Candy Digital launched in June as the official NFT partner of Major League Baseball, swinging for the fences with officially licensed MLB cryptocurrency collectibles. Now, the Fanatics-owned studio has raised a sizeable chunk of the funds as it contemplates continued expansion into the NFT space.

Today, Candy Digital announced that it has raised a $100 million Series A funding round that values the company at $1.5 billion. Sporting goods firm Fanatics is the majority owner of Candy Digital, which was co-founded by Fanatics CEO Michael Rubin along with Galaxy Digital founder and CEO Mike Novogratz and NFT investor and entrepreneur Gary Vaynerchuk.

Insight Partners and Softbank’s Vision Fund 2 co-led the fundraiser, with participation from Connect Ventures, an investment alliance between Creative Artists Agency (CAA) and New Enterprise Associates (NEA), as well as Will Ventures, Gaingels and Athletes Syndicate in partnership with Chaos Ventures.

Retired NFL player Peyton Manning also invested in Candy Digital, along with other anonymous professional athletes. Candy Digital plans to use the funds to expand its team as it further expands its NFT business. Beyond MLB and the MLB Players Association, Candy Digital currently has agreements with the Race Team Alliance (RTA), which represents 13 NASCAR teams, along with a variety of college athletes.

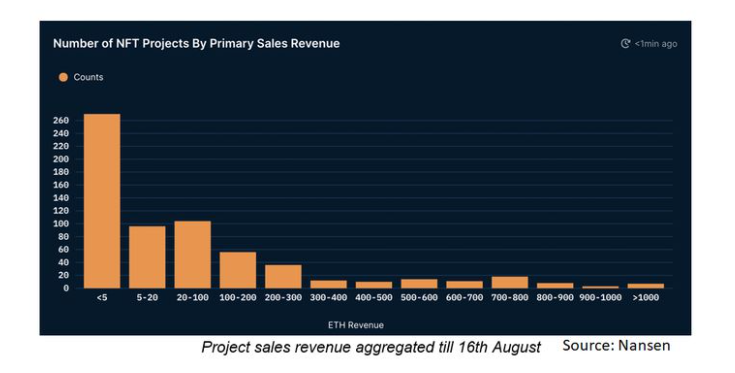

An NFT acts as a blockchain-backed deed of ownership for a rare digital item, be it an artwork, a video file, or something else entirely. The NFT market has skyrocketed so far in 2021, including $10.67 billion in trading volume in Q3.

Sports collectibles have been one of the largest segments of the burgeoning NFT industry, led by Dapper Labs’ NBA Top Shot platform, which has generated over $750 million in secondary trade volume to date. Dapper is also currently preparing the NFL and LaLiga NFT marketplaces, while Tom Brady’s competing Autograph NFT platform features collectibles from a number of popular athletes, including Tiger Woods and Simone Biles.

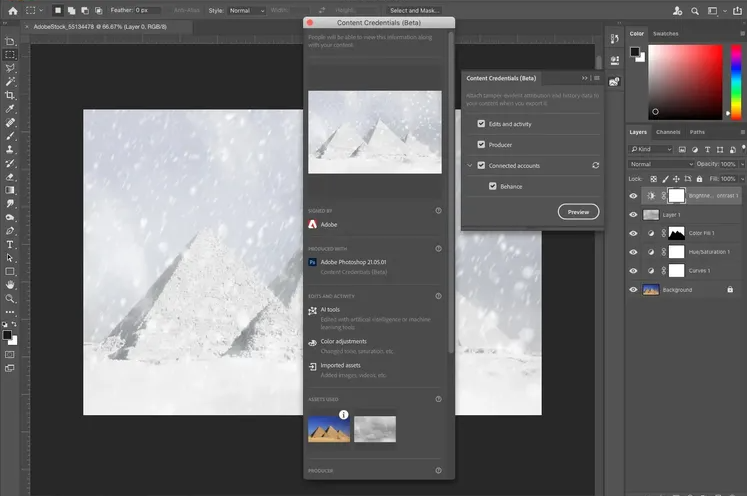

Candy Digital, which mints its NFTs on Palm, an Ethereum sidechain, is currently focused on expanding its Major League Baseball NFT ecosystem. It recently launched a daily MLB Play of the Day collectible and has launched a new marketplace that allows users to buy and sell their NFTs.

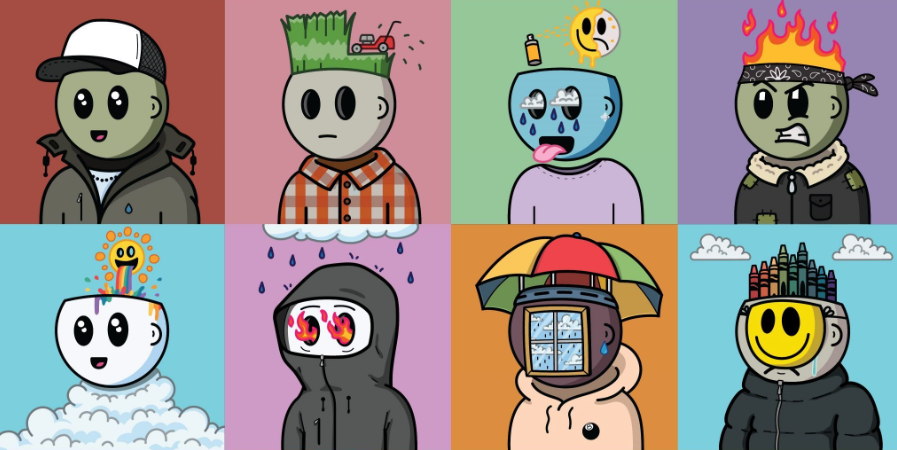

Next week, Candy will release digital collectible packs of MLB icons similar in focus to NBA Top Shot moments, each featuring video footage of a popular baseball player in a trading card-like design. Additional MLB NFT merchandise is planned in the coming weeks, including collectibles based on the upcoming World Series.

Outside of Candy Digital, Fanatics also has a new trading card business already valued at $10.4 billion following a $350 million funding round. Fanatics Trading Cards withdrew sports licenses like MLB and NBA from established rivals like Topps and Panini, offering the leagues and their respective player associations a stake in the new venture.