The NFT market has been a wild ride since 2020 (and much earlier for some of you). The explosion in the number of projects launched in 2021 has brought with it many projects that failed or did not live up to expectations. That leaves us wondering, why are NFTs losing value? In today’s guest post, writer and web3/NFT blogger Alex Gomez of CyberScrilla.com shares his thoughts with us on why NFTs lose value.

We have seen a lot of ups and downs in the NFT market. With that, many investors have made thousands and even millions of dollars. However, an even larger number of people have lost money due to the rapidly declining value of their NFTs. So why are NFTs losing value?

NFTs lose value because they do not provide value to holders. Investors buy these assets at an overspeculated price, and once the creator reneges on his promise, prices plummet. Other reasons include bad intentions, lack of innovation, and excessive speculation in the broader market.

Considering that every NFT is different, there are several reasons why it could lose its value. In this article, we will discuss some of the most likely reasons why an NFT loses value, as well as how that value is determined.

Reasons why NFTs Lose Value

There are several reasons why an NFT can lose its value. Below are some of the most likely causes.

Bad Intention

There is nothing more damaging to a brand than a bad actor. Creators with immoral intent can quickly destroy a brand and everything associated with it, including its NFTs.

Some examples of bad intentions include promising your consumers one thing to promote an NFT, then failing to deliver on that promise. Creators not only lose the trust of their community in this way, but it also results in an almost instant drop in value because holders will quickly liquidate their assets.

One of the most common acts of bad intent seen in the NFT space is outright scams. Creators use their community to promote their brand, then as soon as they run out, they leave the project entirely. This is more commonly known as a rug pull scam.

Minimal Communication

Lack of communication in the NFT space can be detrimental to the value of an NFT. The reason is that investors like to know what is happening every step of the way.

Most of the NFT brands at this stage are startups, so investors are already tearing their hair out waiting for the next “big update”. If updates (both good and bad) are not communicated, investors will be on the edge of their seats or worse, get anxious and sell their shares.

Once NFT project holders notice that others are selling their shares, they get anxious and do the same. This creates a domino effect and the value of the entire NFT project plummets.

An example of a popular NFT project that failed to deliver a big announcement is Moonbirds. When the creator, Kevin Rose, failed to inform his holders that all NFTs were moving to a CC0 public license, many people were outraged.

While it’s debatable whether this decision was a good one or not, there’s no doubt that deciding not to inform your headlines about the update was a mistake considering it caused quite a stir on Twitter.

Furthermore, the minimum price decreased after the unexpected announcement.

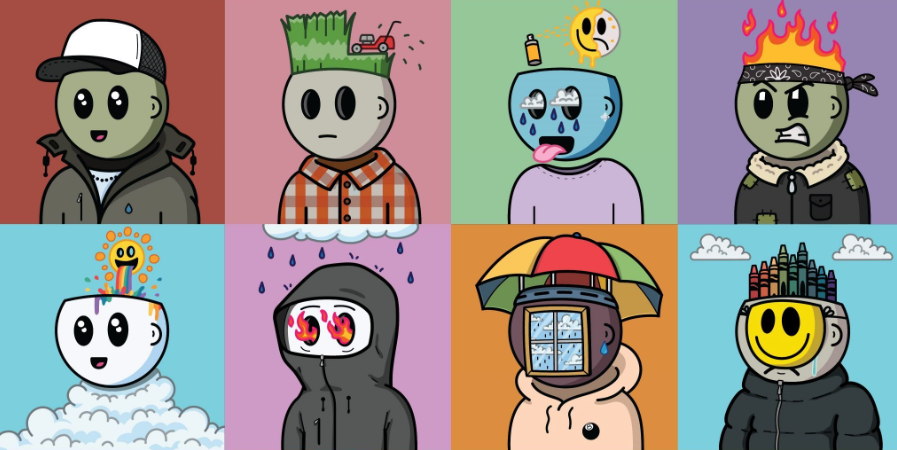

Lack of Innovation

If an NFT doesn’t stand out, it doesn’t stand a chance. We know this to be true thanks to the 2021 phase where everyone was creating random animal NFTs. In less than a year, almost every animal in the alphabet had been used to create “the next best NFT project”.

Now look at the value of 99% of those projects, they’re all basically zero. Of course, there is more than that; for example, how none of the projects actually provided any real value or benefits to their owners.

Rather, they were cashing in on what was popular at the time. In general, the lack of innovation from the creators has doomed these projects for eternity, as well as all animal-themed NFTs.

Excess Speculation

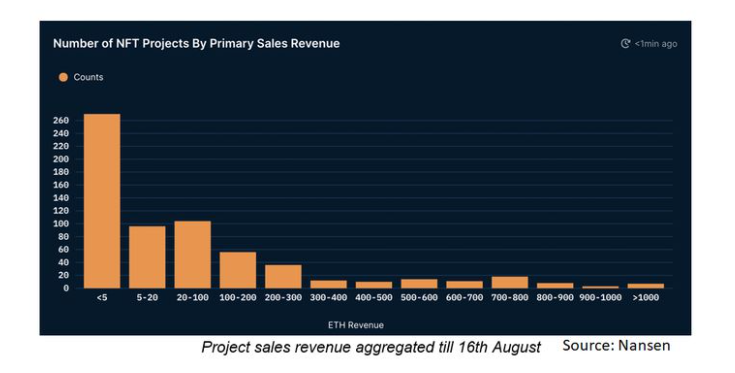

Ultimately, the overspeculation of the entire market is the reason why most NFTs have declined in value. Many investors gamble thousands of dollars in the hope of finding gold, but fail because they did not do the proper research before buying.

As a result, the price of NFT projects has experienced large fluctuations. High value speculation has only led to low value market adjustments once investors realize they made the wrong decision.

Unfortunately, this has been the case for most people. This is why there are very few NFT projects that have actually held their value over time.

What Determines The Value of An NFT?

The value of an NFT is determined by the utilities it offers and the reputation of the brand. This means that it is a combination of brand building, value supply, demand creation, and reputation building over time that affects the value of an NFT.

Below are four important factors that play a role in determining the value of an NFT.

Brand

The brand is what makes each NFT stand out. Top-tier NFTs like Bored Ape Yacht Club, CryptoPunks, and VeeFriends are household names in the NFT space. Why do we know about these projects above the thousands of other digital assets on the market?

Because they have effectively branded themselves. It’s the same reason most of us are willing to pay more for a pair of Nikes. We know Nike, we like Nike, and we understand that almost everyone prefers Nike to lesser-known brands.

That is the power of the brand. Serial entrepreneur Gary Vaynerchuk has spoken countless times about the importance of branding in a world where technology infrastructures are taking over.

An example comes from his speech at IFA 2019, the largest franchise event for business development and personal growth, when Gary said:

“You’re competing with a new infrastructure, which will be properly marketed to the end consumer using the mobile web infrastructure. The number one way to win in this great destructive change of the next decade is to build a real brand.

Gary wasn’t just talking about social media. You’re talking about technology in the macro, and that includes NFTs.

Value

At the end of the day, when we buy something, it’s because we need it or want it. When it comes to NFTs, it probably falls under the “want it” category.

When NFTs first became popular in 2021, everyone wanted one because they wanted to become a millionaire overnight. As technology advances, consumers are looking for value in the form of utility.

The utility appears in many forms, including:

- Access (events, memberships, clubs)

- Investment opportunities (DAOs, company shares, IP)

- Physical and digital products (NFT airdrops and physical goods)

- Services (consulting, freelance, networking)

- Identity (NFT domains, avatars)

It is up to the NFT creator to decide how much value they want to provide to their consumers. With that, consumers are the ones who determine how valuable an NFT is based on how much they are willing to pay for it.

Demand

Value is all a game of supply and demand. How many NFTs are there and how many people want one? In general, if the number of people who want to own a particular NFT exceeds the number of NFTs out there, the value of the asset will increase to a point where only a small number of people can afford it.

From there, the value will increase, stay the same or decrease. The determining factor is how well the brand continues to provide holders with enough value that they want to keep it. If they are executed correctly, the lawsuit will stand.

Reputation

A solid reputation is the result of doing everything I mentioned above well. If you can build a good reputation in your industry, then you will earn the trust of your consumers. When people trust you, they value you even more.

Think of a time when you had a great experience at a restaurant, for example. The food was excellent, the drinks were strong and the service was top notch. Then what do you do? you come back. Not only that, you bring your friends with you because you trust that they will enjoy it as much as you do.

This happens over and over again, year after year, ultimately creating a strong network of people who are the foundation of the brand’s reputation. Once a brand builds a good reputation, it’s easier to attract more people.

This is also true for the value of NFTs. The better the reputation, the more people will want to own one.

Are NFTs Still a Good Investment?

NFTs are suitable investments if you want the utility that it offers. Since the utility of an NFT is easier to measure than its actual value, investing in one solely for monetary gain is risky. With that being said, Chainalysis reported that collectors and investors have already sent over $37 billion to the NFT markets in 2022 alone.

Obviously, there is no lack of investors.

However, it is almost impossible to say which NFTs would be a good investment. Doing your own research to make sure that an NFT checks all your boxes from an investment standpoint is one of the best ways to approach it.

In general, the reasons why an NFT loses its value are plentiful. From bad intentions to miscommunication, it all results in minimal value to end consumers.