Buying Bitcoin

Investing in Bitcoin (BTC) may seem complicated at first, but it gets easier once you break it down into parts. For example, investing in Bitcoin or trading BTC requires an exchange service or account, while additional secure storage methods are recommended.

A cryptocurrency exchange account, personal identification documents if using a Know Your Customer (KYC) platform, a secure internet connection, and a payment method are requirements for ambitious Bitcoin investors. It’s also a good idea to have a separate personal wallet from your exchange account.

Bank accounts, debit cards, and credit cards are all acceptable payment methods to purchase Bitcoin. BTC can also be obtained through Bitcoin ATMs and peer-to-peer (P2P) exchanges. However, starting in early 2020, Bitcoin ATMs progressively required government-issued identities.

Also, Bitcoin is incredibly volatile, but if you’re willing to take the risk, make sure you know what you’re getting into and have a cryptocurrency investment strategy. Also, make sure you’re not investing just out of fear of missing out.

This article will answer frequently asked questions like how do I invest in Bitcoin? What is the best way to buy Bitcoin? How do I buy Bitcoin with PayPal? How do I buy Bitcoin with a credit card?

Before you buy Bitcoin

Investing in Bitcoin may seem difficult at first, but it becomes easier once you break it down into steps. Buying Bitcoin is getting easier as the reliability of exchanges and wallets increases. But before you buy Bitcoin, you need a place to store it.

In the world of cryptocurrency, that place is called a “wallet” and crypto wallets come in a variety of forms. Different types of wallets provide BTC owners with many types of security, storage, and access options. The five main types of BTC wallets are desktop, mobile, online, hardware, and paper wallets.

However, it is important to mention that your wallet does not technically store your Bitcoin. Instead, you own private keys, which are essential to accessing a Bitcoin address and being able to spend the funds. Those digital keys are needed to sign transactions, and if a user loses them, they essentially lose access to their Bitcoin.

Types of wallets

Desktop wallet

on the user’s computer, providing control of the funds they send to that wallet, and there are thick and thin desktop wallets. Thick desktop wallets allow users to download the related blockchain in its entirety and provide independent security management of their funds. On the other hand, thin wallets do not require users to download blocks and can be easily downloaded to a portable device.

Mobile wallet

The main advantage of a mobile wallet is that the user’s funds are always available. It can be a convenient way to pay for goods by scanning QR codes. In some cases, users can take advantage of their smartphone’s near-field communication feature, also known as NFC, which allows them to simply touch their phone to a reader without entering any information.

A common feature of all mobile wallets is that running a full Bitcoin node is not required. This is because a Bitcoin full node has to download the entire blockchain, which is constantly growing and requires significant storage.

Online wallet

If you use a web-based wallet, users’ private keys are stored on an online server controlled by someone else and connected to the Internet. While it allows people to easily access their funds from any device from virtually anywhere in the world, there is always a risk of the server being hacked or even the organization running the service taking control of your Bitcoin. In general, there is a lot to consider when buying and managing your Bitcoin.

Hardware wallets

are dedicated portable devices that store private keys offline. There are several different types of hardware wallets, but they all allow users to carry virtually any amount of money in their pocket.

Paper wallet

are two pieces of information expressed in characters, as well as QR codes, generated by a designated service? One of them is a wallet address that can be used to receive BTC. The other is a private key, through which you can spend Bitcoin stored at that address.

More Options

There are also other Bitcoin storage features. Multisig, or multi-sig, wallets require a confirmation from multiple sources to move or access funds. Some entities also offer Bitcoin custody services, which manage customers’ Bitcoin storage for them.

Read more: The history of Bitcoin: When did Bitcoin start?

How to Buy Bitcoin in Four Steps

The number of avenues for BTC ownership is continually increasing, allowing people to choose the cryptocurrency purchase option that best suits their needs. So if you want to understand how to invest in Bitcoin, follow the steps outlined in the sections below.

Choose a Cryptocurrency Exchange

Every potential new Bitcoin buyer will find a variety of various exchanges vying for their business. Choosing the right one depends on many different factors, with its location being perhaps the most important.

Exchanges around the world are under different government jurisdictions, requiring varying Know Your Customer and Anti-Money Laundering practices, depending on the regions involved. That’s why, in order to set up an account and start trading on certain centralized exchanges, you need to provide personal information, depending on the exchange and your location.

This leads to the subject of exchange rates. There are several different types of crypto exchange: centralized exchanges, decentralized exchanges or DEXs, and peer-to-peer exchanges. Centralized crypto exchanges are online platforms where you create an account with your chosen login details. You also need to provide some personal information, depending on the exchange and region.

On centralized exchanges, you can send funds to that platform in the form of crypto or money from a bank account and you can trade those funds on the platform, including buying and selling Bitcoin. Depending on the exchange, you can trade numerous different types of crypto assets, all on one main platform. However, one of the problems with this model is that you don’t technically hold your funds when they are on the exchange.

DEXs, on the other hand, allow you to transact from your wallet. Essentially, DEXs are made up of pools of liquidity pooled for different assets on the blockchain where the DEX is based. Ethereum-based DEXs, for example, make it easy to trade Ethereum-based assets. Bitcoin itself cannot be traded on an Ethereum-based DEX, although there are certain solutions for that.

Peer-to-peer, or P2P, trading also serves as an option to buy and sell Bitcoin. Various platforms are available to facilitate such transactions, providing an escrow service to protect both parties and their funds.

In addition to native crypto exchanges, customers can also buy Bitcoin on PayPal. However, the platform does not allow users to send their Bitcoin outside of the platform ecosystem and does not give them control of their private keys.

Deciding on a payment option

Exchanges also differ in terms of accepted payment methods. For example, most of the big platforms allow you to link your bank account for bank transfers, as well as your debit card or credit card. Some accept PayPal payments and Coinbase also accepts Apple Pay.

When you first sign up for an account and register a payment method, you must authenticate your identity regardless of the option you choose. For example, in the United States it is generally required to scan a state-issued ID, such as a driver’s license or identification card.

You may also be required to provide scanned copies of additional documents, such as your passport and proof of address, depending on your jurisdiction and the platform you choose.

Place your order

You can start buying Bitcoin after you have been verified and money has been deposited into your account. This method varies depending on the exchange you choose, with some exchanges allowing you to buy or sell BTC simply by pressing a “Buy” or “Sell” button and entering the amount you wish to buy (or sell).

Most cryptocurrency exchanges, in general, provide at least three fundamental order types: market order, stop order, and limit order. Clicking the Buy, Trade, or New Order button on the home screen of the exchange to execute any of these options. After that, you will be able to select one of the three mentioned options before hitting the Submit button.

Store your Bitcoin

While the largest exchanges are becoming more secure, the industry continues to be plagued by hacking and fraud. This is why Bitcoin investors with large sums of money should consider storing their BTC themselves. Experienced traders with strong cybersecurity skills may prefer to own their wallets, as this allows them to move their crypto whenever they want without being bound by an exchange.

How To Buy Bitcoin With PayPal

It may come as a surprise, but no matter what exact trading method you’re using, it’s still not easy to buy Bitcoin through PayPal, depending on where you’re at. the world. Exchanges bypass those payment methods and require users to connect their bank accounts. Most private sellers also tend to be wary of such transactions, preferring cash.

This is due to so-called “chargebacks”. Most credit card or PayPal transactions can be easily reversed by simply calling the card-issuing company. Bitcoin transactions are irreversible, and since it can be extremely difficult to prove that any property changed hands in a Bitcoin transfer, this payment method is generally avoided.

You will need to create a PayPal account before you can buy cryptocurrencies. If you already have a PayPal account, all you have to do to buy Bitcoin is click on the “crypto” button and select BTC.

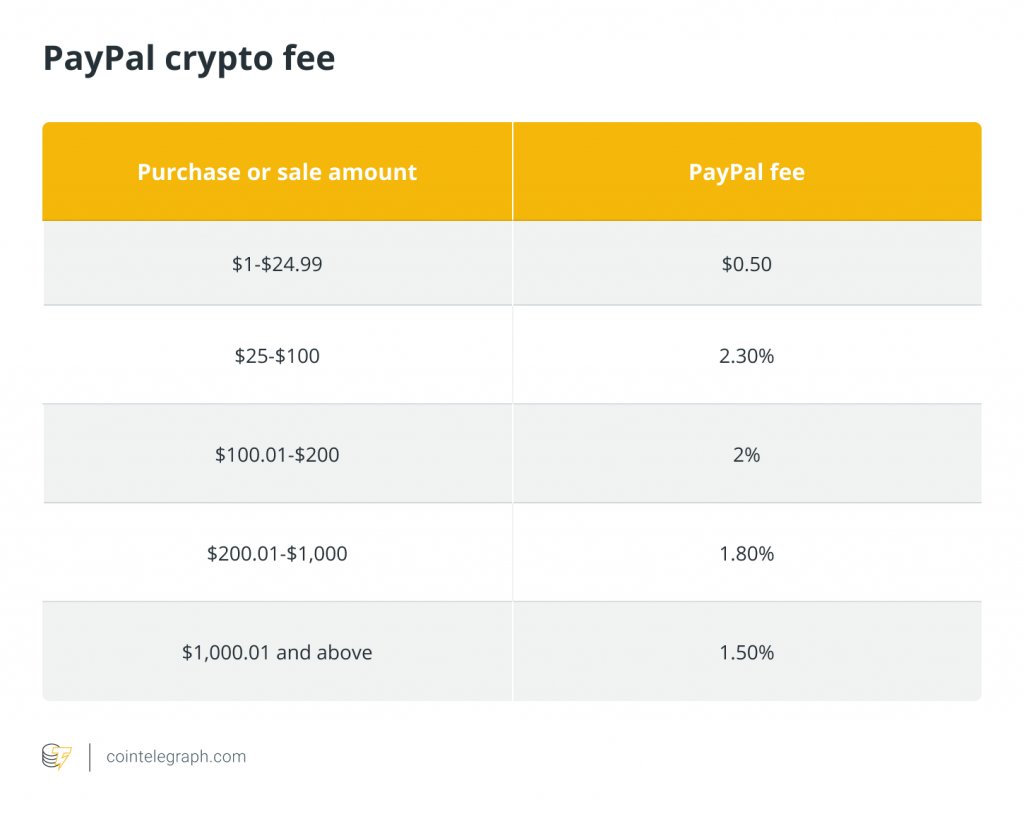

You will need accessible funds, a linked debit card, or a linked bank account to make your purchase. You can spend as little as $1 a week or as much as $100,000. PayPal, like many other cryptocurrency exchanges, charges a fee for buying and selling cryptocurrency, which fluctuates based on the amount purchased.

PayPal’s cryptocurrency fees are listed in the following table:

How to buy Bitcoin with a credit card

You can buy Bitcoin with a credit card at various cryptocurrency exchanges, but there are exchange fees involved. Transaction fees are how cryptocurrency exchanges make money, but using a credit card could cost you much more. If you choose to buy BTC with a credit card, you may be charged broker fees.

Also, your credit card may charge a foreign transaction fee for each purchase if the exchange is made outside of the United States. This cost could range from 1% to 3% of the total purchase price.

The ability to purchase cryptocurrency with a credit card is also subject to the policies of the credit card issuer. For example, American Express restricts the purchase of currency using its card but allows the purchase of cryptocurrency for the time being.

If your preferred exchange and credit card provider allow it, the process for setting up these transactions is quite similar to linking and verifying your bank account via ACH (automated clearing house).

Some Alternative Ways to Buy Bitcoin

You can also buy Bitcoin using the following methods:

Cryptocurrency ATMs

Bitcoin ATMs have been popping up in cities around the world, with numbers continuing to grow. However, these machines generally charge transaction fees that are considerably higher than those commonly seen on crypto exchanges.

To use a Bitcoin ATM, search for a machine in your target area on the Internet. You need to open an account with the Bitcoin ATM provider online or on-site at the ATM. Opening an account often requires following Know Your Customer, or KYC, compliance, which may involve providing a scan of identification and personal details, and then waiting for approval.

Once you show up in person, insert cash into the Bitcoin ATM and then scan your mobile wallet’s QR code or receive a paper receipt with the codes and instructions on how to transfer the Bitcoin funds to your wallet.

It is very unlikely that Bitcoin ATMs will appear in countries where Bitcoin is banned or banned.

An investment

trust An investment trust is a form of collective investment, in which investors’ money is raised from the sale of a fixed number of shares that may have some trust issues when launched.

Grayscale Bitcoin Trust (GBTC), the first publicly traded Bitcoin-related investment vehicle, allows people to gain exposure to cryptocurrency without having to buy or store it directly. GBTC is exclusively invested in Bitcoin and derives its value from the price of BTC. Grayscale also offers different investment products for other crypto assets.

In addition, there are a few Canadian Bitcoin exchange-traded funds, or ETFs, the first of which, the Purpose Bitcoin ETF, was produced by Purpose Investments in 2021. Buying a Bitcoin ETF also gives the buyer exposure to Bitcoin through the main financial channels, although the type of investment product differs from GBTC.

Buying shares in certain companies could also serve as a possible type of investment exposure to Bitcoin. Business intelligence firm MicroStrategy, for example, has poured billions of dollars of its capital into Bitcoin.

Although users may wonder if Bitcoin stocks are available or how to buy Bitcoin stocks, this classification does not technically exist. However, you can buy shares in companies involved with Bitcoin, such as companies focused on BTC mining, or buy shares of companies that have invested in Bitcoin.

gift cards

can be used to purchase gift cards. Gift cards can also be exchanged for BTC. All you need to do is purchase the gift card from any retailer, log in to a platform where some retailers accept gift cards, and complete the purchase.

Be on the lookout for scammers at all times and be aware of the reputation of sellers as well as other common internet security measures. In general, awareness and caution can be vital regarding any activity in the crypto space.

How to invest safely in Bitcoin

Consider the following points before investing in Bitcoin:

Legality and protection issues

Bitcoin has generally attracted the interest of law enforcement agencies, tax authorities, and legal regulators. They are trying to understand how cryptocurrency fits into existing frameworks and what guidelines to implement. Your legality in terms of your Bitcoin activities may depend on who you are, where you live, and what you do with the asset.

It is also worth remembering that the security and safety measures of cryptocurrency exchanges, as well as their legitimacy, vary from platform to platform. Different Bitcoin storage methods also have their pros and cons, which should be considered before committing funds to crypto investments.

Bitcoin Ownership

The security practices to protect your Bitcoin depend on the type of storage you choose, everyone has their preferred practices for how to buy and keep your Bitcoin. Researching these practices, as well as what type of storage is best for you, is a vital part of Bitcoin ownership. Bitcoin may offer fewer limitations than traditional siled finance, though such abilities also come with responsibility.

Should I invest in Bitcoin?

Before looking for the best place to buy Bitcoin, you should ask yourself the following questions:

- Do I have a good understanding of what I am investing in and how Bitcoin and the cryptocurrency market work?

- Is the level of risk acceptable to me?

- Is it significantly more expensive now than it was a few months ago? Why do I want to buy something? Is it just because it’s more expensive if that’s the case?

- Is there any evidence that prices will continue to rise?

- Who do I think will buy it from me at that higher price if I buy it now to sell it even more later?

- Why, if an asset is so valuable, did I pass it up when it was so much cheaper?

- Have I convinced myself that I am “in the know” in some way?

In general, it’s not a good idea to invest if you don’t know the answers to these questions. If you decide to buy BTC, make sure you don’t risk your life savings.