Steph Curry. Eminem. Paris Hilton. Cuban Marcos. The full list of celebrities who have embraced non-fungible tokens (NFTs), whether through creation, collecting or peddling, seemingly grows by the hour and runs the gamut from Rob Gronkowski to lil nas x

The NFTs are here. They are no longer marginal. Specifically, art and collectible NFTs have gone mainstream at an impressive speed, faster than even the dreamiest crypto bull could have dreamed. Now we have a better idea why. As I wrote at the beginning of this cycle, NFTs (especially art and collectibles) are fun, viewable, culturally relevant, and easy to understand in a way that many blockchain concepts are not.

Jeff Wilser is the author of seven books, including “Alexander Hamilton’s Guide to Life,” “Joe’s Book: The Life, Wit, and (Sometimes Accidental) Wisdom of Joe Biden,” and the award for Best Amazon’s Book of the Month in Unpublished Books. fiction and humour.

They can solve real world problems. Just ask Daryl Morey, president of basketball operations for the NBA’s Philadelphia 76ers, who told me a few months ago, “I just moved from Houston to Philadelphia and it was a pain in the ass. I had to move 10,000 comics. I had to move all the art on my wall. I had to move all this shit, and with digital stuff you just move it. It is definitely superior. And it’s the start of a big, big trend.”

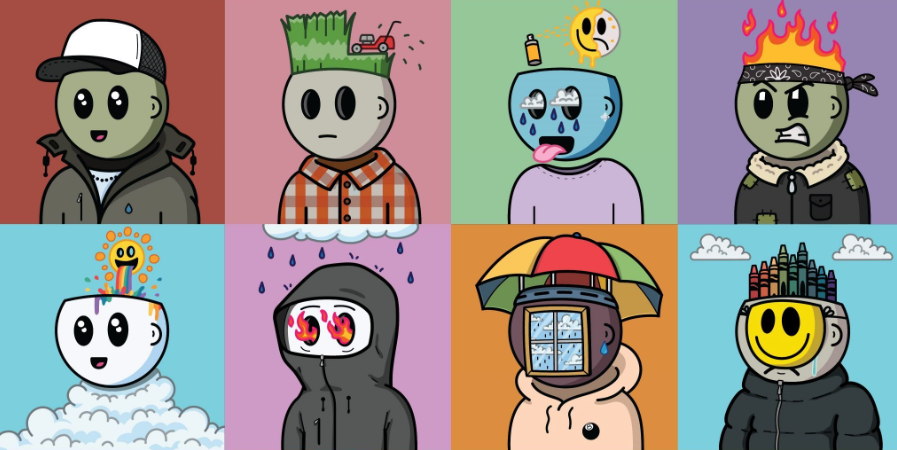

Then there’s the development that many in the space, including myself, dramatically underestimated: the community angle. The social angle. When you join the Bored Ape Yacht Club, CryptoPunk or World of Women NFT, show that you understand. It shows that you belong to the club. “People identify with them on a personal level,” said Maria Shen, a partner at Electric Capital, a blockchain-focused venture capital (VC) firm. “The property says something fundamental about your identity; It says something about their interests.”

This we now understand.

But what’s next?

Just a year ago, art and collectible NFTs were mostly ideas with “potential”, but no one outside of the crypto space was taking them seriously. What categories are in that same phase of early speculation today, which are likely to explode? What silly sounding NFT will be endorsed by Tom Brady in 2022? What bold and revolutionary NFT will Ariana Grande promote in 2023? What are the next chapters in this wild narrative?

I consulted with a group of NFT experts (investors, founders, people who live and breathe non-fungible tokens) to give us an idea of the (possible) future. Some of these categories will seem obvious. Some will seem exaggerated. Some may even feel absurd. However, taken en masse, they have the potential to change the way we consume content, how we spend and earn money, how we demonstrate our identity, how we attend events, how we dress, or even how and where we spend most of our time. .

Maybe. But for now let’s start with the little drops.

Gaming

Every day there are 2 million people playing the little blobs of Axie Infinity, which now has a valuation of $3 billion. “Gaming is really exciting as billions of people buy digital goods within games,” said Devin Finzer, CEO of OpenSea, the largest NFT platform. The reason we haven’t seen even broader adoption yet, Finzer said, is that “the development cycle is a bit longer with games than it is with simpler art and collectible projects. There is a little more delay. He imagines that we will see the fruits of these developments within a year or two.

Jamie Burke, CEO of Outlier Ventures (a UK-based blockchain venture capital and acceleration lab), was originally encouraged by research showing that “people spend five times as much on a chain game of blocks than in a conventional game”. He said skeptics originally “poo-poo” this research, but then Axie came along. Axie’s giant is proof, Burke said, that if the player can exit the game and cash out with cryptocurrency, and if they are free to “do what they want with the money,” then they will spend more money. “It seems really obvious now,” he said, predicting that Axie is just the start of a much bigger boom in gaming that will be “huge in the next decade.”

Fashion and Wearables

“Luxury brands are coming into the NFT space,” Laglasse says, puffing on a cigarette on our Zoom call. Exhibit A: On September 30, Dolce & Gabbana sold its inaugural nine-piece NFT collection, called “Collezione Genesi,” a surreal mix of couture and blockchain, for $5.6 million. The set included physical elements (such as women’s dresses) and their digital companions such as NFTs.

Just two weeks earlier, at London Fashion Week, a new label called Auroboros, which describes itself as “the first fashion house to fuse science and technology with physical couture,” unveiled a line of digital clothing that you “wear” using augmented reality (ARKANSAS). For perspective, this was not at a crypto conference. This happened at London Fashion Week.

Or consider the collaboration between The Bored Ape Yacht Club and The Hundreds (high-end streetwear), which created products for the community. “That sold out in hours,” Shen said. Fashion brands know an eager (and wealthy) audience when they see one. “In 18 years, we’ve never seen anything like what’s happening on our website right now,” The Hundreds co-founder Bobby Hundreds said at the time. “Just wow.”

Trendy wearables might just be scratching the surface. Shen imagines that NFTs could create new ways to monetize and invest in fashion. Wear slippers. “To flip a shoe you have to do a physical inventory,” he said. “Imagine if you could increase the speed at which you can flip items.” Or maybe new financial instruments, powered by NFTs, could allow people to invest in the fashion sector. “You can create financial products, like an index of today’s best-selling sneakers,” Shen said, which could allow you to invest in a group of the 100 most popular sneakers, for example, instead of rolling the dice on just one pair. .

This is also a crossover with decentralized finance (DeFi) NFTs, which brings us to…

NFT DeFi

Let’s say you spent your last $5 million on a CryptoPunk NFT, but now, whoops! – you forgot you have to pay the rent. No problem. You can use that CryptoPunk as collateral for a loan at NFTfi. “NFTs allow for some new asset behaviors,” said Andrew Steinwold, managing partner at Sfermion (an NFT investment firm) and an NFT podcast host.

Think about that loan. When you put up the CryptoPunk as collateral, you automatically get it back when you pay off your debt. And if you fail? Thanks to the magic of smart contracts, the NFT is transferred to the lender, eliminating the need for debt collection and bounty hunters. That’s just the beginning. As my colleague David Z. Morris has written, NFTs are breaking up (to provide more liquidity), acting like quasi-securities, and becoming financial enough that they can soon earn interest from the US Stock and Exchange. Commission (SEC).

Burke expects innovation to continue at a rapid pace. Imagine an increase in secondary markets, or even “derived” markets. Imagine that, for whatever reasons, Epic Games decides not to integrate NFT into Fortnite. Perhaps some derivative NFTs could fill the gap? “Let’s say I have a sword, and it’s a really valuable sword,” Burke said. “And I want to take money from the game. The sword is so valuable that it has the ability to pay off my student loan or buy a house.” He continues, clearly enjoying the thought experiment: “Shit, I love my sword but I need the money.”

Right now, there’s nothing you can do about it. You just got a dummy sword and it’s stuck in Fortnite. But perhaps an NFT of the “twin” of the sword, which lives outside of Fortnite, could be bought and sold on a derivatives market, and then some kind of mechanism would allow the transfer of funds once the transaction is complete (delivery of the sword). in Fortnite. This is the kind of possibility that NFT+DeFi could unleash.

In that sense, Burke believes that we are much more likely to see growth in new, creative, blockchain-enabled financial products before we see the NFT-ization of things that already exist in traditional finance, like writing your House. . “Where will DeFi growth come from? In this regulatory environment, they certainly won’t be real world assets, or anything remotely resembling a security,” Burke said. “That will be a fight of a decade.”

Events and Ticket Sales

Another hypothetical: Drake has an upcoming concert and you want to go. Tickets are $100. Now imagine that the ticket you buy is actually an NFT, and your NFT does the following six things:

1. It’s embellished with some artwork from a designer you like.

2. Serves as concert souvenirs. So it might even be worth something one day, like old Beatles concert ticket stubs.

3. Inside the venue, you can use the NFT as a means to get snacks or beers.

4. Thanks once again to the magic of smart contracts, your NFT revenue automatically pays Drake 40%, DJ 10%, lighting crew 2%, janitors 1%, and so on. successively. No middleman is needed to orchestrate payments, which means you pay almost nothing in fees.

5. If you purchased the VIP ticket, the NFT unlocks your access to visit Drake’s backstage, or maybe gives you exclusive access to future digital goodies.

6. Surprisingly, the NFT gives you the right to be not just an event attendee, but even a Drake concert shareholder. This NFT works as gig capital and you will get a small portion of the profits. If things break, right? Maybe you even earn money by attending the show.

This future is closer than you think. “What we’re excited about is NFTs being used in the real world,” said Carolin Wend, co-founder of Mintbase, an NFT minting platform. Take an upcoming festival in Lisbon, NEARCon, which is based on the NEARProtocol, a smart contract system that Mintbase uses instead of Ethereum. “The founder of the festival wants to do 100% NFT ticketing,” Wend said, and this could (one day) include “staking” your ticket, meaning you could make a profit on what you spend for the ticket.

Some of these capabilities are still disabled going forward, but even at the Lisbon festival (which took place on October 26), Wend expects “QR to go out of space,” so people can scan QR codes to do things like redeem your NFTs for burritos. The latter is not hypothetical. In Lisbon, Wend said, “we’ll make NFT burritos.”

NFT Community Platforms

Remember those Dolce & Gabbana NFTs? Now imagine that you are the lucky person who bought one. Imagine that you are the proud owner of the crown jewel of the set, literally a crown, called the “Doge Crown”, an almost comically embellished piece of jewelry. (Unfortunately, the “Doge” refers to the Doge’s Palace in Venice, not the Shiba.) The crown looks like it’s straight out of “Game of Thrones.” How do you store it? Perhaps he keeps the physical crown in his private vault, or perhaps he displays it, modestly and tastefully, high above the throne room in his Mykonos villa.

But what about the digital NFT? What are you doing with that? Or as Burke says, “Where do you flex that?” Think about it from the perspective of Dolce & Gabbana. “If you’re a high-end luxury brand, it’s all about controlling the retail experience,” Burke said. He supposes that trying to render such a lovely and intricate crown in a pixelated metaverse like Decentraland could, at least in the current version, turn into “pretty shitty portable”. (Burke points out that, for this very reason, Dolce & Gabbana is giving the buyer of the NFT two years to decide where to deliver it.)

So Burke predicts some sort of environment where people can come together, chat, and flaunt their NFTs. Maybe it’s a form of AR, or maybe virtual reality (VR), or maybe something similar to Web 3.0 or maybe something else entirely. The point is that there must be a good environment to experience NFT. “What are network platforms? That’s going to be the big trend,” Burke said.

Shen has a similar idea with a different twist. She envisions “a home for NFT communities” or, more precisely, “a social network made for NFT owners.” Perhaps this network is connected to your wallet that owns a Bored Ape, and can only be accessed by verified users who own certain NFTs.

Or maybe they just hang out in the metaverse? Which brings us to…

Metaverse

“The metaverse is going to be one of the future game changers of the NFT space,” said Maxime Laglasse, head of content at Nonfungible.com. The short version: the metaverse may be a place to store and appreciate NFT art, it’s a hub for gaming, it’s Zuckerberg’s new mission in life for a reason, and maybe it’s an evolved version of how we’re all getting through. hang out online anyway. (You can get my long version here and an even longer version here.)

Virtual Land

A wise investor once said: “Earth. It’s the only thing they can’t do anymore.” The investor was Lex Luthor. And his advice might ring true in the metaverse. Virtual worlds like Decentraland, The Sandbox, and Cryptovoxels put a hard cap on your real estate, which means that, in theory, a finite supply will become more valuable if demand soars.

“This is pretty promising,” said Matty “DCLBlogger”, an influential voice in the NFT community who has been something of an oracle, launching a widely shared Twitter thread in 2020, over a year ago! – which described 25 future NFT use cases. The thread seems prescient, aptly calling for the rise of art, collectibles, and gaming. Matty is just as optimistic in virtual land. “Look at Axie Infinity,” he said. “There are over a million players”, and some of these players will think, “maybe it makes sense to own that land”.

Once you start wrapping your brain around the idea that people could benefit from digital real estate, the possibilities are dizzying. Maybe you own land, build a virtual office building, and then rent the building for a virtual conference. And when your conference attendees want to blow off some steam, they might want to gamble during cocktail hour, so you rent a casino game that lets them win and lose real cryptocurrency. As Matty said, “It gets really crazy.”

Digital Identity

Self sovereign identity (SSID) has long been one of the most intriguing applications of blockchain technology, and NFTs could be the key that unlocks the door. (Why is the SSID important? Here is my manual from last year.) Laglasse sees the Ethereum Naming Services, or ENS, as a useful example. “Now you can link your Instagram account, your Twitter account and almost all social media accounts to ENS,” Laglasse said. “Since it’s decentralized, you can really own the name that you display to the community.”

Laglasse classifies them as “Utility NFTs”, in the sense that you can’t normally exchange them for money (like art and collectibles), but instead exist to prove that you own something. Another idea along the same lines: NFT of university diplomas. This would allow a Vietnamese student to travel to the US, for example, and decisively demonstrate that they have a diploma. Laglasse predicts: “It’s going to happen one day.”

Social networks and influence

This one is a little soft, a little hard to visualize. But stick with it. “Think of all the digital value created through social media platforms,” Burke said. It refers to that elusive and difficult-to-quantify concept of “online influence”. Currently, Burke argues, the only real way to monetize that influence is through advertising, with the influencer only earning a small slice of the revenue pie. But what if this influence could be quantified, scored, and captured as an NFT?

This “influencer NFT,” let’s call it, wouldn’t be as simple as rewarding the number of Twitter followers. “It’s a form of atomized sociability,” Burke explained, where “I can atomize each piece of content and I can quantify the relationship I have with my community.” He said that this NFT could take into account variables such as online reputation, trustworthiness, or even the ability to curate and create good content. “This is the hardest to explain,” he said with a smile.

Remember the “Klout” score, in the early days of Twitter, where an algorithm was trying to quantify the social mojo of users? Klout never seemed to catch on, going under in 2018, but you can see the (possibly evil) appeal of the idea. “Literally any form of digital value stream could, in theory, become an asset,” said Burke, who also envisions this NFT being plugged into a DeFi ecosystem, as if it were used as collateral on a loan.

Shen thinks of this concept as a more refined version of a credit score, but one for credibility and influence. “You can actually have NFTs that are part of your identity and reputation,” he said. She points to the example of Rabbithole.gg, where users can earn cryptocurrency, tokens, or NFTs by demonstrating that they have certain skills or have completed certain tasks, such as signing up for an ENS name.

Steinwold likes another example: Galaxy.eco aims to use on-chain data to reward people for certain verifiable activities. Maybe if you have 1,000 trades on Uniswap, get a Master Trader badge. Or if you’re a long-time heavy holder, you get Diamond Hands. Maybe I should coin you an NFT if you can prove you’ve read this far in the article.

Music

“The industry as a whole definitely needs some disruption,” said Matty, who hopes that music will eventually take off in the same way that art and collectibles do. Maybe this has started. Shawn Mendes, Grimes, and Snoop Dogg dove into NFT and discovered new ways to monetize and engage with fans. Kings of Leon weren’t satisfied with simply releasing an album like NFT; they were so excited that they played their NFT in space.

Live Nation wants to do for music what Top Shot did for the NBA: capture “moments” as collectibles. “We’ve all learned from Top Shot in the NBA,” CEO Michael Rapino said on an earnings call, adding that he wants Live Nation to create “magical moments that we can coin and attach to our ongoing ticket fests and special moments.” .

Or maybe NFTs, music and DeFi could merge. “If music masters could be pooled together and then split up, they could receive income like broadcast dividends,” Shen said. Then he raises another possibility: Imagine if the rights to each song were captured as an NFT, and then you put together the top 40 songs of the month, split the pool, and then you could buy a piece of that pool and receive a revenue stream. “That would be interesting,” he said, “we just haven’t gotten to that point yet.”

Four more quick ones

Healthcare: “In the healthcare industry, it’s going to be huge,” said Laglasse, who envisions NFTs can be used to safeguard the confidentiality of health records, as well as bolster monitoring of the supply chain of medicines.

Advertisement: Here’s a curveball. “Advertising is not something people pay attention to,” Matty said. But he asks, “Why wouldn’t websites sell NFTs that give people the right to certain media ads?” All of this is at stake.

Fantasy Sports: Sorare already has a foothold in the world game of soccer. It doesn’t take much imagination to watch the NFL and fantasy football mega-industry go up in flames.

NFT Search: “Right now, NFTs are an interesting but confusing and chaotic category,” Shen said, adding that they “look a lot like websites from the ’90s before Google came along.” She has a point. There is no clean search function for NFT… yet. Imagine a Google for NFTs. Or a decentralized Google for NFTs.

And finally, the most maximalist scenario:

Digitization of everything physical

“A lot of people still don’t realize how big NFTs are going to be,” Steinwold said. “They are going to be used for anything. All forms of value will be represented as NFT.” This is a bold statement. I ask him if I heard him correctly. Will all forms of value be represented by NFT?

Why are you so confident?

“We spend most of our waking hours online,” Steinwold reasons, arguing that this is a trend that will continue to accelerate over the next 20 to 30 years, and that soon “we are going to have a lot of digital goods.” In the future, Steinwold said, if you buy a cool pair of Air Jordans (the physical ones that go on your feet), you’ll want your NFT partner. You’ll want the NFT so you can flaunt it, flex it, and maybe use it in a metaverse or play-to-win game.

“Maybe not this chair,” he said and pointed to his chair over the Zoom, laughing a little. But he hopes that people will eventually want to NFT his wine, baseball cards, rare coins, watches, cars, you name it, and “this is how the world is going to go.”

Maybe that sounds exaggerated. But just a year ago, the idea of mainstream NFTs for art and collectibles also came up.