The most paradigmatic example of this bursting of the bubble is the collapse of the NFT price of the first tweet in history. It sold for $2.9 million when it was released. A year later, last April, an attempt to resell was abandoned when the maximum offer was $14,000. How did this 99% loss in value happen in such a short period?

Actually, NFTs are not dead because they were never alive. No matter how hard you try, when the product itself can be accurately reproduced for free at the click of a button, its only value is the price at which it can be resold.

Therefore, a great exercise in hyperstition and self-fulfilling prophecy is required to extract value from the product. In other words, the hype that has been generated around NFTs has been instrumental in inflating the bubble and allowing some investors (primarily early adopters) to make money. Following the logic of Ponzi schemes, more people need to constantly enter the world of NFTs to prevent trust and growth from stagnating. And in terms of attracting the general public to invest in digital assets, the use of emotional suggestion techniques has been essential.

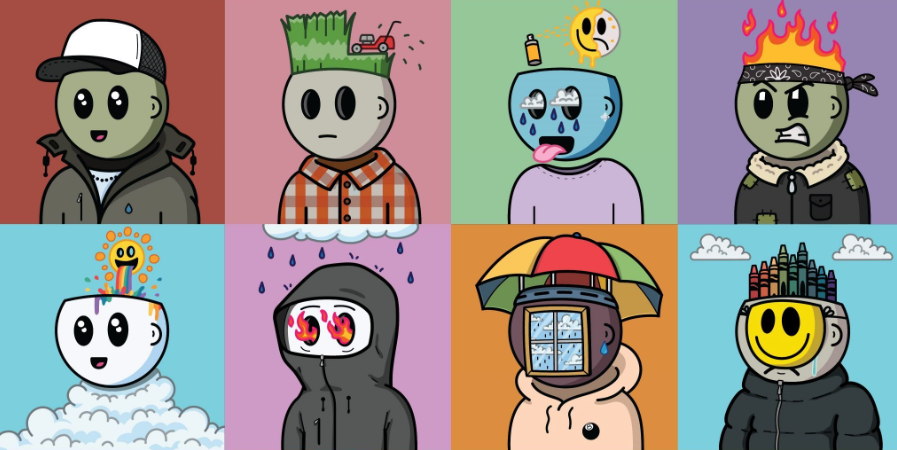

In an attempt to legitimize this format not only in monetary terms, the first tweet sent by Twitter founder Jack Dorsey was tokenized. This imbued the object with nostalgic and cultural value. Similarly, historical meme tokens like Nyan Cat have sold for millions of dollars. The fact that the value of NFTs is intrinsically linked to confidence in this same value, without there being another official, bank or state structure to support it, makes it necessary to expand their credibility through these strategies. Using popular culture references serves as a red herring: you can pretend you’re investing in crypto out of attachment and affection for a certain cultural artifact, pretend interest exists out of fetishism for a celebrity, artist, or their work. , or camouflage inversions under layers of irony, aware that Bored Apes are nothing more than aesthetically ugly monkeys randomly generated by an algorithm, and that is precisely what makes them funny. But, as Dan Olson said in the viral video Línea sube, this is not a fandom like the others, because the product itself is not important, only the profit it generates.

Just as it is essential to have new investors, it is also essential that those who do invest do not withdraw and sell, because if this were to happen en masse, the value of crypto art would fall. This creates a supposedly communal atmosphere in which the participants in this great house of cards must constantly convince each other and themselves that they will be rich if they last long enough. This story is reinforced by the claim that this is a select group of visionaries who have been able to get ahead of their contemporaries and who, thanks to this, will be led to the land of plenty and will never have to work again. Maintaining high expectations of what is to come has become a very important currency and it is essential to constantly keep increasing the hype.

Launching his own collection, the most famous of all Spanish influencers to embrace NFT, Willyrex, declared that “Those who trusted will be rewarded! Those who didn’t will fail!” Who knows if in an ominous or sardonic way.

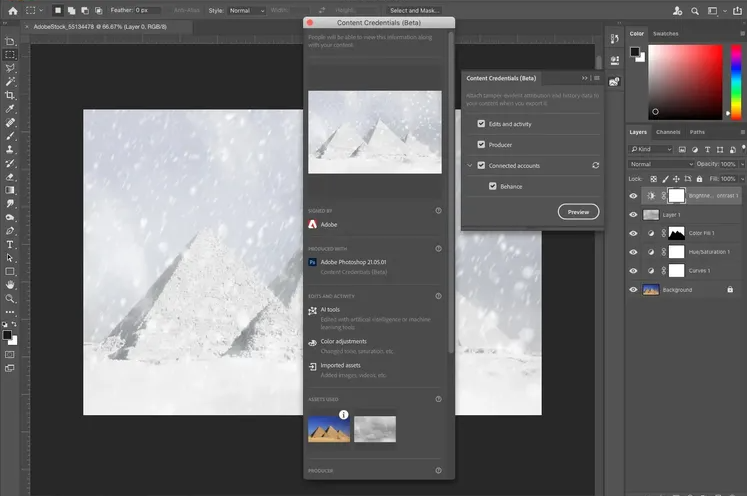

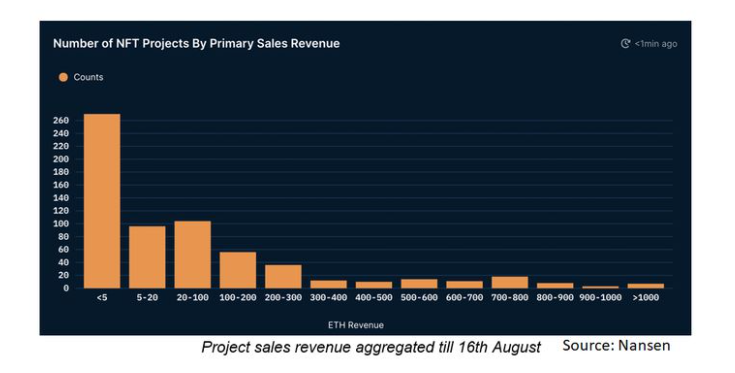

When first introduced to the general public, the intersection of digital art and blockchain was defined as a tool that would allow artists to profit from their work. Even so, the much-heralded democratization has not materialized, nor has the disappearance of intermediaries. Even less can we say that this technology has allowed most artists to earn money, since the costs of creating and maintaining NFTs are a great obstacle. Not to mention the uneven distribution of sales, which means very few people actually make any money selling their art this way.

None of this is anything new in the world of commercial art. It is well known that gallery circuits tend to be exclusive and rely on speculation derived from the hype of novelty and the ability to absorb new trends. NFTs fit this logic perfectly: the more people agree that an arbitrary object has value, the more value this object will have. However, the art market is not a large enough niche to satisfy the speculative needs of non-fungible tokens.

The reality is that, above all, NFTs act as an introductory narrative to the world of speculation, far from the stereotypes that are normally associated with it. The joggers are no longer irate gray dudes in immaculate suits, inseparable from their briefcases, but much more relatable people: influencers, streamers or bloggers. Instead of expert economists (even though there are still endless complicated technicalities), they are ordinary young people. The cryptobro, the latest digital fashion tribe, can usually be seen in the minimalist outfit of T-shirt, baseball cap, and sneakers that is so popular among Silicon Valley developers. The cryptobro could be anyone: your neighbor or even you.

The last frontier of all this phenomenon also seems to be the last hope to revive NFTs now that their reputation has been seriously damaged. As part of the logic of turning every aspect of human culture into a quantifiable and salable commodity, through clicks and statistics, in the last decade we have seen our actions in cyberspace increasingly become ways of building personal branding. . Meanwhile, our jobs have been uberized and gamified. Following this logic, the transformation of gaming into business is the last frontier of platform capitalism and the attention economy. Especially through video games.

To maintain the exponential growth that the world of video games has experienced in recent years, exploitative practices such as crunch culture have been necessary, which have given rise to bizarre phenomena such as endless streaming. NFTs look like a new expansion opportunity that could stave off the recession that is already said to be coming.

The sale of tools, skins, new utilities or downloadable content exclusively for those who pay for it is a booming practice, which has culminated in the creation of what are known as play-to-earn games. These are cryptocurrency-based video games, where the action itself matters much less than the chance to make money playing it. Big companies like Epic Games and SquareEnix have supported tokenizing aspects of their games through NFTs and creating internal economies.

It remains to be seen if this tactic will brighten the world of cryptocurrencies and be able to attract new people to the gaming community. During the rise of MMORPGs (Massively Multiplayer Online Role-Playing Games) like World of Warcraft two decades ago, a shadow economy was created around buying and selling add-ons and characters, mostly involving workers without rights. . At the moment, looking at which states have been most successful in implementing play-to-earn games, which happen to be precisely those with the most obvious economic problems and inequalities, it does not seem that NFTs have led us to any hopeful future, Contrary to what some of its enthusiasts predicted a couple of years ago.