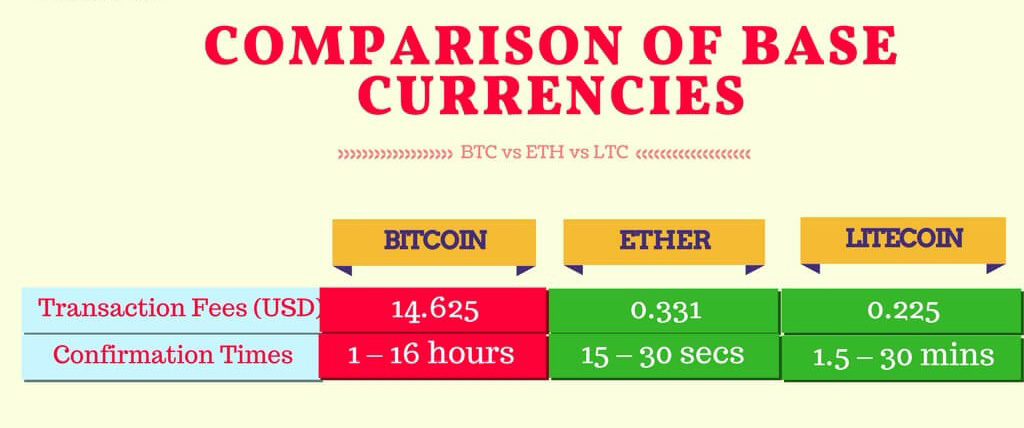

Stage 1 requires you to open a local crypto exchange that accepts your national currency (eg USD, CAD, GBP, EUR). Most of the time, local cryptocurrency exchanges do not offer a wide variety of currencies to trade, and that is the main reason to buy the base currencies.

If your only goal is to buy and hold a base currency of BTC, ETH of LTC, then Stage 1 is sufficient. If you want to buy other coins besides those 3, you have to proceed to Stage 2. It should be noted that in both Stages, you should not store your coins in an exchange, but in a private wallet that you control, so as to secure your coins. in a safe way.

STAGE 2

Assuming you plan to buy other altcoins besides BTC, ETH, or LTC, you need to enter Stage 2. This fee requires you to open a cryptocurrency exchange that only accepts cryptocurrency deposits. Unlike the cryptocurrency exchange in Stage 1, the cryptocurrency exchange in Stage 2 does NOT accept fiat money or your national currency. You can only use the base currency you purchased in Stage 1 (BTC, ETH, or LTC) to purchase other altcoins. Here is the list of differences between an exchange that accepts fiat currencies (Stage 1) and exchange that accepts cryptocurrencies (Stage 2).

UNDERSTANDING CRYPTOCURRENCY TRADING PAIRS

After understanding the cryptocurrency trading process, it’s time to delve into the mechanics of cryptocurrency trading pairs and how it works.

STAGE 1

In the first stage, the base currency of BTC, ETH, or LTC that you buy will be quoted in your national currency. This is easy as you will know the value of the coins you are buying with your national currency. For example, if the current price of Bitcoin is $20,000 and you plan to buy $1,000 worth of Bitcoin, you will get 0.05 BTC per $1,000. If the price of one Bitcoin rises 50% to $30,000 each, then your BTC has risen 50% as well, thus valuing your 0.05 BTC at $1,500. You would make a $500 USD profit if you sold all your BTC and cashed out your investment.

STAGE 2

This is the most complicated step; understand the relationship of trading pairs when buying altcoins using BTC (or ETH/LTC) as your base currency. Since you cannot buy altcoins directly on Stage 1 exchanges, the price of altcoins is not quoted in your national currency. Here is an example:

In this example, we will see the ticker Monero (XMR) / Bitcoin (BTC) or simply XMRBTC. In other words, I am using BTC to buy XMR. The price of a Monero is quoted in BTC instead of USD. Its current price of 0.025 simply means that it costs you 0.025 BTC to buy 1 XMR. This “price” is just a ratio of the value of BTC to the value of XMR (the USD value of BTC was $14,800 while XMR was $370, giving a ratio of 0.025).

The reason it can get complicated is that we’re used to buying things pegged to our national currency, and pegging the altcoins we want to buy to BTC requires you to know the value of BTC in USD at that specific time, as well as the value of XMR in that specific moment.

HOW TO RECOGNIZE YOUR EARNINGS?

Following the example above, there are 2 ways you can monitor your profits (or losses):

1/ VALUATION OF YOUR COINS IN USD

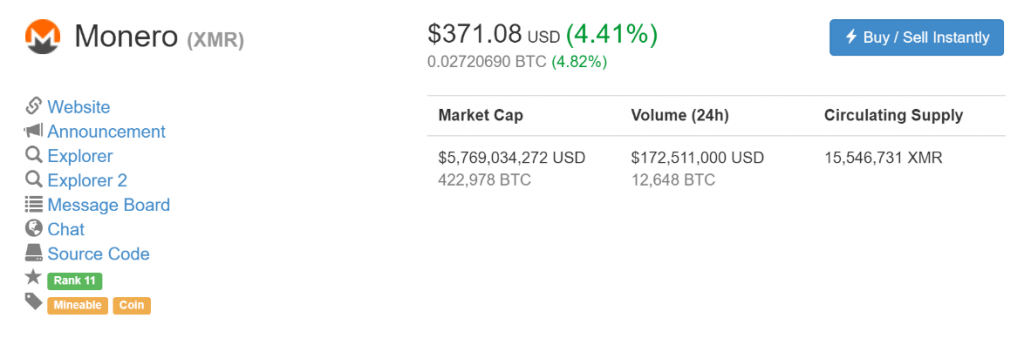

When you have used your 0.025 BTC to buy 1 XMR, you monitor the USD value of your XMR. This means valuing your XMR only in USD, making it easy for you to calculate your earnings. There are many apps and resources that allow you to do that, and Coin Market Cap is a popular resource:

So if your XMR increases to $500 in the future, you know you’ve earned $130 on your initial investment of $370, giving you a huge return on investment. more than 35%.

2/ VALUING YOUR COINS IN A BASE CURRENCY

The main purpose of valuing your coins using a base currency (most commonly BTC) is to increase the number of coins you own. Following the example above, if you bought 1 XMR using 0.025 BTC and the price (or ratio) of XMR/BTC increases to 0.030 in the future, it means that your XMR has increased by 20%. This also means that you can buy 20% more Bitcoin with your XMR. If you decide to sell your XMR for BTC, you would have 0.03 BTC, which is 20% more than when you started with 0.025 Bitcoin. And so, you have increased the amount of coins you have in your hands!