Fungible Tokens Non-fungible tokens, or NFTs, are an evolution in the cryptocurrency space and a step forward in reinventing modern finance and other industries.

Money is fungible because there is no distinction between one dollar and another. Shares of the same type in the same company and commodities of the same quality are often interchangeable. However, NFTs, being non-fungible, represent unique physical and digital assets, such as a piece of art, a song, or an in-game collectible that other investments cannot replace. Each non-fungible token is registered on the blockchain and has metadata and a unique identifier that makes it impossible for NFTs to be exchanged or matched with each other.

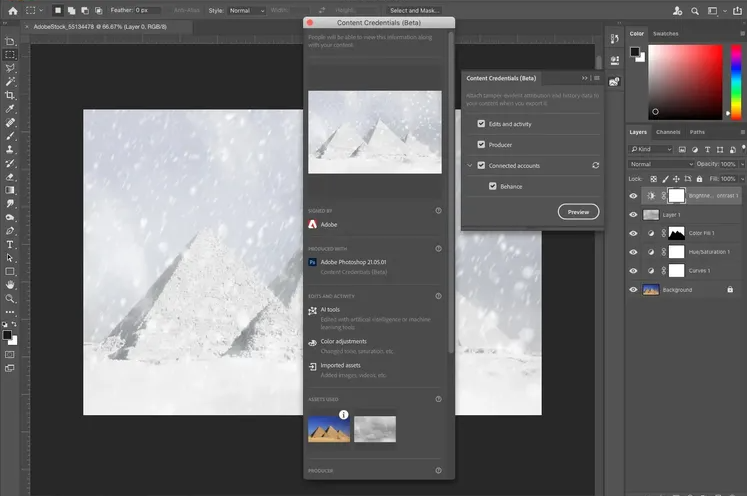

By enabling digital representations of individual items combined with the benefits of smart contracts, NFTs can cut out the middleman and connect content creators with audiences directly, offering blockchain-generated certificates of authenticity for digital assets. Therefore, the concept of NFTs has the potential to drastically change the current landscape of cryptocurrencies and art.

So what else makes non-fungible tokens attractive to artists and collectors? Where and how to buy NFT? How to sell an NFT and what form of sale is better to choose?

Let’s outline the answers to the above questions in this article.

What are NFTs?

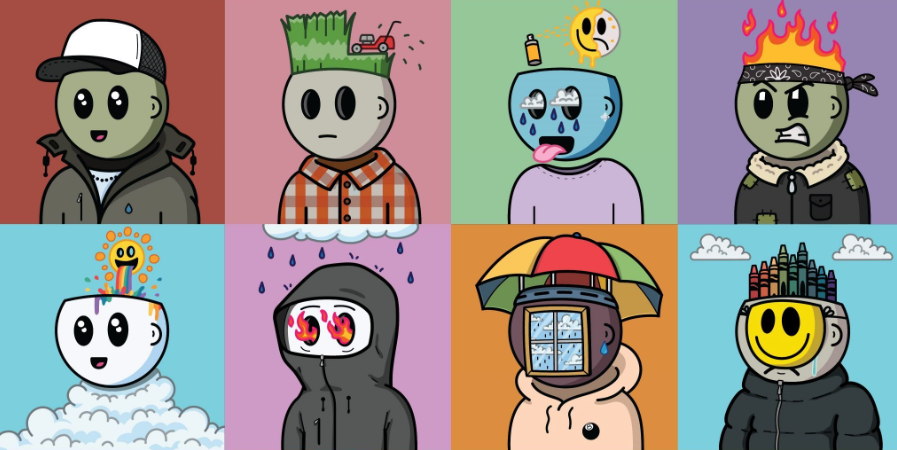

Non-Fungible Tokens are “unique” cryptographic digital assets that represent real-world objects and digital items such as art, music, virtual terrain, in-game collectibles, videos, photographs, and other creative products. In the digital world, they can be bought and sold like any other property without having a tangible form of their own. NFTs are unique, limited in number, and valuable due to their scarcity. They cannot be duplicated and can be easily authenticated. NFTs can be viewed as proof of authenticity and certification of ownership of virtual or physical assets registered on the blockchain.

Possible use cases for NFTs include some notable ones such as digital art, in-game collectibles, music, fashion, sports, academia, decentralized finance (DeFi), tokenization of real-world objects, domain name ownership, licensing, and certifications. , patents, documentation, and others. . Additionally, NFTs could be used to track metadata, improve ticket sales for events, and even transform real estate.

Although NFTs have been around since the early 2010s (NFT prototypes were experimental assets created on the Bitcoin network in 2012 under the name of colored coins), NFTs have recently gained popularity in the crypto community. Thus, NFTs are becoming an increasingly ingenious way of buying and selling digital items. NFTs give artists and other content creators the opportunity to monetize their work and sell it directly to audiences in the form of NFTs, completely independent of creative industries’ intermediaries represented by galleries, auction houses, and major record labels.

Read more: 7 Things You Should Know About NFTs

Buying NFTs

Some might say that buying Graphics Interchange Format (GIF) or Portable Network Graphics (PNG) files for thousands or millions of dollars seems irrational. However, people are still willing to spend large amounts of money on something that they could easily view, capture and download on the Internet for free. Why?

NFTs directly link social and financial capital in terms of developing the network of relationships between people and demonstrating belonging to the community. Information immutably recorded on the blockchain contains built-in authentication. Essentially, it allows content creators to digitally “autograph” their NFTs and gives the audience the opportunity to connect with artists, own their favorite art, and join a particular community. Since NFTs are called “Investment as Status”, buying them is considered to be one of the most efficient ways to maximize social capital by forming more bonds and bonds in the crypto space.

When collectors buy an NFT, they buy something unique and rare, the fundamental criteria for any true collector, even if an image or piece of music has been shared online hundreds of times.

It’s worth noting that collectors don’t buy the original content itself, as they probably don’t own the copyright. Due to technology, the creator of the content retains the copyright and most NFT platforms give them the opportunity to claim royalties in the future when the item is sold again. Rather, when they buy NFTs, collectors buy tokens that connect their name to the content creator’s art on the blockchain, which is the most valuable.

Therefore, buying NFTs allows collectors to own original items registered on the blockchain that serves as proof of ownership.

Where to buy NFTs?

There are several online marketplaces in the crypto space that have the option to buy and sell non-fungible tokens. Not all of them work identically, provide the same functionality, and offer similar types of NFTs. However, most of the platforms are based on the Ethereum blockchain. Other non-Ethereum NFT services belong to blockchains like Cosmos, Polkadot, or Binance Smart Chain, to name a few.

Other differences between NFT markets include various factors, whether they support the required NFT file formats and standards, the accessibility of the NFT platform, the price to create (or mint) an NFT, and other details that might be more important to you. content creators than buyers.

Although each NFT market works differently, most of them have a wide range of NFTs to buy. At the same time, veteran buyers choose a market, based on the type of non-fungible token they want to buy.

Determined by various use cases of non-fungible tokens, the following types of NFT markets can be classified into:

Choosing a crypto wallet and cryptocurrency to fund a wallet

When choosing a desirable collection and NFT market, collectors must create an account in the market in order to buy NFT. However, before doing so, they will need to connect their cryptocurrency wallet to their chosen NFT platform, as until then they will not be able to buy or sell anything.

A crypto wallet as a place to safely store digital assets is an essential part of any blockchain system. Members of the crypto community need wallets to use blockchain services, access various platforms, sign transactions, and manage their balances according to blockchain fundamentals. In this way, all crypto platforms and NFT markets, in particular, eliminate the need to store user account data, making your operations more accurate and secure.

Before setting up a wallet, it is crucial to ensure that the wallet matches the cryptocurrency used on the platform the buyer intends to use. As most NFT services are based on Ethereum, they accept the native Ethereum cryptocurrency Ether (ETH) as a viable payment.

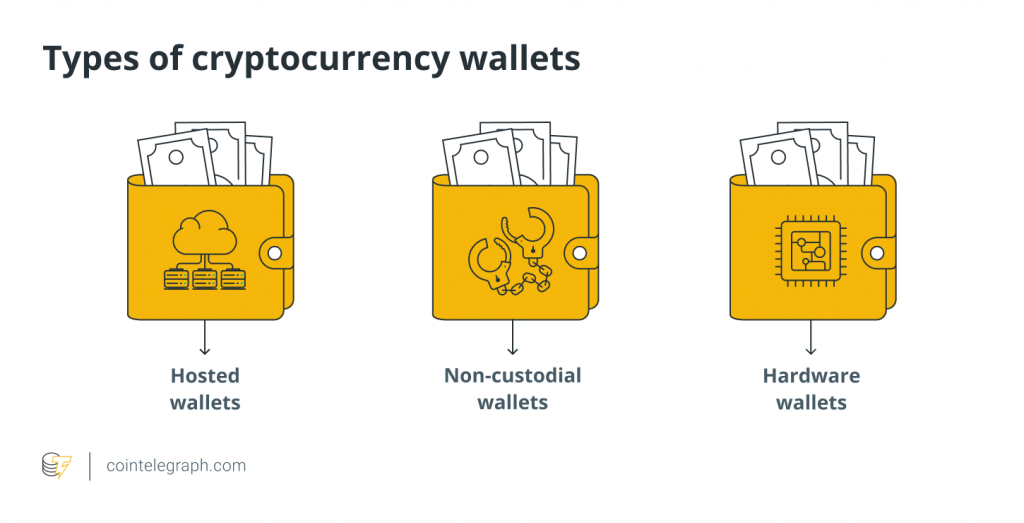

There are several types of cryptocurrency wallets, including hosted wallets, non-custodial wallets, and hardware wallets.

A hosted wallet, also known as an escrow wallet, is considered the easiest to use and set up. It’s called hosted because a third party automatically stores users’ cryptocurrencies, similar to how banks store money in checking and savings accounts. Since third parties are responsible for the security of users’ cryptocurrency, with this type of wallet, users do not have to worry because they will never lose their cryptocurrency, even if they lose or forget their password or private key. The biggest disadvantage of using a custodial wallet is not only the lack of autonomy but also the loss of anonymity, as this type of wallet often recommends users to perform Know Your Customer (KYC) verification which refers to identity verification. In addition to that, users need to make sure that the hosting company is trustworthy and competent.

A non-custodial wallet does not rely on a third party to keep users’ cryptocurrency safe. Instead, it gives them complete control of the security of their crypto funds. Users do not have to submit a request every time they want to send cryptocurrencies, as they are free to choose the type of transaction fee, either the default or a higher fee, depending on how quickly they want the transaction to be processed. Although these wallets provide the necessary software to store cryptocurrencies, the responsibility for remembering and protecting passwords falls entirely on the users themselves. If users lose or forget their passphrases, also known as mnemonic phrases and initials, they will not be able to access their wallets.

A seed phrase refers to a randomly generated list of 12 to 24 words (arranged in a specific order). It is generated by cryptocurrency wallet software and is used by users to regain access and control of their on-chain crypto funds. It is recommended to keep a copy of the seed phrase offline for security. For example, write it down and keep it in a safe place. The method not recommended is to keep the opening phrase on a device connected to the Internet or leave it in any digital format, such as a printed file or a photograph. If a malicious actor discovers the user’s seed phrase, they will have full access to the crypto assets in the wallet.

Also, with non-custodial wallets, users can access advanced cryptocurrency operations like staking, borrowing, borrowing, and more.

A hardware wallet, also known as a cold wallet, is a physical device the size of a USB flash drive. This type of wallet is quite complex to use and relatively expensive. The apparent benefit of using a hardware wallet is the secure storage of users’ private keys without the security risks of online wallets described above. A hardware wallet can keep crypto funds offline and secure even if the user’s computer is hacked.

Choosing the right wallet depends on collectors’ preferences and, in part, on the type of security they are willing to have. They can keep the purchase process simple with a hosted wallet, have complete control of their crypto with a non-custodial wallet, or take extra precautions with a hardware wallet – the choice is entirely up to collectors.

In short, once collectors set up their wallets and have enough crypto funds, they can go ahead, connect them to a suitable NFT marketplace, create an account, and start buying NFTs.

Read more: 10 best nft marketplace in year

Options for buying NFTs

There are a few possible options for buying non-fungible tokens, and most of them resemble an eBay scheme. Therefore, it is quite simple for a regular collector to understand how the purchase of NFTs works.

The most common option is an auction. Most NFT markets work like auction houses. They usually offer two types of auctions. The first is an English auction where the highest bid wins at the end of the auction. A timed auction (a form of English auction) is an auction where each lot can be bid for a specific period and at the end of the period, the buyer who has submitted the highest bid wins and buys an NFT. Another type is a declining price auction called a Dutch auction. The price of an NFT starts at a certain level (the maximum price) and then regularly decreases by a certain amount (for example, 0.1 BTC every 10 minutes). When a user offers the current price, the Dutch NFT auction is closed.

Non-fungible tokens can also be purchased through NFT drops. In this case, collectors have to wait for one of the drops to be announced and try their luck buying rare NFTs before they run out. These types of drops can be sold in seconds and typically require collectors to sign up for the particular NFT platform and fund their crypto wallets beforehand so buyers don’t miss out on buying NFTs when they drop.

Also, some NFT platforms have a “fixed price” or “buy now” option. It refers to a sale at a predetermined price that NFT creators set at which they want to sell their non-fungible tokens immediately. Buying at a fixed price can be seen as the easiest solution for collectors, as they do not need to rely on auctions and wait for a certain delivery time. Still, collectors should pay attention to the currency of the price and its format, as prices are often listed in cryptocurrency decimals (eg ETH) and may not be accompanied by fiat value (eg. USD). Buyers should also keep in mind that this dollar value can change frequently due to the volatility of the cryptocurrency market at any given time.

In addition to that, the amount of cryptocurrency in the wallet must be greater than the price of the NFT they wish to buy since, most likely, collectors will have to pay the transaction fee, also known as a gas fee, while buying. Gas fees are payments that are required to successfully process and validate transactions on the blockchain. Users make them compensate for the computing power required to do so.

Selling NFTs

There are two main ways to sell NFTs: selling a minted NFT (the way for content creators) and selling an NFT that the collector has already bought and is now willing to trade.

The first way is likely to be the endpoint of the process of creating (or minting) non-fungible tokens. Minting refers to an easy procedure after which the representation of innovative products, such as artwork, collectibles, songs, memes, etc., become part of the blockchain, tamper-proof and secure, and the content becomes an NFT and is “tokenized”. .” Since then, these digital items can be sold and traded as NFTs, as well as digitally tracked when resold thereafter.

To start mining, content creators just need a Mac or PC, an NFT-capable cryptocurrency wallet with a certain amount of cryptocurrency, and an account with a blockchain-focused NFT marketplace.

Before clicking the “Create” button, it is usually advisable to do one last check. The minting process is complete when the makers sign their NFTs and pay the gas fees. After that, the transaction is considered validated and content creators can see their newly minted NFT on their profiles on their chosen NFT platform.

Additionally, NFT marketplaces may require content creators to set a royalty percentage when selling NFTs. Royalties allow them to earn a specific commission each time the NFT is sold to a new collector. Royalties can potentially establish lifetime passive income streams for content creators automatically due to the basics of non-fungible token technology.

Most NFT markets also have the option to choose a sales method or the ability to set a price for the NFT while a token is being minted. Therefore, newly minted NFTs are often considered to be put up for sale immediately after their creation.

In other cases, to sell NFTs, content creators must go to their accounts on the NFT marketplaces and locate digital items from their NFT collections. Once they find the necessary NFT items, they will need to click on them. This action will reveal a “sell” or “list for sale” button. Once creators have this option, they can click on it and define the method of sale, either an auction or a fixed “buy it now” price.

If they are lucky enough, with the help of NFT platform representatives, they may have the opportunity to create a drop for their non-fungible tokens, which will probably add some level of awareness and probably help them sell successfully. your creations

How to sell NFTs you bought

The process of selling collected non-fungible tokens is no more complicated than the process of selling newly minted NFTs.

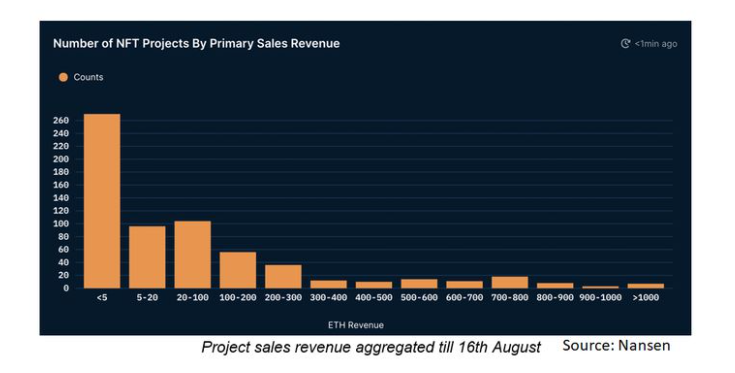

At the slightest wish, collectors can effortlessly resell their NFTs on the secondary market. The term “secondary market” covers all subsequent resales of the work, while the “primary market” refers to the first sale of an NFT. To sell NFTs, collectors need a few things that they likely already have: an account on the NFT marketplace of their choice, a crypto wallet connected to it, and an amount of cryptocurrency used on that marketplace.

The main difference here is that collectors will not be able to receive royalties when NFTs from their temporary collection is sold. Royalties as a percentage of all future sales will be sent directly to the wallets or original creators of the NFTs.

Thus, content creators are considered to be forever associated with the copyright to their creative products in the form of NFTs, while collectors only receive non-fungible tokens in their collection on a temporary basis. Non-fungible token collectors, like collectors in other traditional markets, only have basic property rights, such as the right to own, sell, or give away the items they have purchased, and these rights end with the sale of the particular NFT.

To sell NFTs, collectors must go to their profiles on the NFT platforms and select the NFTs they wish to sell. After clicking on the salable NFT, they should find a “sell” or “list for sale” button. Clicking this button will take them to a pricing page where they can select the terms of the sale. At that point, they will need to set a price for the NFTs or choose to start an auction. In case collectors wish to start an auction, they should check what type of auction is supported on the selected NFT platform. Most of the time it could be an English auction, a timed auction, or a Dutch auction.

The NFT renaissance continues to spread despite the volatility and underdeveloped nature of the cryptocurrency market as a whole and the high level of uncertainty surrounding non-fungible token valuations. If content creators and collectors sometimes do not benefit from the sale of NFTs, the purchase of non-fungible tokens is still considered a great way to support artists, musicians, designers, or other collectors of creative people who are interested. in such digital assets.