A Bitcoin ATM (ATM) or BTM (Bitcoin ATM) is a popular means of bypassing the traditional banking system of buying or withdrawing Bitcoin (BTC). ). They have grown in popularity over the years along with the rise in the value of cryptocurrencies and the increased level of trust in them.

Other ATMs allow users to buy and/or sell other cryptocurrencies such as Ether (ETH), Bitcoin Cash (BCH), Dash (DASH), and Litecoin (LTC), among others.

If you haven’t used one yet or want to learn more about it, read on. In this article, we will discuss some interesting points about Bitcoin ATMs. We will also provide you with useful information such as typical requirements and steps to consider when buying or selling Bitcoin.

Read more: How to Sell Bitcoin: 5 Ways to ‘Cash Out’ Your BTC Holdings

What is a Bitcoin or BTM ATM?

An ATM or BTM is similar to a regular ATM in that it is a physical kiosk. What sets it apart from typical ATMs, of course, is that it allows users to purchase Bitcoin in exchange for cash or debit. Some BTMs also allow users to sell Bitcoin for cash.

BTMs look like typical ATMs. However, they connect to a Bitcoin wallet instead of a bank account. Instead of a bank card, the Bitcoin wallet serves as a repository from which coins are sent or loaded. Some Bitcoin ATMs look a lot like traditional ATMs because they are, in fact, traditional ATMs with custom software for Bitcoin.

A Brief History of Bitcoin ATMs

The first ATM for cryptocurrencies was first opened on October 29, 2013. It was a Robocoin machine located at Canada’s Waves Coffee Shop in Vancouver. It only worked until 2015 due to operational errors by Bitstamp but is widely recognized as the world’s pioneering Bitcoin ATM. Shortly after, a Bitcoin ATM was opened in Europe. It was located in Bratislava, Slovakia, and was installed on December 8, 2013.

Meanwhile, the first Bitcoin ATM in the United States was installed on February 18, 2014, in Albuquerque, New Mexico. However, it was short-lived and was withdrawn after only a month of operation.

Like the cryptocurrency itself, Bitcoin ATMs have since faced many regulatory challenges. Eventually, a consensus was reached by agreeing that Bitcoin ATMs also needed to comply with the same laws and regulations as traditional ATMs.

This includes limits on the number of deposits and withdrawals a person can make per transaction, per day. For example, in the United States, all Bitcoin ATM operators must register with the Financial Crimes Enforcement Network (FinCEN) and follow the Bank Secrecy Act (BSA) anti-money laundering (AML) regulations.

The Bitcoin ATM may need your cell phone number to send you a text verification code depending on the amount of the transaction. Before completing a transaction, you may need to scan a government-issued ID, such as a driver’s license.

Also, to the dismay of many cryptocurrency enthusiasts, many Bitcoin ATMs no longer offer the anonymity they once did. This is due to current regulations that require users to verify their identity before making transactions, especially for large amounts.

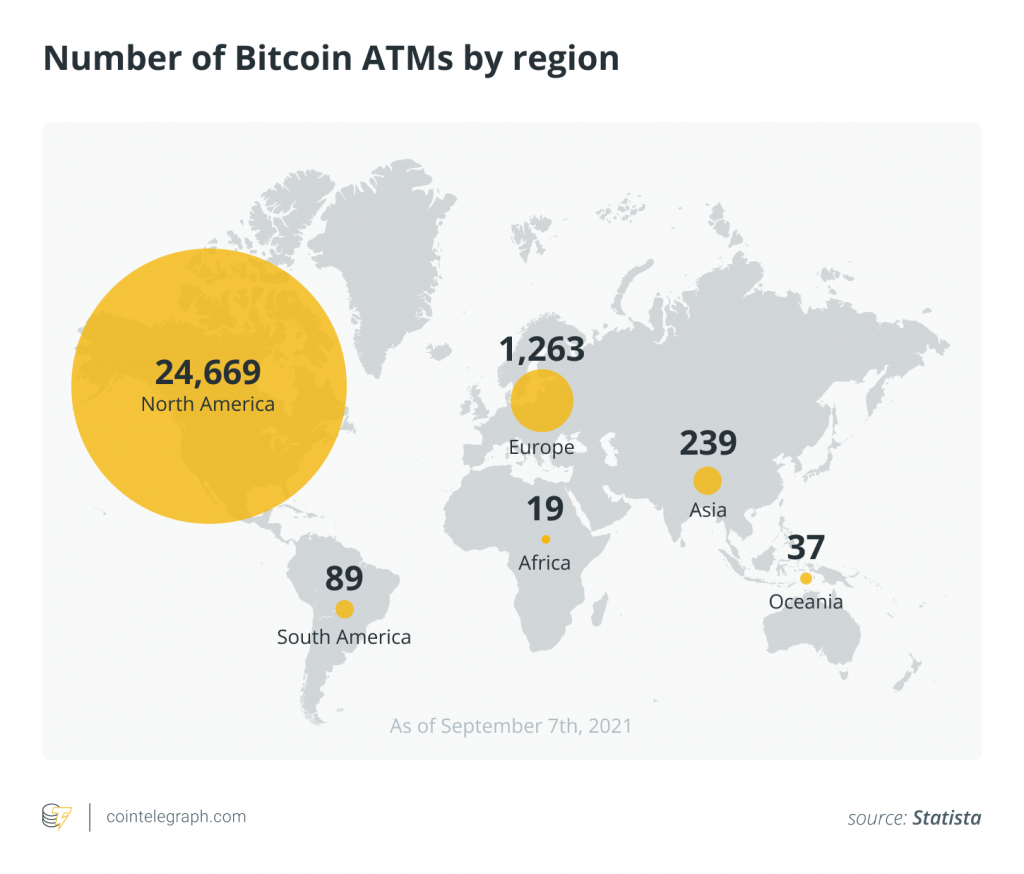

There are currently around 28,000 Bitcoin ATMs worldwide, the vast majority located in the United States. North America has the largest Bitcoin ATM market share globally at nearly 90 percent. Today, the largest Bitcoin ATM manufacturers are Genesis Coin (41.5% market share) and General Bytes.

Most BTMs are found in cafes or specialty stores, as well as transportation hubs like train stations and airports. In general, business owners who wish to have a BTM installed within a business space will need to enter into a contract with a Bitcoin ATM provider. The provider will take care of installing the device on-site.

How does a Bitcoin ATM work?

Unlike online cryptocurrency exchanges, Bitcoin ATMs allow for the convenient buying and selling of Bitcoin. In general, Bitcoin ATMs require users to have an existing account in order to use the machine.

The two types of Bitcoin ATMs or BTMs are:

- Way Machines: One-way transaction machines that support the buying or selling of cryptocurrencies.

- Two-Way Machines – Two-way machines that support both the buying and selling of cryptocurrencies.

BTMs must be connected to the internet to power the exchange of cryptocurrencies for cash. BTMs typically move money via a public key on the blockchain, while some still use paper receipts. Bitcoin ATMs also often require a verification process, especially when transacting large amounts.

Unlike traditional ATMs that allow physical deposits and withdrawals of funds, Bitcoin transactions are based on the blockchain. They send cryptocurrencies to a user’s Bitcoin wallet via a QR code. Because they are not connected to a bank account, they are also not operated by large financial institutions. However, as we mentioned, they adhere to similar laws and regulations.

Users will usually be prompted to scan a QR code that corresponds to their Bitcoin wallet address. After which, the purchased coins can be transferred to your wallet. A record of the transaction will then appear in the user’s digital wallet after a few minutes of processing.

There are also lower and upper limits on the cash that can be deposited through a BTM. Within the US, all Bitcoin traders must register with FinCEN. They are also subject to the AML clauses of the Bank Secrecy Act (BSA). The Bitcoin ATM may need your cell phone number to send you a text verification code depending on the amount of the transaction. Before completing a transaction, you may need to scan a government-issued identity, such as a driver’s license.

How to use a Bitcoin ATM

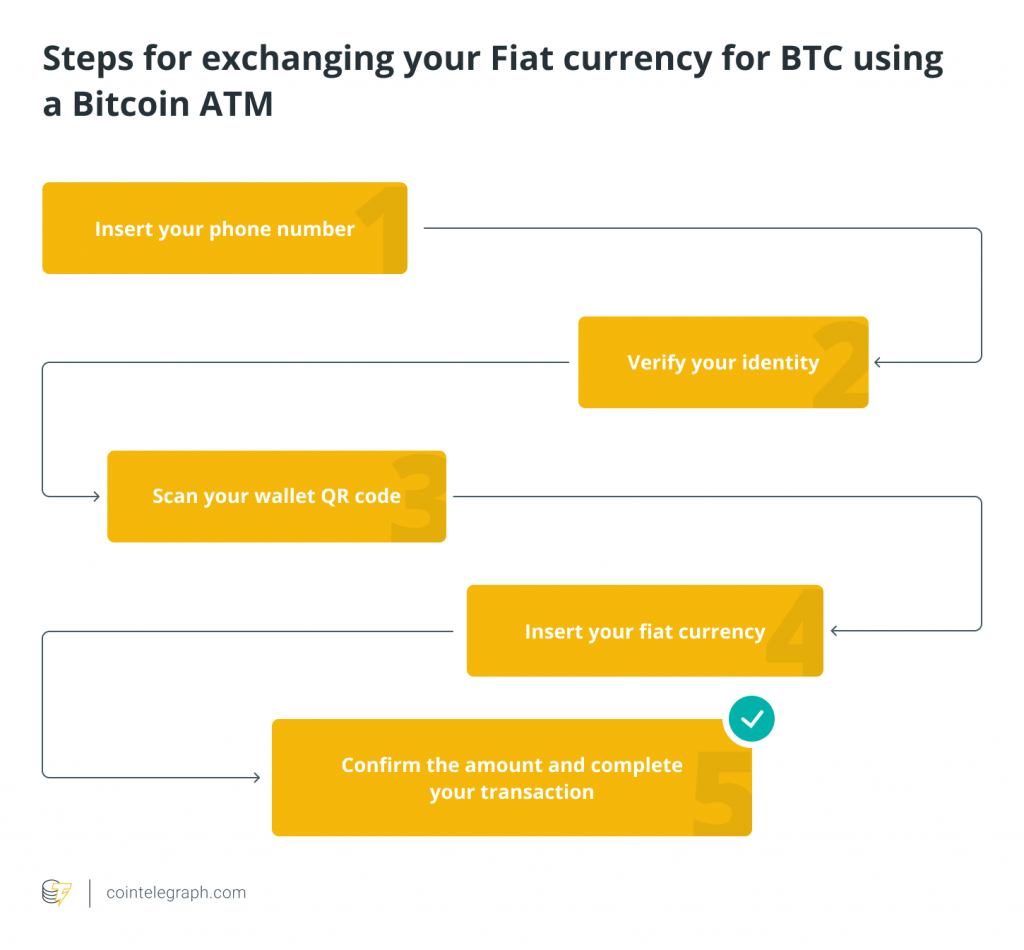

Below are the typical steps to exchange your fiat currency for Bitcoin using a Bitcoin ATM. In short, this is how to buy Bitcoin from a Bitcoin ATM:

Step 1: Enter your phone number

Bitcoin ATMs require identity verification. Your mobile phone number is usually required to obtain a verification code before proceeding with your transaction.

While Bitcoin ATMs used to be big on anonymity, today they must comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations.

By law, all BTMs must have some form of identity verification, such as scanning a government-issued ID or providing a phone number.

Step 2: Verify your identity

After submitting your phone number, you will now need to verify your identity. You can do this by waiting for the verification code that the BTM will send to your number via text message. Then you have to enter that exact code on the machine you are using.

You’ll then get a message that says, “Your code is 7654321. Thank you,” or a variation of it. BTM manufacturers incorporated this step to deter people from entering false phone numbers into BTMs.

Step 3 – Scan your wallet’s QR code

If you’re using a Bitcoin ATM, there’s a good chance you already have a Bitcoin address. This is where the actual BTC will be sent.

Before you can use a Bitcoin ATM, you must have a Bitcoin address. This is where the machine will send the actual BTC. If you don’t already have one, there are a couple of ways to get a public Bitcoin address:

- Use a paper wallet

- Use an app

- Use an address on an exchange

That said, it’s your QR code that’s important. This represents your Bitcoin address, so you’ll need to scan it so the Bitcoin ATM knows exactly where to send your BTC. Please note that BTC ATMs support multiple wallets. Therefore, it is best to check with your wallet provider if you are unsure.

Read more: Bitcoin Wallets: A Beginner’s Guide to Storing BTC

Step 4: Insert your fiat currency

Now you simply need to insert how much you want to exchange for Bitcoin. Just like a conventional ATM that accepts cash deposits, you just need to put your money into the machine’s designated receptacle.

The machine will then tell you how much it is worth in terms of Bitcoin. For example, if you insert $400, you will see a message that looks like this: $400 USD = 0.0095 BTC.

Step 5: Confirm the amount and complete your transaction

Once you’ve double-checked that you’ve entered the correct amount of money and are happy with the trade, all you have to do is press “BUY” or “CONFIRM.” The Bitcoin you just bought will be sent to your Bitcoin address, which you confirmed earlier with your QR code.

Keep in mind that it can take anywhere from ten minutes to an hour to process transactions made at a Bitcoin ATM. It usually takes six network confirmations to do this, so don’t worry if you don’t immediately see the amount reflected in your digital wallet.

Selling Bitcoin Using ATMs

Depending on the machine, you can buy Bitcoin, sell it, or do both. Instructions vary by machine. However, in most cases, buying or selling cryptocurrencies is not much different from withdrawing money with a bank card.

Here are the general instructions for when you want to cash out or sell Bitcoin at a Bitcoin ATM:

- Select the option you want. If you want to withdraw money, click “Sell BTC”.

- Scan the QR code on your wallet. You can scan it from your mobile app, print it, or enter the address manually.

- Verify your identity. This varies from country to country, but most BTMs require users to enter a phone number, scan a valid ID, or take a photo. Some machines even accept fingerprints. Verification is a must for transactions involving large amounts of BTC.

- Send the cryptocurrency to the specified address. This can usually be done by scanning a QR code. Some machines issue cash immediately, while others will ask you to wait for the recipient to confirm the transaction.

- Confirm the transaction on your end and wait for the machine to complete the transaction.

- Don’t forget to save your receipt.

The steps for using BTM to sell Bitcoin are much more varied, but these are the basic steps you will be asked to take. On the other hand, they are usually easy to use and very intuitive, so just pay attention to the on-screen instructions and make sure you enter the correct information.

Advantages of using a Bitcoin ATM

Some of the advantages of using a Bitcoin ATM are:

- It is a fast and convenient way to buy and/or sell Bitcoin.

- No physical cards or bank cards are needed to make transactions.

- Some machines (in countries that do not require KYC) do not require identity verification, keeping you anonymous.

- It offers access to Bitcoin to people who do not have or prefer not to have bank accounts.

- It makes buying Bitcoin accessible in areas where there are limited ways to buy cryptocurrencies.

- It is an accessible way to transact with Bitcoin, as there are many BTMs around the world.

Cons of Using a Bitcoin ATM

There are also some cons that come with using Bitcoin ATMs. Some of them are:

- Very high transaction fees. Bitcoin ATM fees typically range from 7% to 12% for buying or selling Bitcoin.

- May not be suitable for large transactions as most Bitcoin ATMs limit withdrawals and deposits (ranging from $1000 – $10,000).

- Most locations require identity verification, which means your transaction won’t be completely anonymous.

Where To Find A BTM: Bitcoin ATM Locations

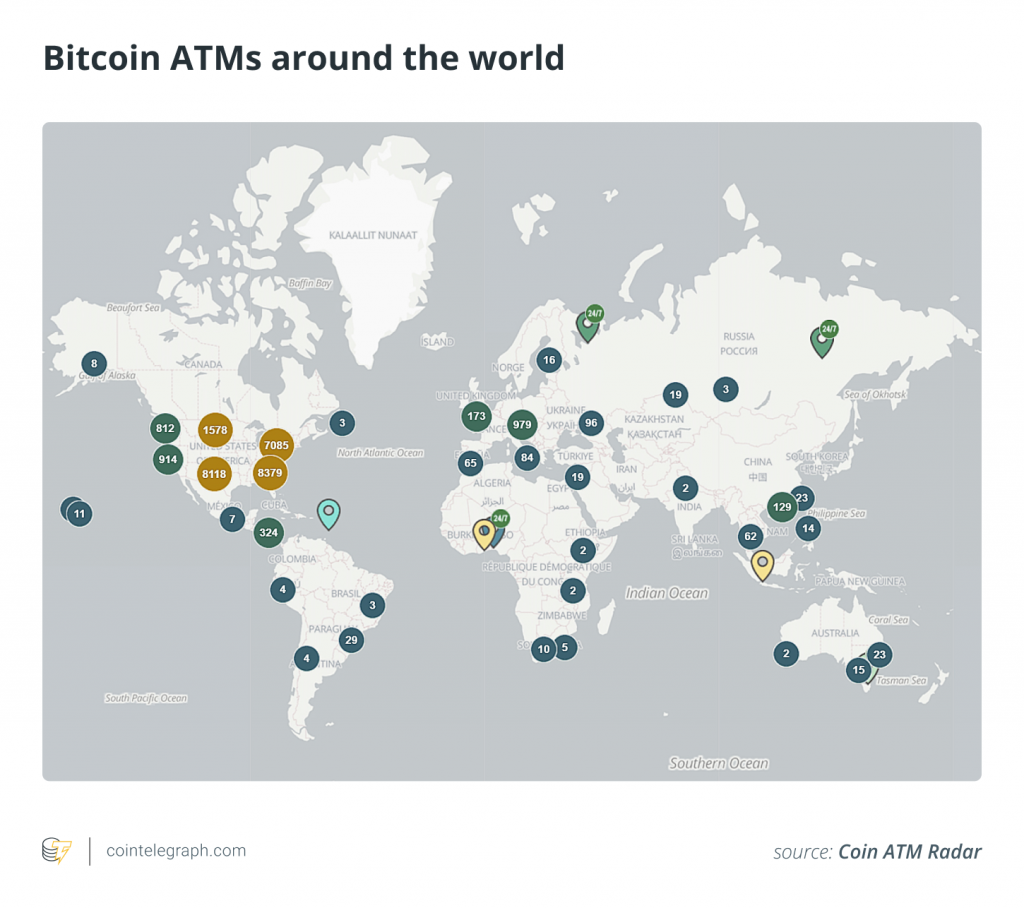

As mentioned above, there are about 28,000 BTMs around the world, most of them in North America. Here is a map showing the distribution of Bitcoin ATMs around the world:

Statista reports that the majority of BTMs are located in North America and Europe, with other machines sparingly distributed in other regions.

To find the exact location of a Bitcoin ATM near you, you can visit Coin ATM Radar to perform a local search. All you have to do is type in your address or city to find the nearest BTM.

This is how you can locate a Bitcoin ATM using Coin ATM Radar:

- Go to Coin ATM Radar. Here, you will see a map of Bitcoin ATMs showing locations around the world.

- At the top left of the map, type your city or address and press “enter”.

- You can also filter based on:

- The type of cryptocurrency you want to make (BTC, ETH, DASH, LTC, etc.)

- The type of transaction you want to make (Buy or Sell)

- The type of machine you need (ATM, ATM, or other)

- Click on a Bitcoin ATM location near you to view details. You can view information about the following:

- The name of the building/location Hours of

- operation

- cryptocurrencies

- Supported transactions

- ATM type and manufacturer

- You can also click “View Details” or “Get Directions” to find more information and get turn-by-turn directions from your location to Bitcoin ATM via Google Maps.

Important facts about Bitcoin

ATMs Although Bitcoin ATMs have been around for quite some time, it is still quite an innovative concept that arouses both curiosity and suspicion.

Here are some important (and interesting) facts about this piece of technology:

Speed of BTM Adoption

The technology behind Bitcoin ATMs is still relatively young. As such, it continues to continually improve along with changes in security measures and standards to be met.

However, BTMs have come a long way since the first Robocoin machine was installed in a Vancouver coffee shop in 2013. Today, they have grown exponentially in number, showing that the general public is also adopting Bitcoin very quickly.

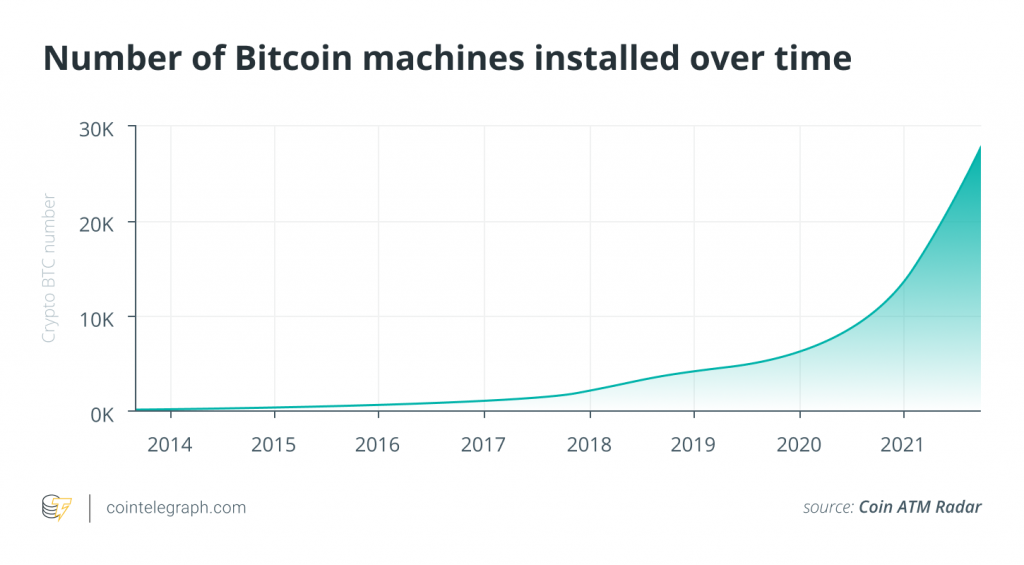

In 2020 alone, Bitcoin ATMs in the US saw a massive increase (177%) in installs, perhaps due to increased demand for cashless payment methods. Coin ATM Radar data on Bitcoin ATM installations show a huge upward trend, with numbers approaching 30,000 in 2021 –

given where we are now in terms of cryptocurrency and Bitcoin ATM acceptance per part of the general population, it seems that the numbers will continue to increase over the next few years.

Bitcoin ATM

So how much does it cost to use a Bitcoin ATM? As we discussed, Bitcoin ATM fees are still quite high despite the growing popularity of BTMs. Typical Bitcoin ATM fees are 10% to 15%. However, they can go as low as 7% or as high as 25%.

If, for example, you’re buying $800 worth of Bitcoin with an average purchase fee of $10, you’ll receive $720 worth of Bitcoin and pay an $80 fee. That’s pretty significant.

On the other hand, let’s say you are selling $1,000 worth of bitcoins at a selling fee of 7%. This means that you will only receive $930 of your fiat currency and pay a $70 fee for the transaction. Again, it’s a pretty hefty chunk of money.

The way to avoid this is to do your research before going to a machine near you. That way you can predetermine which machines have the lowest rates.

Types of Altcoins Supported by Bitcoin

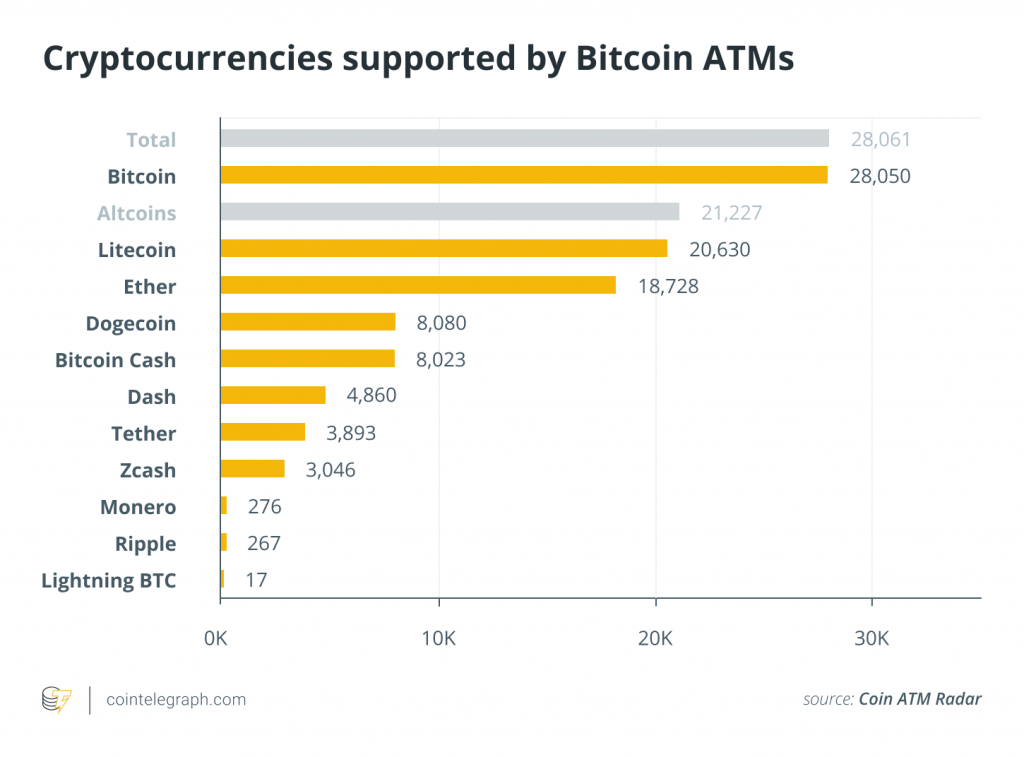

ATMs Although called Bitcoin ATMs, most of these machines actually support transactions involving other altcoins. This means that you can use them to buy or sell other cryptocurrencies besides Bitcoin.

Here is a chart showing the relationship between cryptocurrencies and Bitcoin ATMs that support them:

Bitcoin ATM technology is still relatively new, hence the limited number of other cryptocurrencies supported by these machines. There are currently 1600 different types of altcoins, so it could be a long way to go before all of them are supported by the major BTM manufacturers.

However, seeing the rapid rise and acceptance of BTM technology, there is a very good chance that we will continue to see more altcoins being brought on board and supported by BTM makers around the world.

Conclusion: The future of Bitcoin ATMs

has continued to increase in value since its inception in 2013. Back then, a Bitcoin was worth around $200. Years later, its value rose to thousands of dollars despite price fluctuations.

Along with its huge growth in value, the number of Bitcoin ATMs also increased exponentially. This highlights the continued patronage of Bitcoin and other cryptocurrencies.

As the world continues to shift to digital solutions in general, including financial transactions, Bitcoin and other cryptocurrencies are also expected to become even more popular.

Ever since Satoshi Nakamoto first mined Bitcoin, it has remained an independent online currency, free from the control of regulators and large financial institutions.

This is also the reason why many world leaders, financial elites, and economists have repeatedly raised suspicions about it. However, due to Nakamoto’s “almost perfect code”, the Bitcoin blockchain has thankfully never been hacked since it was invented.

Despite this, there is no guarantee that the Bitcoin blockchain will remain impregnable indefinitely. Nonetheless, investors and enthusiasts rely on its track record and are assured of the continued safety and success of the cryptocurrency.

Consistent with that, Bitcoin ATMs are expected to continue to increase in number and popularity in the coming years. People like them because they are accessible, convenient, and novel. Bitcoin ATM fees remain one of the major flaws of the technology, but as of now, they cannot be avoided as it offers many people a safe and convenient way to purchase cryptocurrencies.

If you plan to buy or sell Bitcoin through a Bitcoin ATM, remember to check online resources first so you can assess which Bitcoin ATMs offer the lowest fees. Also, make sure you always enter the correct details (such as details about your digital wallet), as there is often no way to undo transactions caused by such errors.

We hope this article has helped you learn the basics of Bitcoin ATMs. As always, feel free to check our homepage regularly for the latest rates, news, and updates on various cryptocurrencies.