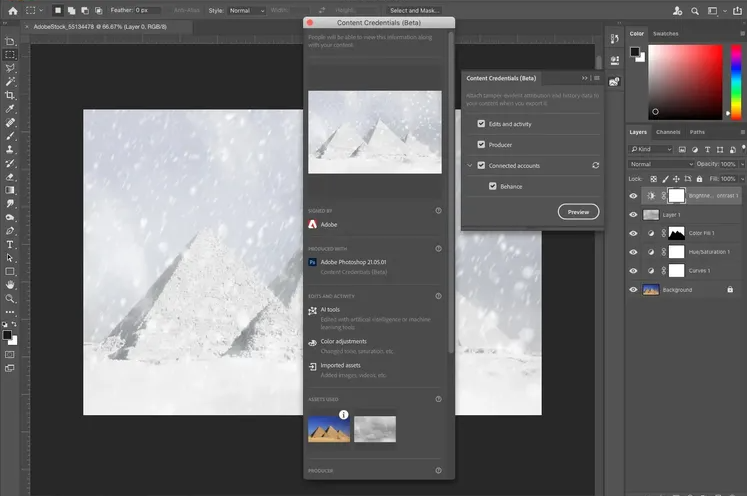

On a cold January day, NFTs began to disappear. Major services like MetaMask and Twitter were suddenly unable to display images associated with newly uploaded tokens, despite users having clear records of ownership. Something in the distributed, decentralized technology stack had gone terribly wrong.

The problem was the NFT OpenSea marketplace, which was suffering from a database outage. The outage caused the OpenSea image upload API to crash, blocking any services that depended on it to upload tokens. In a scene full of militant decentralizers, a single company had come to the center of almost every product. Reporting on the chaos, Vice saw a user who had tweaked the company logo to read “Sea Closed.”

It was an awkward but revealing moment. One year into the NFT boom, it’s hard to mint a collection or list a token for sale without interacting with OpenSea in some way. The company has become the central intermediary and the de facto enforcer of community standards. When an ape is stolen, the rightful owner turns to OpenSea for help, and the platform has become the biggest bottleneck in blocking a sale. It is also the largest single market ever for a token to be listed. Even tokens that are not minted on OpenSea eventually find their way there by simple gravity. And as the outage showed, even Web3 projects without an explicit connection to OpenSea often rely heavily on the company’s infrastructure.

the most successful company to emerge from the NFT boom

It’s a strange situation for a company in the NFT business. In essence, OpenSea provides a simple, centralized service (the ability to view and trade tokens on the blockchain) that is based on a decentralized blockchain that is much more chaotic. Cryptocurrency service Coinbase (another prominent Andreessen Crypto investment) followed a similar playbook to an $85 billion initial public offering, but it’s not clear that the same tricks would work in the Web3 wilderness.

OpenSea declined to make executives available for an interview for this article, but when contacted for comment, company representative Abram Smith stressed the company’s lofty ambitions. “It’s possible that one day, almost everything we own will be accounted for on the blockchain,” Smith said, “and OpenSea’s opportunity is to become a central destination for these new economies to thrive.”

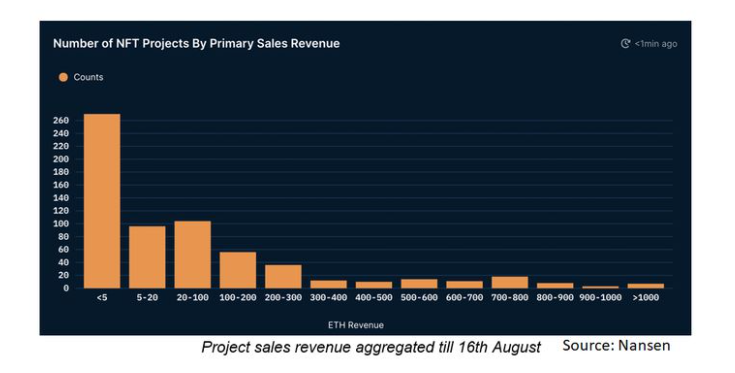

Still, many investors and analysts view the company’s position as more precarious than you might think. It is easily the most successful company to emerge from the NFT boom of last year, processing hundreds of millions of dollars in transactions daily. On a technical level, it is inescapable, as the outage dramatically demonstrated. But it’s remarkably distant from the rudimentary token-launching culture that has fueled the recent boom in digital art, and many aren’t sure Web3’s decentralized future has room for an intermediary platform like OpenSea.

“I think the question is whether OpenSea is like AOL or Netscape, or will they be able to maintain their dominance in the market,” said Brian Krogsgard, who hosts a crypto podcast called UpOnly. “And I think that’s a very open question.”

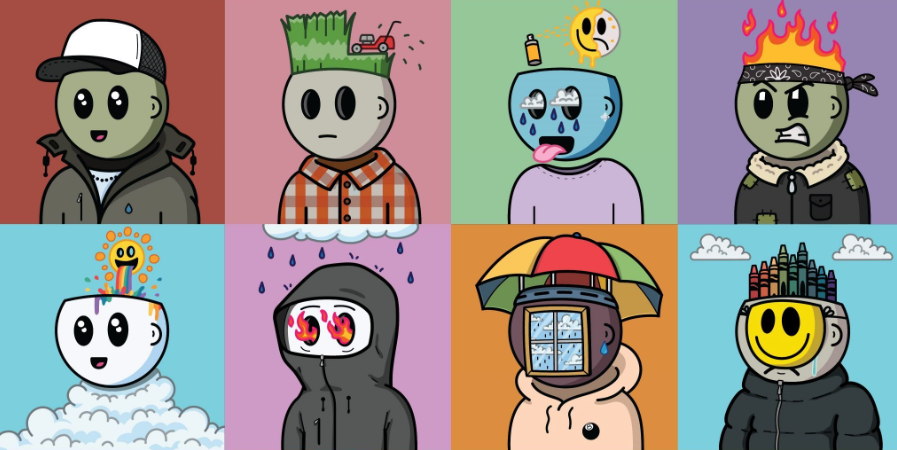

Like almost all tokenized blockchain projects, OpenSea started with a game about cats. Launched in 2017, CryptoKitties were the first major NFTs: a set of trackable and playable images of cats written on the Ethereum blockchain. Arriving amid growing blockchain hype, the project generated more than $10 million in sales in a matter of months. There were a number of follow-up projects from third-party developers: KittyHats allowed you to customize your kittens, while KittyExplorer (from the same developer) allowed you to analyze the overall ecosystem. It was easy to laugh, but for true believers, the potential was electrifying.

The idea for OpenSea came from our interest in CryptoKitties

OpenSea was launched in December 2017 with an eye to capturing that potential. CryptoKitties charged a 3.5% commission on all sales, so OpenSea lowered the figure to 2.5% and got to work building a broader platform. The two co-founders were young but already highly experienced: CTO Alex Atallah worked for a millennial-focused survey company, while CEO Devin Finzer had already founded a claims-finding company acquired by Credit Karma.

But the real draw was its timing. The Ethereum blockchain, long praised for its ability to encode smart contracts on the blockchain, was launching a new standard that would form the foundation of NFTs. Called ERC-721, the standard allowed for a new type of object on the blockchain, something that could be traded and traded like Bitcoin but kept each individual token unique. ERC-721 was only a few months out of beta, and CryptoKitties demonstrated that it could be integrated into a real marketplace. Finzer and Atallah wanted to create tools for that new market: a platform to buy and sell these tokens at scale. The idea was good enough to get them included in Y Combinator’s winter 2018 accelerator program, where they were described as “like Ebay for crypto assets.”

“The idea for OpenSea came from our interest in CryptoKitties,” Finzer said in an interview years later. “While marketplaces for digital goods have been around for quite some time, they tend to be self-contained ecosystems: individual marketplaces for specific games, marketplaces for domain names, marketplaces for tickets, etc… With the introduction of ERC721, it felt like one. an idea was possible for the first time.”

In less than a year, OpenSea raised $423 million

It would be three years before the sales of Beeple and Bored Ape kicked off the contemporary rise of NFT, and they were long, cold years for OpenSea. The internal mantra was to become “the Amazon of Web3,” which meant developing tools like buying, selling, and bidding for this new generation of blockchain tokens. But for a long time after the CryptoKitties boom waned, NFT boosters were left scrambling to find ways the technology could actually be used. Finzer was a regular presence on NFT groups on Reddit, promoting OpenSea as a way to trade cards in Gods Unchained (an early NFT-based card game) or how it could revolutionize software licensing, but for a long time time there were few people willing to accept it.

In hindsight, those years gave OpenSea a crucial advantage in competing NFT markets. Basic online marketplace systems had been around for decades, but OpenSea was implementing the familiar features in a new format. It’s simple for eBay to offer something for sale to a high bidder, but doing the same transaction with an NFT requires an intricate chain of smart contracts that handle bids, proof of ownership, and secure exchange. OpenSea isn’t the only group implementing such contracts (and more importantly, most systems are open source), but they still have the best system for it.

At the same time, venture capital firms were showing a new interest in blockchain startups, particularly Andreessen Horowitz. In February 2018, Andreessen was one of the leaders in a $12.9 million Series A round for Dapper Labs, a new company from the founders of CryptoKitties. That June, the VC group announced a new fund focused entirely on cryptocurrency. Former Silk Road task force prosecutor Katie Haun, already a Coinbase board member, joined the firm to build her expertise in the space. While OpenSea was creating tools, the rest of the market was growing.

“In the end, what we are talking about is the tokenization of everything”

In 2021, that market opened up, and OpenSea was perfectly positioned to take advantage of it. Haun joined the company’s board in February 2021, and OpenSea’s fundraising accelerated. In less than a year, they raised $423 million from three subsequent rounds of funding. The Serie A round closed just a month after Haun joined the board, led by Andreessen Horowitz and attracting big names like Tim Ferriss and Mark Cuban. Series B came three months later, valuing the company at $1.5 billion. By January 2022, the valuation had risen to $13.3 billion, fueled by a massive influx of revenue.

Richard Chen, a general partner at 1confirmation who invested as part of the seed round, says the money was badly needed to build the team from a basic development team to a full-fledged company that could handle the challenges of all its new users. . “When the rig was blowing up, they were just fighting fires, a lot of technical debt,” Chen told The Verge. “They needed to raise funds to grow the team really fast.”

The open blockchain makes it easy to track company growth, and a chart by Chen paints a particularly striking picture. In January 2020, OpenSea generated just over $65,000 in total fees (a combination of OpenSea’s 2.5 percent commission and any commission charged by third-party vendors). A year later, when the NFT fever started to pick up, it was just shy of $615,000. By January 2022, that same number had risen to $386 million.

With so much momentum, wild predictions have become hard to resist. Right now, NFTs are mostly used for collectible art (think of the apes that have become so inescapable), but unlike select platforms like Rarible or Foundation, OpenSea has no particular attachment to the world of digital art. The same blockchain system could just as easily be used for concert tickets, real estate, or graduate diplomas. In the high-flown rhetoric of venture capital, the company’s CEO envisions a world where everything becomes an NFT, with no limits as to where OpenSea’s 2.5% commission can go.

“Ultimately what we’re talking about is tokenizing everything,”

Finzer said on an Andreessen podcast with Haun in May 2021. “There’s the existing digital asset landscape…but then there are the new markets that They haven’t even been really dreamed of yet.”

Towards the end of Web3’s great year, Jack Dorsey decided to rain down on the show. “You do not own ‘web3’,” Dorsey tweeted. “VCs and LPs do it. You will never escape your incentives. Ultimately, it is a centralized entity with a different label.”

It was a thinly veiled shot at Marc Andreessen, which started a broader feud between the two men. But the divide between true believers and venture capitalists is bigger than just two clashing egos, and OpenSea has ended up on what many see as the wrong side. Andreessen Horowitz’s investments have fueled much of the recent cryptocurrency boom, most notably with Coinbase and OpenSea, but also dozens of smaller bets that have yet to pay off. In each case, the goal is to carve out an early niche in an emerging market and turn it into a big-money outlet, a goal that doesn’t fit easily with Web3 dreams of decentralized ownership.

An analyst in the NFT space pointed to a 2020 article by Andreessen Horowitz as a crucial playbook, outlining how to operate in a decentralized space while maintaining a dominant market position. The publication recommends “progressive decentralization,” in short, decentralize as much as possible without losing control of the product or the market.

“the core of this is really about market dominance”

“The dominant platforms seem to be really designed around the values of Web2,” he said. “The decentralization thing feels like a wrapper to gain buy-in, but the core is really about market dominance.” (She asked not to be named for fear of being ostracized in the NFT community. “It’s definitely a space where you have to be hyping the hype, otherwise you’re out of the club,” she explained. “It’s kind of like Scientology like that.”).

When asked for comment, OpenSea described its approach to blockchain differently. “We take a coordinated approach to create a safe and friendly experience for our users without undermining the fact that they are interacting with blockchains,” said Smith, speaking as a representative of OpenSea. “As such, the property is decentralized and offers portability and control over your digital property, which is simply not available on Web2.”

Other players in the community are less concerned, seeing the NFT market as too decentralized to be dominated by a single player. “I am literally zero [percent] worried about a monopoly situation,” CryptoPunks CEO Cyrus Younessi told me. “In the end they don’t control it. Ethereum is a neutral open market. If people want to trade something, they’ll find a way to do it… This whole space is built on not letting any company make those decisions.”

At the same time, the rapid growth of OpenSea has caused a series of problems in the platform, as a result of the slow investment in trust and security infrastructure. The new rise in NFT trading has led to an increase in stolen tokens and other legal issues that require intervention, and OpenSea has been forced to act as a moderator of those disputes with few pre-existing policies on when and how a token should be listed. on the blacklist. When the company reviewed its “shared storefront” contracts a second time earlier this year, it found that more than 80 percent of the items were “plagiarized works, fake collections and spam,” prompting widespread takedowns.

There are also simple security issues, which have become urgent due to the huge amounts of money on their platform. An interface bug that had been inactive for months allowed attackers to trade in old contracts, leading to hundreds of thousands of dollars in unwanted sales. In a more embarrassing internal incident, OpenSea’s head of product was publicly denounced for insider trading in September, using secret wallets to drive sales on the platform. (He was fired shortly after, after what the company called “an immediate and thorough review.”) They’re the kind of headaches that might open the door for a competitor, but so far no competitor has emerged.

Even for skeptics, it’s hard to deny how powerful it is to have all buyers and tokens in the same place, making offers and deals. With all her doubts about the platform, the anonymous analyst still uses OpenSea and is very happy to see a new offering. He told me about a surprise offer he had received months before.

“I logged into the site and someone had made an offer on an NFT that I got for free,” he told me. “I was doing the math and I realized, oh my gosh, this is $20,000.”

She laughed, remembering the rush of success. “I felt converted. I love OpenSea!