Let’s say you want to invest in cryptocurrency and hold it for the long term. How do you decide which blockchain has the most growth potential?

Crypto analysts often use the Total Value Locked (TVL) metric, which tracks how much capital is locked in a project’s smart contracts.

However, despite its widespread use, TVL is very imperfect. Given the speed at which projects in DeFi arise and collapse, TVL becomes an unreliable proxy for the long-term success of a chain.

TVL becomes even more misleading when the use of liquidity mining incentives is widespread across all projects, leading to the phenomenon of “mercenary liquidity” in which capital flight occurs once the incentives are exhausted ( for more information on TVL issues, see here).

Why the number of developers matters

Fundamental metrics, at a minimum, should be valid beyond the near-term future.

A lesser-known metric for gauging the strength of the project has been looking at the number of developers flocking to the project.

While TVL gives us an indication about the number of users investing in the blockchain project, looking at the developer contributions tells us something about the builders and brains behind the project. In short, TVL tells us about the demand, while the number of developers tells us about the supply.

If Blockchain A had 10,000 more active developers in 2021 than Blockchain B, you can be sure that big things are coming up for Blockchain A, even if its token price is currently low.

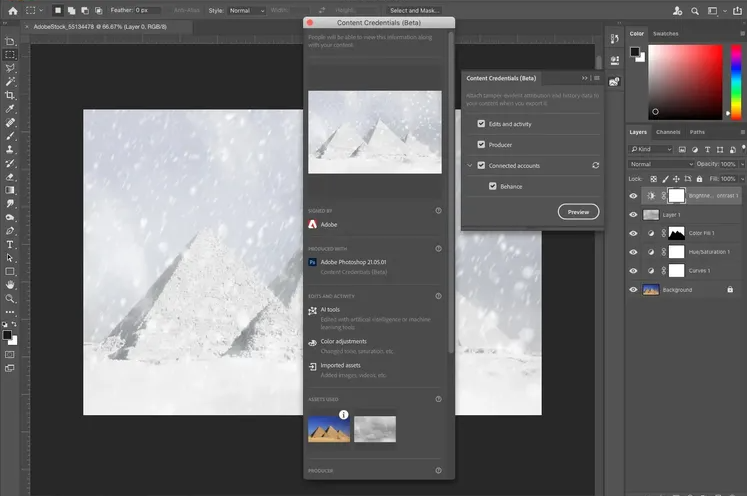

Due to the open source nature of blockchains, code contributions and developer activity are publicly accessible. Fortunately, we don’t have to clean up a thousand Github pages ourselves.

A recently published report by Electric Capital analyzed up to 500,000 unique code repositories (excluding copy-paste code) and 160 million code commits on Web3 to study which blockchain had the most active developer participation.

Here are some of their significant findings:

Layer 1 Blockchain Overview

The stiff competition between Tier 1 platforms means that blockchain companies must compete not only for users but also for developers.

Developers are segmented into community developers working on decentralized applications (dapps) and protocol developers working on the core protocol.

It comes as no surprise that Ethereum leads the total developer race, with a total of 2,980 developers in 2020 and 3,920 in 2021. Ethereum also attracts the largest percentage of all developers entering Web3.

Followed by Ethereum is cross-chain Polkadot Layer-1 (sometimes referred to as Layer-0), with a total of 840 developers in 2020 and 1,400 in 2021, then Cosmos, Solana, and Bitcoin.

Polkadot’s leadership stems largely from its use of Substrate (based on the Rust programming language), which gives developers the speed advantage to quickly build a custom blockchain for their own specific use case without having to configure your network validation.

Updating strings in Polkadot is also much faster due to its backwards compatibility that doesn’t require developers to fork.

Now that we’ve compared absolute sizes, let’s talk about which chain is growing the fastest.

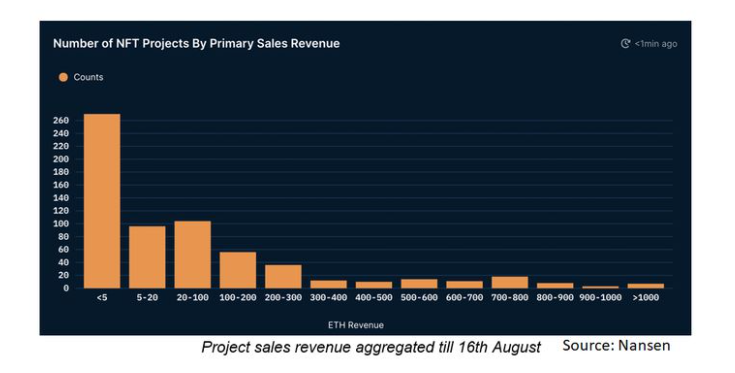

Among mid-sized ecosystems with 300-1000 developers, Solana had the largest developer growth with significant 5x growth, while Near saw 4x growth, a sign of promise for both chains.

This is followed by Polygon with 2x growth, despite being a sidechain scaling solution. After Polygon is Cardano (90%), Binance Smart Chain (80%), Cosmos (70%) and Bitcoin (10%).

Despite its explosion in market cap in 2021, Binance Smart Chain saw slightly lower developer growth.

However, Bitcoin’s slower growth is not surprising given its lack of smart contract capabilities and its long-standing presence.

These findings are affirmed in a recent Messari research paper, which finds the highest growth in the same ecosystems.

How about smaller chains in the 51-300 developer category? Terra takes the lead with 4x developer growth, followed by Internet Computer, Fantom, Harmony, Avalanche, Algorand, Chainlink, Hedera, and Moonriver in respective order.

Terra’s exponential growth in 2021 in market capitalization and TVL, despite its smaller number of developers, suggests that Terra is achieving “more with less.” Incoming Terra developers are likely to continue to increase in 2022.

When we merge small and medium developer blockchains, Terra sees the highest growth of full-time developers, while Fantom has the highest growth of part-time developers.

Note that this comparison may not be ideal, as smaller emerging chains will see a higher rate of growth until the diminishing effects kick in.

Interestingly, despite Ethereum’s dominant presence in layer 1 smart contract wars, competing chains have managed to hang on to their successes by introducing EVM support and allowing Ethereum dapp developers to easily transfer their projects. .

This suggests that chains that lack EVM support (such as Singapore-based Zilliqa) could be a setback.

Web3 Overview

How is Web3 doing as a whole? 2021 saw the highest growth in new developers at 34,391, recording the highest ever.

At least an all-time high of 18,416 monthly active developers committing to code on open source Web3 projects.

The increase in active developers tends to be correlated with an increase in the price of the network. This may mean that a growth in developers leads to greater network value in the future, but it may also suggest that a valuable network attracts developers in the future. Correlation is not causation.

In conclusion

Note that much of these numbers underestimate actual developer activity, since it only includes open source projects.

In short, Ethereum, Polkadot, Cosmos, and Solana emerge as the platforms with the most developers, a good sign of things to come for their DeFi ecosystems in 2022.

Although the proportion of Web3 developers is still small relative to the total number of developers in the market, it is now hard to deny the growth of Web3 as a whole.