Interest in non-fungible tokens (NFTs) and crypto collectibles peaked after a digital image collage titled “Everydays: The First 5000 Days” sold at famed auction house Christie’s for a record $69. .3 million dollars. The NFT, created by Mike Winkelmann, a digital artist popularly known as Beeple, set a new record for a digital-only artwork and became the third most expensive artwork by a living artist to sell at auction.

The resulting popularity of NFTs has attracted a multitude of creators and artists who see blockchain-based technology as a means to monetize their talents. Of course, the NFT market proliferated rapidly and thousands of digital files were exchanged daily. However, buying, selling, and transferring NFTs usually comes with a transaction cost, namely gas fees.

If you want to trade NFTs, you may be wondering what NFT gas fees are and why they are necessary. This article will help you understand how NFT gas fees work, why fees are required, and how to calculate them.

What Is A Gas Fee?

A gas fee is the charge users pay to transact on the Ethereum blockchain. The gas is used to compensate miners for the computing power and resources spent to validate transactions and include them in the blockchain. In other words, gas fees are a reflection of the amount of computing power required to record a transaction on the Ethereum blockchain network.

Gas fees are denominated in gwei, which are fractions of minutes of Ether (ETH), the native token of the Ethereum network. One gwei unit is equal to one billionth of ether, that is, 1 nanoether or 0.000000001 ETH.

Gas prices fluctuate, depending on the complexity of a transaction and the traffic on the network. Naturally, a transaction that requires more computing power will command higher fees. Also, making transactions during peak periods with heavy traffic on the Ethereum network will attract higher fees.

Gas rates can be compared to a freight trucking service, where the goods are transactions. The heavier the goods transported from point A to B, the more fuel or gas will be spent. At the same time, if the road is congested, the trucks also consume more fuel to reach their destination. The trucking service will also prioritize the movement of goods from customers who are willing to pay more than the base price.

What Do Gas Prices Mean For An Artist?

Artists and creators know that dealing with NFTs on the Ethereum network can be expensive due to gas fees. But they understand that NFT gas fees are the price to pay to create, sell and buy NFTs. Of course, this has a significant impact on NFT creators and artists. So what do gas rates mean for artists?

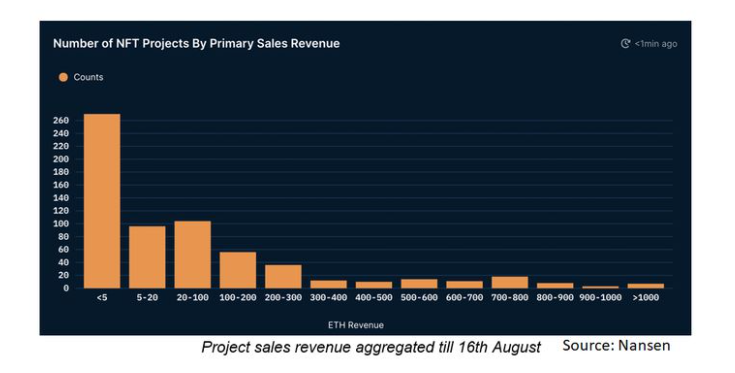

Contrary to popular belief, NFTs don’t always sell for six figures. Most sell moderately, for a few hundred dollars, and many may not sell at all. Considering that you have to pay gas fees to create and sell your NFT, you might lose money instead of making a profit. To make matters worse, it’s not easy to predict what you’ll pay for gas since the price keeps changing.

High gas prices mean that artists can find it difficult to profitably create and sell their work. To make their artwork-related NFTs more affordable when gas prices rise, some artists may try to reduce the total price of the artwork to offset the cost of gasoline. However, this presents a new challenge, as buyers may perceive the work to be of less value as they have to decide whether it is worth spending a larger percentage of the total cost on gas fees.

Gasoline prices are not related to the absolute value of the digital asset and, in some cases, can exceed the price of the assets offered for sale. This is especially difficult for new and upcoming artists who have not yet established name recognition.

Essentially, an artist without a strong enough reputation may have a hard time selling their art when they overcharge to attract higher prices.

How Is Gas Used To Mint An NFT?

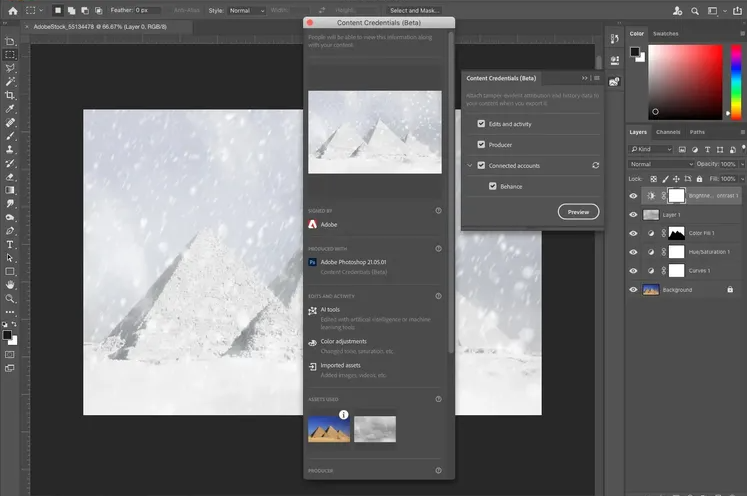

Minting an NFT describes the process of converting digital files into digital assets stored on the blockchain. Like any other transaction on the Ethereum blockchain, minting an NFT requires resource-intensive computations on the part of the miners. Gas fees were envisioned as a way to compensate miners for helping to record their transaction on the blockchain (and, in this case, mint the NFT).

For the artist, coining the NFT is relatively easy, a bit like uploading a video to YouTube. Once you have uploaded the file, you need to approve the gas fee, which will come from your digital wallet. When you have paid the fee, the minting process will begin.

Because gas fees are not directly related to the value of the NFT, sellers and buyers of digital art can lose money on a transaction. In other words, your costs could exceed what you get, or pay, for the NFT.

Why Does Minting An NFT Require Gas Fees?

Minting is the act of creating an NFT on a blockchain. Because blockchains are decentralized networks that do not belong to a central authority, they are maintained by miners who mint NFTs. Miners use their own computing power and, in return, expect payment to cover their time and resources.

Gas fees help keep the blockchain running by incentivizing miners who validate and add user transactions to the blockchain. Since they are paid for the work, the miners will strive to earn more in gas fees, which will increase the security of the network. A higher incentive means miners are more willing to spend resources validating transactions to secure the blockchain. This also optimizes the speed of transactions, since more computational resources will be dedicated to mining operations.

How Much Does It Cost To Mint An NFT?

The costs of minting an NFT fall into the following categories:

- Gas Fees – To transact and store your NFT on the blockchain

- Account Fees – Charged by the NFT marketplace you have chosen to use

- Listing Fees – A charge for listing sales

The prices differ from blockchain to blockchain. There are even price differences between transactions on a single blockchain. These fees depend on several factors, including the amount of data used, the speed of the transaction, and the time of day.

The cost of minting an NFT varies widely. When converted to fiat, the cost can range from $1 to $500 or more. Creators can choose from several NFT marketplaces, with each platform charging different fees.

Ethereum

Ethereum has become more expensive in recent years, a victim of its own popularity. The network is limited in capacity, and the more people use the platform, the more crowded it becomes. Since the gas rate depends on supply and demand, the costs have risen.

Currently, the Ethereum gas fee is made up of a base fee and a tip. The base fee is burned and the tip is paid to the miner.

Total Transaction Fee = Gas Units (Limit) × (Base Fee + Tip)

With a gas limit of 21,000, a base fee of 100 gwei, and a tip of 20 gwei, the total fee is 2,520,000 gwei or 0.00252 ETH. This would equate to around $7.49 (at $2,971.81 for one ETH).

Minting NFTs on Ethereum can be expensive. NFT minting gas fees fluctuate due to demand on the network and the current price of ETH. Gas fees peak during periods of high demand, as users compete to have their transactions added to blocks. In addition to the gas fee, some NFT exchanges also charge a small fee for listing and transaction fees that are a percentage of the cost of the NFT traded.

Historically, the costs of minting an NFT have been as high as $500 per transaction.

NFT marketplaces like Rarible and OpenSea offer artists the option of lazy minting, allowing you to postpone minting (adding) your NFT to the blockchain until someone buys it. Lazy minting lowers the barriers to entry for creators. This is especially useful for artists new to the field, as they don’t yet know how well their works will sell.

Using deferred minting, the artist can defer payment until the time of sale. The gas fee is deducted in the same transaction as the sale, and gas fees are typically paid by the buyer instead of the seller or creator. Otherwise, you can choose regular minting, which means you’ll pay gas fees every time someone wants to buy your token.

There is no lazy minting option on the Solana blockchain, but gas fees are much less expensive than Ethereum.

Solana

Although Ethereum is the most popular of the blockchains, it is not the only one that mints and stores NFTs. There are others, including Polygon and Solana.

Solana has grown in popularity and could even unseat Ethereum as the leading blockchain network. It is currently the second largest blockchain by transaction volume behind Ethereum.

Unlike Ethereum, fees do not typically increase due to network congestion. The fees on Solana are also significantly lower than those on Ethereum.

Creators incur three blockchain transactions when they mint an NFT on Solana. There are two approval transactions and another to list the NFT. Each transaction on Solana costs around 0.00045 SOL, which was around $0.04 at the beginning of March 2022.

Do Gas Fees Affect The Price of An NFT?

The gas fee is separate from the price of an NFT. The price of an NFT is related to supply and demand, depending on what the buyer is willing to pay for the asset.

This is the reason why an artist can lose money by minting an NFT. If gas rates are high and the digital artwork doesn’t sell well, the creator could suffer a loss.

Sending and Selling NFTs Require Gas Fees

There are fees involved in selling NFTs, which may include transaction fees and gas fees.

New sellers are often unaware of the costs, which is why they sometimes end up losing money. Transferring NFTs should be cheaper than minting them. Costs vary by market, so it’s important to check before making a transaction. At the moment, OpenSea is the largest single generator of gas tariffs.

How To Navigate Gas Fee

Gas rates change throughout the day. The actual gas fee is determined by supply and demand and is set by the miners.

The gas fee you pay will depend on the complexity of the transaction, the price of the related cryptocurrencies, and the amount of traffic on the network.

The minimum transaction fee is 21,000 GWEI. Since a GWEI is one billionth of an ETH, the least you can expect to pay is 0.0021 ETH. Multiply that by the current ETH price to get the minimum transaction cost.

Smart contracts and NFTs will cost much more than the 21,000 GWEI minimum. This is due to its complexity and the amount of computational power required to perform transactions. NFT transactions are much faster when you are willing to pay higher gas fees. However, when the network is busy, gas fees increase as users try to speed up their transactions.

Thrifty users who can wait often trade on the weekend, or at quieter trading times during the day, to save on gas fees. Some platforms will allow you to set a gas fee limit and will transact when the fees are low enough. If you can wait an indefinite period when prices drop, this may be an option for you.

It is easy to check the current price of gas rates on the Internet using a gas tracker.

Set A Gas Limit

A gas cap is a limit you set on the amount of ether a transaction can consume. The risk you run by setting this limit is that the transaction may be declined. Setting a low limit could save you money if your transaction is not urgent.

If you set the gas limit higher than necessary, you will receive a refund for any excess funds. If you set the limit too low instead, you could lose money if your transaction fails. You can also wait a long time before a miner is willing to make your transaction.

The Bottom Line

NFTs have exploded in popularity in recent times and have given many artists and creators digital wings. Blockchain technology offers them new markets where they can ply their trade. However, these markets have costs, and unless artists understand the costs of minting and selling, they could lose money.

Artists can set gas limits, or trade when the market is quiet, to save on gas fees. New creators can make use of the deferred minting option and pay when the NFT is sold. Those who know the tricks of the trade can cut their costs on their way to success on the blockchain.