The US Securities and Exchange Commission is examining NFT creators and the cryptocurrency exchanges where they trade to determine if any of the assets violate agency rules, according to people familiar with the matter.

One focus of the investigation is whether certain non-fungible tokens, digital assets that can be used to indicate ownership of things like a painting or sports memorabilia, are being used to raise money like traditional securities, the people said. In recent months, lawyers for the SEC’s enforcement unit have sent out subpoenas requesting information on token offerings.

The inquiry is the latest attempt by the SEC under Chairman Gary Gensler to ensure that the crypto market adheres to its regulations. In February, the commission and state regulators imposed a record $100 million fine against BlockFi, a popular virtual currency exchange, for failing to register products that pay customers high interest rates for lending their digital tokens.

As part of its review, the SEC is seeking information about so-called fractional NFTs, which involve dividing assets into units that can be easily bought and sold, said the people, who asked not to be named because the investigation has not been completed. been publicly revealed.

The SEC declined to comment. Regulatory requests for information do not always lead to enforcement actions.

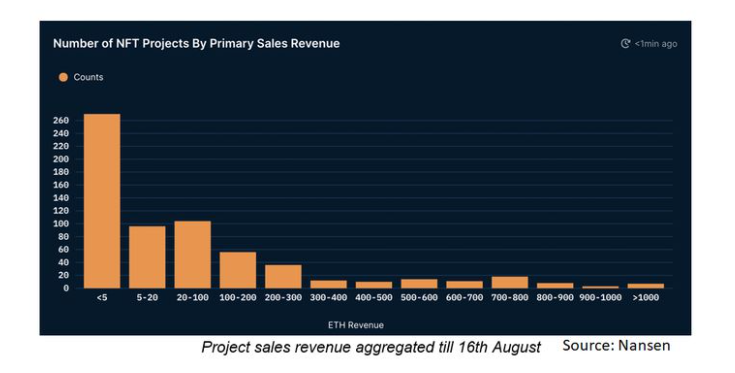

The NFT market exploded last year, attracting attention for multi-million dollar sales and the purchase of celebrities, who represent some of the assets. In addition to serving as representations of physical collectibles, token sponsors often tout their value as digital certificates of authenticity that cannot be replicated.

About $44 billion worth of cryptocurrency was sent to smart contracts on the Ethereum blockchain linked to NFTs during 2021, up from $106 million a year earlier, according to data from Chainalysis. Due to the boom in the market, some NFT marketplaces have taken steps to remove projects that could put them in the crosshairs of regulators, such as those that offer royalties or involve raising funds for a business.

A key legal question is whether digital assets, including NFTs, are securities and therefore subject to the same rules as shares. While the SEC has said many tokens fall under its purview, some cryptocurrency enthusiasts argue that regulations meant to police stock markets shouldn’t apply to virtual currencies as well.

The SEC applies the so-called Howey test, which stems from a 1946 US Supreme Court decision, to decide whether something is a security. Under that framework, an asset generally falls under the purview of the agency when it comes to investors who put up money to finance a company with the intention of benefiting from the efforts of the organization’s leadership.

As for NFTs, even the SEC’s most crypto-friendly commissioner, Hester Peirce, has raised the specter that some might meet that standard. “Given the breadth of the NFT landscape, certain parts of it could be within our jurisdiction,” Peirce, a Republican, said in December on CoinDesk TV’s “First Mover.” “People need to think about potential places where NFTs could enter the securities regulatory regime.”