APPER TORY LANEZ, who looks like he might settle his felony assault case after he allegedly shot Megan Thee Stallion in the foot last year, has been busy becoming something of an online entrepreneur. Before cleaning up his Instagram page ahead of his upcoming LP Alone at Prom, Lanez kickstarted various cryptocurrency and NFT businesses on social media with the vigor of CNBC’s Jim Cramer. In the videos, he was almost yelling at fans, assuring them that the products he was promoting were the opportunity of a lifetime. Even on text-based Twitter, his level of intensity was constant, often posting in all caps.

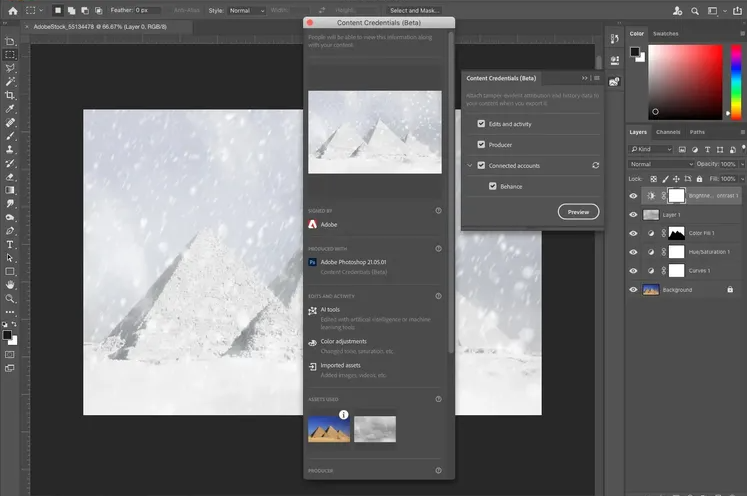

Last month, Lanez teamed up with a platform called E-NFT to release his new album When It’s Dark as an NFT, or “non-fungible token.” The idea was that each copy of the album would be minted with a unique token, providing an infallible book of ownership. The value of NFTs comes from their verifiable scarcity. Even if, as some critics of the technology point out, someone is capable of copying a digital file, the blockchain certifies its origins. Similarly, the idea was that Lanez’s NFT album would increase in value once it became available for resale on the E-NFT marketplace. On the day of the release, Lanez posted a video on Twitter saying that the album sold a million copies in less than a minute and that one of his NFTs had already sold for $50,000.

On Reddit and Twitter, dozens have complained that glitches and inconsistencies in the platform have made it difficult to sell the NFT, leaving several customers who bought the project hoping to sell it for a profit. There are even YouTube home videos outlining fans’ frustrations with their purchase.

Anthonio Vasquez, an NFT artist known as Frag, says he bought 10 copies during the NFT pre-sale period for a total of $10. The 27-year-old cryptocurrency enthusiast says that while the process seemed normal at first, things started to “go downhill” as soon as the album market opened. For one thing, the site crashed immediately, and Vasquez says it took more than 24 hours to get fully back online. It was at that time that he discovered other discrepancies. In a Twitter DM, he said that none of the other websites where he bought and traded NFTs charge 15% on each sale, “just this website that was promoted by Tory.”

Vasquez criticized Lanez on Twitter, saying that the fees associated with the transactions alone make it seem unlikely that they would benefit from the NFT. Lanez responded to the Tweet by saying, “Lots of people got MUCH more return than they invested…but even if I was taking what you’re saying [sic] seriously…The NFT was sold for 1 buck…even if it was resold for only $2 you will still DOUBLE your $” He then added two clown face emojis to the bottom of the tweet.

Vasquez still disagrees. “Not true at all because with the gas fees and the 15% going to E-NFT, you would barely walk away with 50 cents,” he says. The “gas fee” you mention is a charge associated with Ethereum transactions, representing the computing power required to mine the currency. Gas fees typically change throughout the day, depending on the volume of transactions on the blockchain at that time. Vasquez says that E-NFT charged an additional 15% for the seller’s transactions.

Lanez did not respond to multiple requests for comment.

In a statement to Rolling Stone, Brian McFadden, chief strategy officer at E-NFT’s parent company, says all technical issues have been resolved. “Due to the unprecedented volume of E-NFT transactions, there were some short-term and minor issues with the functionality of the site, but all known transactional issues are now fixed.”

When another buyer, Bianca “Binx” Petruzzella, first heard about the album, she was professionally intrigued. As the co-owner of New York-based agency NFT Third Planet Studio, the 43-year-old entrepreneur wanted to see if the platform Lanez used for the launch might be a good fit for her artists. She says she bought 10 copies of the album for $1 each. “We bought several albums during pre-sale to see what features they offer, and if this was a platform we would consider using for our own musicians,” he tells Rolling Stone via email.

Petruzzella says that after the site’s initial block was fixed, he attempted to sell the album for $1,000 on the marketplace as the $50,000 figure he had seen on social media “seemed like a long shot.” After following the site’s instructions, it says that initially it did not receive any confirmation and the browser window just went blank. Then, three hours later, Petruzzella received an email from the E-NFT saying that the NFT had, in fact, been sold and the funds, in the Ethereum cryptocurrency, had been liquidated. The asset was then removed from your collection. She has not received any payment yet.

While the E-NFT terms stipulate a processing period of up to 30 days for seller transactions, Petruzzella has now been waiting for over a month to receive the funds from the sale or get the NFT back. His attempts to contact customer service, he says, have been unsuccessful. “The only response we get is the same auto-generated email that someone will reply to us,” he says.

According to Catherine Zhu, special counsel at Foley & Lardner LLP and a member of the law firm’s NFT task force, that 30-day processing period is not typical for NFT releases. “If you use any of the other platforms, the transfer of funds should be quite fast, if not the same day,” he explained by phone. “Usually the way it’s done is through a smart contract. It is the rewriting of the registry in the chain of blocks. Therefore, there is no processing period that the company takes on top of that. I would say that’s pretty unusual.”

McFadden says the processing times are due to the fact that they don’t just accept cryptocurrency for payments. “Because Emmersive offers credit card transactions for the primary and resale market, not all monetary transactions happen on the blockchain,” he says.

But the problems did not stop at the long waiting periods. Immediately after his NFT sale apparently went through, Petruzzella says he tried a separate test. This time, he tried to withdraw two of his NFTs from the platform to his personal crypto wallet. She says that she finally received confirmation that the NFTs had been transferred successfully. Except they haven’t landed in your crypto wallet yet.

McFadden says that users can in fact withdraw NFT purchases to their crypto wallets and can view them on the blockchain in real time using Polyscan, which keeps a record of blockchain transactions. Petruzzella notes that he recently noticed a page in his account that displays a link to the Polyscan log of withdrawn tokens. However, when he clicked on the link, he was taken back to Lanez’s NFT page. “The one we sold disappeared along with the ones we withdrew. No contract addresses are provided for them,” says Petruzzella.

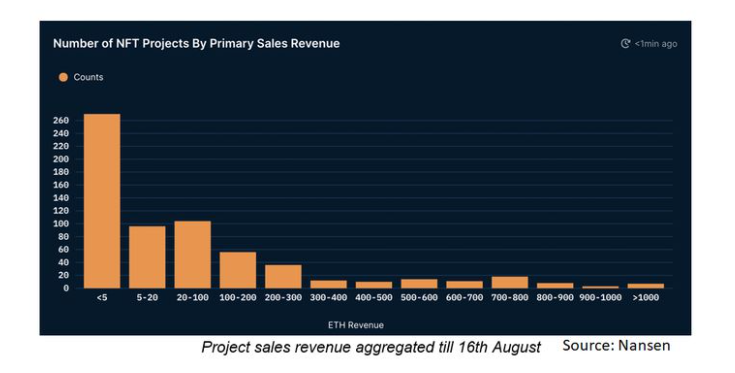

In addition to the withdrawal and transaction problems, Vásquez says he noticed irregularities in the structure of the market itself. “When other NFT collections go down, they usually have a limit on transactions, which prevents hoarding and allows more people to interact with the NFT, to build the community of said project,” he said. Without those limits, Vásquez points out, people who bought hundreds of copies of the album were able to flood the market and, in essence, manipulate the price.

A look at the E-NFT listings for When It’s Dark actually shows thousands of NFTs available from $15 to $1.10 from a handful of different sellers. McFadden says that only verified users can transact on the site. “There are large quantity buyers, but they are all verified people,” he says.

Ultimately, for Vazquez, Petruzzella and others who bought Lanez’s NFT, the issues center around a few bucks, but Petruzzella, for example, isn’t ready to give up. “A lot of people just take it as a loss and move on,” she says. “But I run a company in this business. This is not OK”. She says that she is still waiting for a response from the platform’s support team.

And when Rolling Stone took a look at the backbone of Lanez’s NFT launch, the platform’s corporate lineage raised more questions than it answered.

Strange Bedfellows

According to his NFT’s press release, Lanez was an early shareholder in the company behind the E-NFT platform, Emmersive Entertainment. Public records show a history of inscrutable corporate maneuvering by the parties involved in that business. Emmersive Entertainment, corporate name EVNT Platform LLC, is a subsidiary of Pennsylvania-based Vinco Ventures. That company has traded on the New York Stock Exchange under at least four names since it was incorporated in July 2017 (under the name Idea Lab X Products Inc).

And some dubious characters have been involved with Vinco Ventures. A former member of the company’s board of directors was arrested in July on charges including embezzlement, conspiracy and fraud in connection with another company called FTE Networks, Inc. According to a filing with the SEC, FTE bought a company founded by the Vinco’s current CEO, Chris Ferguson. , in 2013, and subsequently added him to the FTE board of directors in 2016.

Meanwhile, Vinco recently announced that it would be participating in a “reverse triangle merger” with former MoviePass president Ted Farnsworth’s new business, Zash Global Media. The deal hinged on Zash’s acquisition of a Singaporean TikTok-style app called Lomotif, which Farnsworth says is worth between $4 and $5 billion. It’s worth noting that as recently as December, Farnsworth and his former MoviePass partners agreed to settle claims brought by the Federal Trade Commission, including charges that they misled investors about the profitability of the MoviePass service. Additionally, according to an investigation published in the Miami Herald, Farnsworth and his companies have faced several lawsuits dating back to the early 2000s.

(Neither those lawsuits nor the arrest of the former Vinco board member involved Ferguson, E-NFT or Tory Lanez.)

Now, it seems that Zash and Vinco are focused on both music and NFTs. In the press release for Lanez’s NFT album, they explain the connection between Lomotif, E-NFT, and Lanez: “There are very few people on Earth with [Lanez’s] gift. When you combine that talent and vision with the marketing power Vinco can access through Lomotif, it’s a clear winner. With tens of millions of active users, we are able to market our proprietary E-NFTs to a target audience not only across the country but also around the world.”

And Vinco recently announced plans to spin off its NFT business into another publicly traded company called Cryptyde. Despite ongoing customer complaints about E-NFT on social media, the company continues to herald Lanez’s album release as a success story. The “first album in history to go platinum on the blockchain,” according to Vinco’s latest investor presentation.

It makes sense that Lanez would want to get into crypto. There has been a clear increase in the talk about the potential applications for the blockchain technology that underpins cryptocurrencies and NFTs. And the latter, in fact, has promising applications within the music industry. Zhu explains that while the current NFT boom is introducing more established brands and celebrities to the market, they should proceed with caution when choosing a platform to partner with. “There’s a lot of options when they’re trying to do these NFT pitches, so when they figure out who they’re partnering with, they make sure it’s not bad for them from an advertising standpoint,” he said. He says. “There is a risk to their brands because they have a very visible profile.”

Hip-hop’s wannabe Crypto Don?

When it comes to Tory Lanez’s NFT album, the stakes are not high for any buyer. The album sold for a dollar at the time of its release, and despite a faulty website and some perhaps inflated claims about its investment potential, it’s not like anyone was claiming to have wasted their life savings in the style of Bernie Madoff. But Lanez’s promotional style goes beyond what is normally seen on celebrities when it comes to promoting a product or service. The rapper has around two million followers on Twitter, which puts any endorsement he makes under a specific type of scrutiny. Influencers, for example, must disclose whether or not a brand they post about pays them, per FTC guidelines. In 2018, Tesla CEO Elon Musk agreed to pay a $40 million fine after the SEC sued him for securities fraud. The case arose due to Musk’s tweets about a possible buyout of his company, which in turn caused the company’s stock price to skyrocket.

(As far as Rolling Stone knows, Lanez was not paid for his E-NFT posts.)

Vasquez says he’s concerned about Lanez’s promotional habit in part because of what appear to be inconsistencies in the products he endorses. “You can see on his social media that he has now switched to many other cryptocurrencies that cannot even be used to buy his own NFT album,” he says. Vasquez points to Lanez’s regular posts about the Boostcoin cryptocurrency. Until a few months ago, Lanez was enthusiastically posting about Boostcoin competitor UniSwap.

Still, crypto platforms remain murky territory when it comes to legal guidelines. One major question is whether or not a celebrity like Lanez telling his followers that an NFT being resold for thousands of dollars amounts to investment advice. According to Zhu, it could be in conflict with the Securities and Exchange Commission. “There is a four-part test called the Howey test that is applied to determine whether a product will be considered a security,” Zhu explains. “That includes an expectation of earnings for the company.”

The so-called “Howey Test” comes from a 1946 Supreme Court case that set a precedent for what types of transactions are subject to requirements under the Securities Act of 1933 and the Securities Exchange Act of 1934. According to In the ruling, an investment contract exists if there is an “investment of money in a common enterprise with a reasonable expectation of profit from the efforts of others.”

The Howey Test provides the framework for a 2019 report from the SEC’s Strategic Center for Financial Technology and Innovation on digital assets. In an adaptation for the burgeoning market for new technologies, the SEC determined that a digital asset should be considered a security if “a buyer can expect to earn a return by participating in distributions or through other methods of appreciating the asset, such as selling at a profit.” in a secondary market.

Zhu offers simpler terms. “From a practical point of view. If you’re putting an NFT out there to make it look like it’s tradable and its value goes up, then it could be considered security and should be registered,” she says. “If you’re exaggerating value on social media, that might fall within what’s considered value.”

A representative for the SEC did not respond to our request for comment.

In recent months, regulatory interest in blockchain technologies has reached a fever pitch. In September, the SEC filed a case against online crypto lending platform BitConnect, alleging that they managed to amass $2 billion from investors “through a fraudulent and unregistered global offering of investments in a program involving digital assets.” . The SEC case alleges that BitConnect promised exorbitant returns from its platform, but actually “diverted funds from investors for its own gain by transferring those funds to digital wallet addresses controlled by them.” The case also involves a handful of promoters who the SEC claims were rewarded for amplifying the brand with commissions. BitConnect denies any wrongdoing.

(There is currently no indication of any SEC or other investigations into Lanez, Vinco Ventures, Zash Global, or any related person or entity.)

For now, Lanez appears to be taking a break from the crypto world altogether. Last week, he mysteriously deleted all of his Instagram photos and posted a cryptic tweet to his fans: “It was real.” It was probably a promotional effort for his new LP Alone At Prom, due for a December release.

However, before going dark, Lanez was heavily promoting a new product, Fancy Frenchies NFT, a digital French bulldog avatar available on the Solana platform. According to the company’s website, a portion of sales from the NFT will be “donated to a canine charity chosen by our great Fancy Frenchies community.” In one of Lanez’s latest video posts on Twitter, he says they sold out in three minutes.